At the beginning of the Corona virus crisis, the price of gold was not much interested in the event, which explains the movement of the gold price in narrow and limited ranges between 1568 and the $1546 support. With several trading sessions in this performance, we noted that there may be a price explosion soon in one of the two directions, and during Friday trading session, the opportunity was natural towards more gains pushing prices towards the $1576 resistance, the highest in two weeks ago, and with the beginning of trading this week and the growing concern, the price of gold rose to The level of $1588 an ounce. The limited performance of the yellow metal price is due to the fact that the Chinese crisis increased investor appetite for safe haven assets, and gold is one of its most important elements, as well as what happened at the time of the gold purchase season in an important consumer of the metal with the start of the celebration of the Lunar New Year there. Corona cost gold its important purchase season.

The strength of the US dollar prevented gold from moving toward the following psychological resistance at $1,600 an ounce, which is the current bulls’ goal, and the nearest level in the event of worsening conditions in China and in other global countries. The deadly virus has so far harvested 56 deaths and affected thousands. Numbers are terrifying and can increase round the clock, which rises more concern in the global markets, and therefore give gold prices a push to achieve more.

The recent gold gains are on a date during the last week of January 2020, which carries with it many events and important data that affect investor sentiment, of course, the first of which is the deadly Corona virus and its global consequences. Then the Bank of England and the Federal Reserve announcements of their monetary policies, and the rate of growth of the US economy. Also, Brexit date falls next Friday.

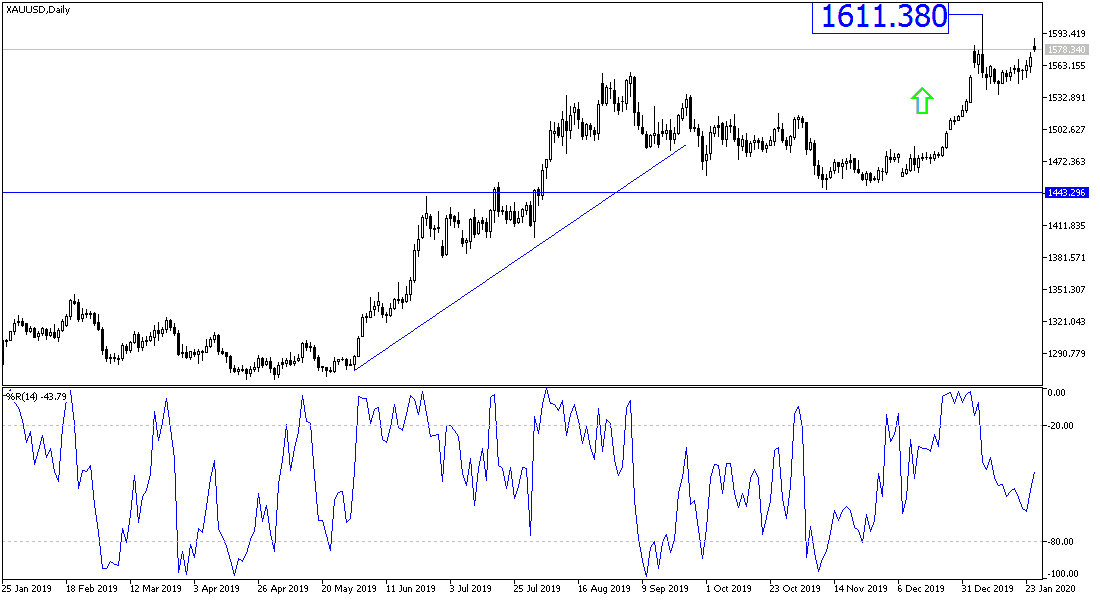

According to the technical analysis of gold: the general trend of gold prices is still bullish and as we mentioned before, we now confirm that the increase in global trade and geopolitical tensions will remain a catalyst for investors to buy more gold, and thus push it to higher levels, and most certainly the $1600 psychological resistance. There will be no correction of gold prices, as the technical indicators have reached strong overbought areas without calm returning to the global financial markets in the event that it was officially announced that the risks of the globally deadly Corona virus were contained.

According to the economic calendar data today: The price of gold will react to the announcement of the IFO index of German business sentiment and new US home sales data.