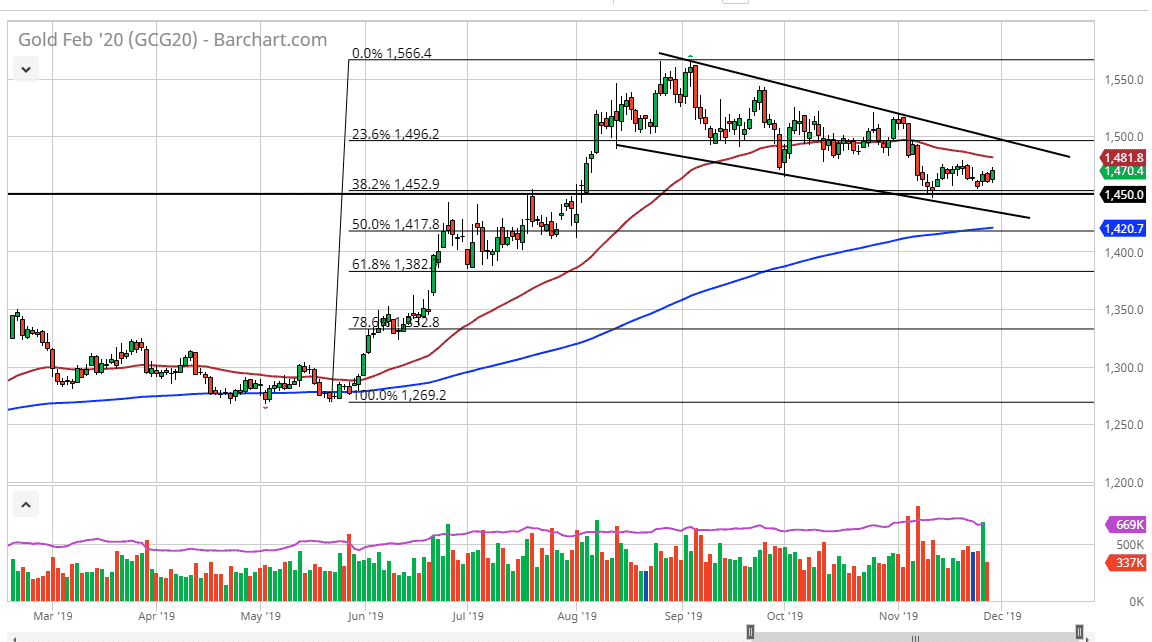

Gold markets have rallied a bit during the day on Friday in what would have been very low volume. This is the day after Thanksgiving, so there aren’t a lot of traders in the United States trading. At this point, the market has shown the $1450 level to be support, as it was previous resistance. At this point, you should also take a look at the fact that the 38.2% Fibonacci retracement level is right there, and of course an area that has seen so it’s resistance there based upon the ascending triangle, a certain amount of “market memory” comes into play.

There are a lot of conflicting signals in this market, so is very likely that the action will continue to be very noisy in general. At this point, the 50 day EMA is starting to slope lower, so if we were to break above that it would be a signal that we are going to go higher. At that point I would anticipate that gold would go looking towards the $1500 level. That is a large, round, psychologically significant figure, and also a place where there has been a lot of action back and forth. Gold of course is very sensitive to the overall risk appetite around the world, and that of course is going to be due to the US/China trade situation.

All things being equal, the market is likely to see this area as crucial, and at this point it’s likely that traders are starting to try and discern whether or not this has been a bit of a “double bottom”, which of course is a very bullish sign. If that happens to form a “double bottom” here, then it’s likely that the market will turn completely around. That being said, if we were to break down below that level it’s likely that the market would accelerate to the downside and go looking towards the 200 day EMA underneath. That of course is a trend defining indicator, so as long as we stay above there you have to think that there is still the possibility of a rally but the biggest problem with gold right now is that the headlines continue to go back and forth, causing a lot of problems when it comes to risk appetite. Unfortunately, we are all over the place as far as that is concerned, so you will have to be very diligent and cautious with your position size.