The GBP/USD price is trying hard to avoid a drop below the 1.3000 psychological support to avoid more selling. The pair is on an important date this week, with both the Bank of England and the Federal Reserve announcing their monetary policies, along with markets' reaction to the official Brexit date next Friday. The pair's recent losses reaching the 1.3040 support, which is considered the most stable in the face of the recent strength of the US dollar amid investor appetite for hedging against the risks of the rapid spread of the deadly Corona virus, spreading out of China to more than 10 countries around the world, which threatens the future of global economic growth.

Recent data showed that the British economy may see a recovery after the elections. The IHS Markit Composite PMI reading was at 52.4, which is well above the expected 50.5 reading by markets, and indicated that the economy returned to growth after an uneasy end for 2019. IHS Markit said, “The data highlighted a decisive change in the direction of the private sector’s economy at the beginning of 2020. Business activity grew for the first time in five months, driven by the highest sharp increase in new business since September 2018.

The way the government prepares for the economy after Britain’s exit from the European Union will become clearer on March 11 when Treasury Secretary Sajid Javed delivers the budget, which is expected to include a set of spending commitments. As is well known, increased spending - especially on infrastructure - can boost economic activity that ultimately supports more strength in the GBP's performance against other major currencies.

The Bank of England is likely to keep interest rates on monetary policy unchanged this week after economic data indicated positive momentum after the general elections late last year and the reduced political uncertainty associated with the UK's withdrawal from the European Union.

The Bank of England is expected to maintain the interest rate at 0.75 percent and quantitative easing at 435 billion pounds at the last meeting of Mark Carney as Governor of the Bank of England. The central bank is scheduled to announce the results, as well as to announce the minutes of the meeting on January 30 at 7 am ET.

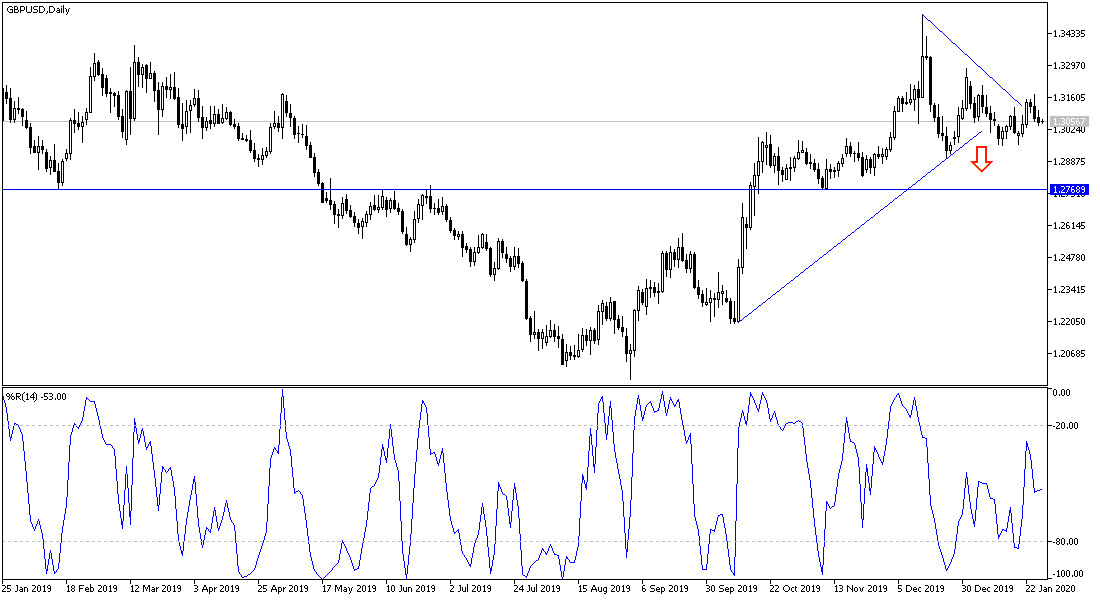

According to the technical analysis of the pair: The direction of the GBP/USD price is in a neutral mode with a downward trend in the event of a breach of the 1.3000 psychological support, after which the bears may push the pair to the support levels at 1.2945 and 1.2875 respectively, which establish the strength of the downward correction. There will be no optimism for the bulls without moving towards the 1.3300 resistance, and I still adhere to the preference of selling the pair from each ascending level. In the transitional period that follows Brexit, it will not be rosy, and failure of the agreement means an exit without a deal, which would be disastrous for both sides of the Brexit.

For today's economic calendar data: All focus will be on the US session data with the release of Durable Goods Orders numbers, the US Consumer Confidence and the Richmond Industrial Index.