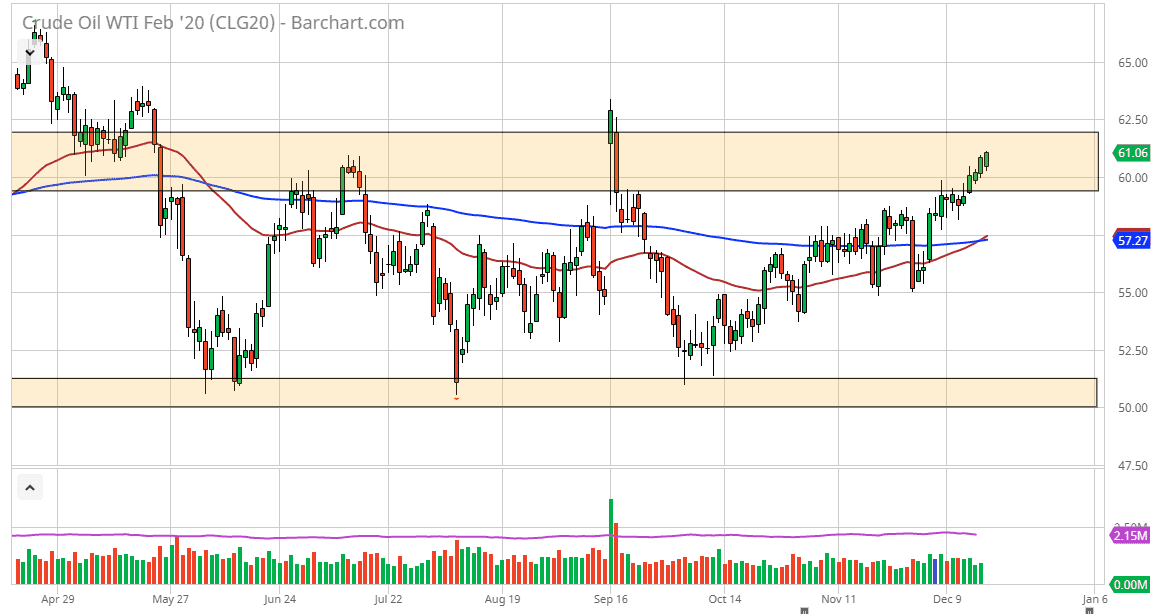

The West Texas Intermediate Crude Oil market rallied again during the trading session on Wednesday, as we recovered from the gap lower. This shows that the market doesn’t care about supply right now, because the EIA numbers weren’t as strong as anticipated, showing a drawdown of 1.1 million barrels as opposed to the anticipated 1.5 million barrels. More than likely the market is trying to deal with OPEC production cuts, and as a result it’s very likely that we will see a continued idea of upward pressure, but I also recognize that the $62.50 level above is massive resistance.

All things being equal, the market is likely to continue to see a lot of noise, and I don’t think that we break above the $62.50 level quite yet, because sooner or later traders will start to figure out that there isn’t much in the way of demand right now. Granted, the market is looking very bullish, but the global growth story is very uneven and not exactly exciting at this point.

To the downside I think there is plenty of support at the $60 level, but we could break down below there and go looking towards the 50 day EMA which is just cross above the 200 day EMA, which is a very bullish sign. Ultimately, this is the “golden cross”, and it suggests that we are in fact going to have a longer term uptrend come into play, but I think it’s probably a bit early to start talking about that.

If we were to break down below there is to moving averages, then it’s likely that we go down to the $52.50 level which is the bottom of the range that we have been in for some time. This is a wrong time of year to look for a lot of action though, and it will start to slow down over the next couple of days as we start to head into the holidays. With this, it’s very likely that we continue to see buyer step in on short-term charts, picking up value as it appears. I believe at this point it’s very likely that we will continue to see a lot of noise, but certainly it looks as if we are going to see more of an upward trajectory than anything else. By looking for value, you can take advantage of short-term positions.