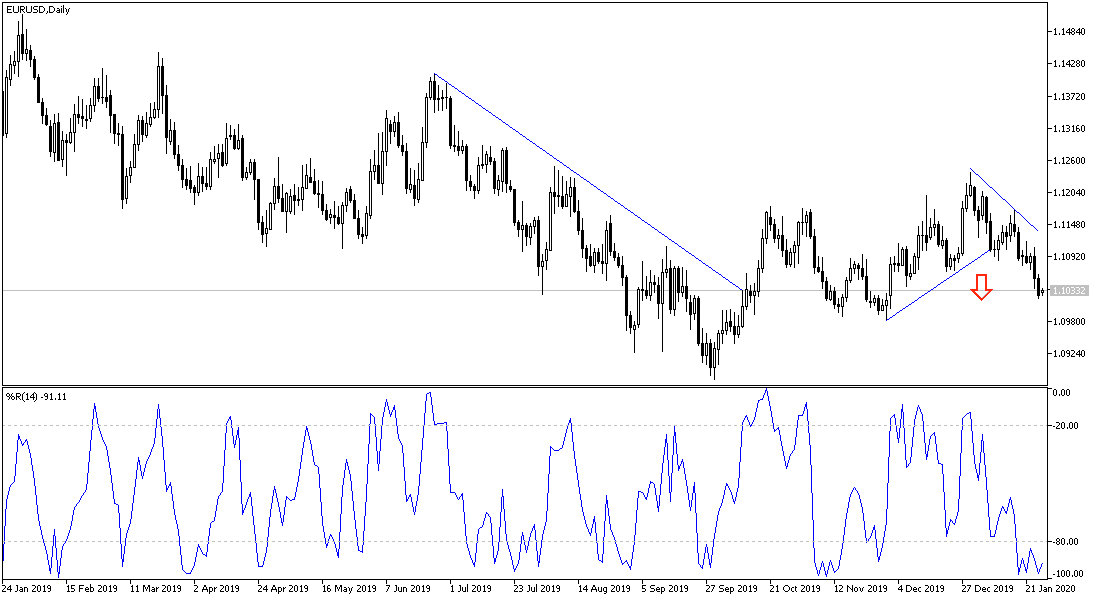

EUR/USD attempts for a bullish correction collapsed during the past week’s trading, with investors returning to buy the dollar as a safe haven amid risk aversion, with the increasing fears that the spread of the deadly Corona virus across the borders of China will hinder global economic growth, which is still weak from the consequences of the global trade war. The pair continued to drop to the 1.1019 support, the lowest level for nearly two months.

Forex traders interested in this major pair are wondering whether the price of the pair has reached good buying areas.

Actually, the EUR/USD reached buying levels near the 1.1000 psychological support, but at the same time, it still has opportunities for more losses in the event that the global market continues to fear the worsening situation in China and the spread of infection to other countries. The Euro was among the worst performing major currencies last week, although it is now near the major support levels on the charts, and looking at the economic figures due in the coming days, which may provide the single European currency some push upside.

The Euro is in a narrow range that runs between 1.10 and 1.12 for months.

The Chinese National Health Commission said the new deadly and spreading virus in the country could be transmitted from person to person even in the incubation stage - in other words, before people began to notice noticeable symptoms. The number of injuries more than quadrupled last week to 1975 by midnight on Saturday, while the number of deaths rose to 56.

The Euro will react today to the announcement of an IFO survey of German companies' sentiment, and the index may provide some support for the Euro, if it reads positive, as did the reading of the ZEW survey last week. As the ZEW survey showed that the current conditions, as well as the sentiment around the six-month forecast, rose significantly in January, and given that the economic recovery in the Eurozone is the key to the Euro’s future wealth; any recovery in the IFO index may help to stop the Euro’s decline as happened last week . The dollar may find some movement with the announcement of new US home sales figures as the US housing market remains strong, and has not been affected much by the global trade war.

According to the technical analysis of the pair: On the daily chart, the EUR/USD pair is still in the range of a descending channel, its strength will be supported by breaking through the 1.1000 psychological support, after which the next support levels may be at 1.0975 and 1.0880. The pair will not have chances for a bullish correction without breaching the 1.1200 resistance, and I still prefer to sell the pair from every upside level.