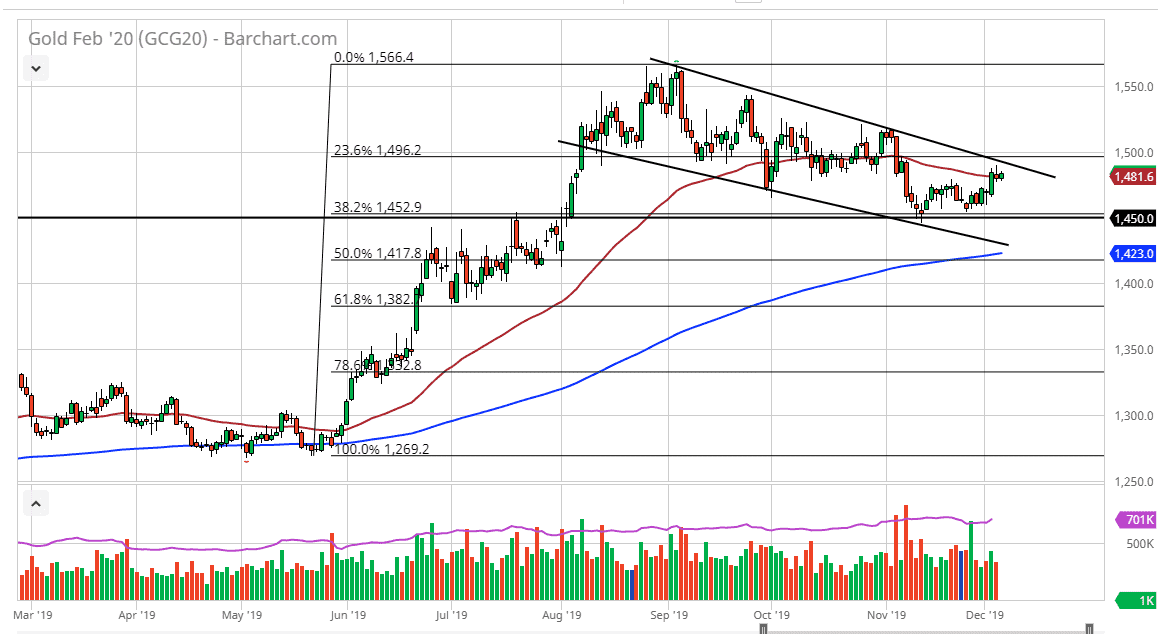

Gold markets initially tried to rally during the trading session on Friday but then got hammered after the jobs number came out much stronger than anticipated. With that being the case, it looks as if we are going to go down towards the $1450 level, an area that has been supportive more than once. This was the scene of the top of the ascending triangle, and as a result it should be supportive in this area. Overall, the market should see that as support again, but if we were to break down below the $1450 level, the market is likely to go down towards the 200 day EMA.

If we were to break down below the 200 day EMA then it’s likely that the market will fall apart at that point. As we have gotten into a major “risk on” type of attitude on Friday, it’s obvious that the market will spurn gold. That being said, the market is likely to find a lot of noise in this area underneath, but if we were to break down below there then the next move would be towards that 200 day EMA. If we were to break down below there, then the market is likely to go to the $1400 level. This is a market that will continue to react to the US/China trade situation, and of course the general risk appetite overall. Right now, it looks very likely to test this major support. I believe that in the next couple of days we will get a longer-term determination as to what the trend in gold will be. The fact that we are closing towards the bottom of the daily candlestick on Friday does suggest that there is a lot in the way of negativity, so at this point in time it’s very likely that the market will continue lower in the short term, but if we were to break down, it will probably be some type of obvious situation such as a move forward in the US/China trade situation. The jobs number being a strong as it is of course is a very bullish sign as well, so at this point it’ll be interesting to see how this plays out. I believe that in the next couple of weeks we will see some type of impulsive move that tells us where we are going next. To the upside, if we can break above the $1500 level, then it’s likely that the market will continue the longer term uptrend.