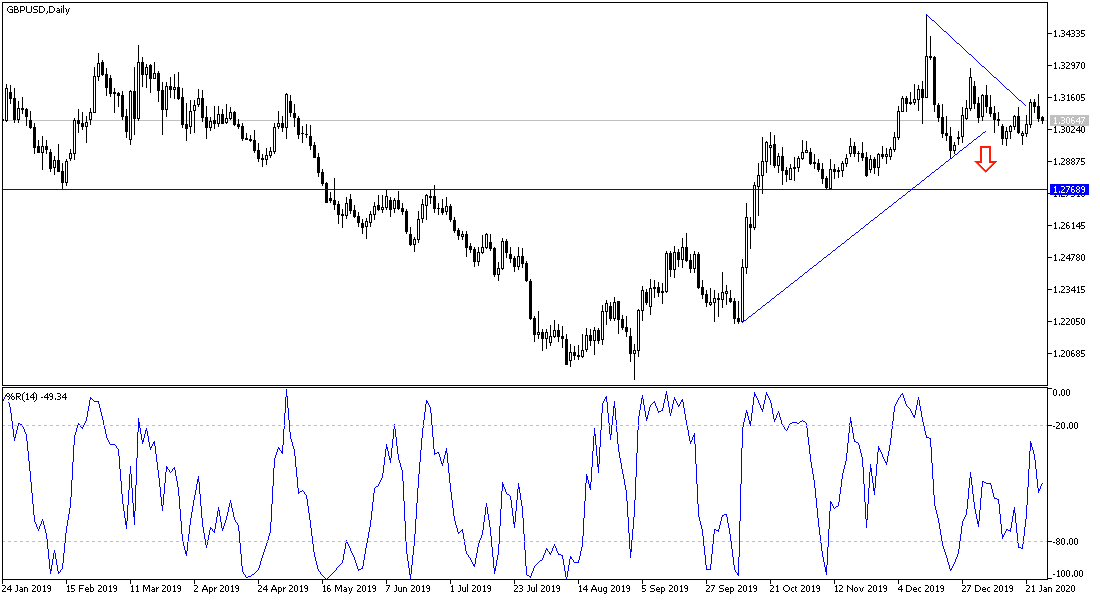

The British Pound showed great resistance against the recent strength of the US dollar, and the price of the GBP/USD pair continued to maintain its momentum for a bullish correction, and gains at the end of the week's trading reached the 1.3172 resistance before closing around the 1.3070 support, as global tensions increased from the rapid spread of the deadly Corona virus, which was a good environment for the USD gains, as investors took it as a safe haven. Investors' willingness to take risks stopped until the future of this concern became clear.

Expectations have recently shifted that the Bank of England may refrain from cutting interest rates when it meets this week, which could provide some support to the British pound in its current bullish correction path. The pound against the dollar remained in a downtrend between April 2018 and October 2019, but it overcame the main downtrend since mid-October when Prime Minister Boris Johnson announced victory in his attempt to renegotiate aspects of the Brexit deal.

The Pound received some support after the announcement of better-than-expected December jobs and wages data, which gave investors’ confidence that the Bank of England led by Mark Carney may not be in a hurry to cut rates. Further fueled these expectations were results of the PMI results from IHS Markit, which indicated a stronger-than-expected rise in services and manufacturing activity for Britain during January.

Bank of England Governor Mark Carney, and several members of the Monetary Policy Committee said earlier this month that they would vote for a rate cut when they meet next Thursday if they see no signs of improvement in the country's economic performance in the new year. The Bank of England has left interest rates unchanged since August 2018, although most other central banks have cut interest rates. Next Thursday's meeting will be the last for Governor Mark Carney as Chairman of the Monetary Policy Committee because he is scheduled to leave the bank on March 16, 2020.

According to the technical analysis of the pair: The opportunity for a bullish correction for the GBP/USD pair will persist, unless the pair moves towards the lowest psychological support level of 1.3000. On the other hand, returning to the 1.3300 resistance culminates in the bulls controlling performance. Despite optimism about the pair's performance, I still prefer to sell it from every bullish level, as the negotiation marathon beyond January 31 will remain a pressure factor on the pound in the coming months. There are no economic data releases from Britain today and the dollar will be affected by the new US home sales figures.