There is no doubt that the Japanese yen is one of the most popular safe-haven assets for investors in times of uncertainty, and the US dollar is behind it in this regard. Therefore, with the spread of the deadly corona virus in China and the increase in infection rates in some countries around the world, it was natural for the USD/JPY price to abandon recent gains by retreating to the 109.17 support. The opportunity for the pair's upward correction will be affected if it falls back below the 108.80 support this week, which already happened in the beginning of today’s trading. Besides the concern of Corona, the dollar will be on an important date this week, with the announcement of the US GDP growth rate and the announcement of monetary policy decisions by the Federal Reserve Bank led by Jerome Powell.

Stronger expectations are that the Federal Reserve will keep interest rates unchanged at 1.75%, and the monetary policy statement, that accompanies the announcement of the most closely watched rate by investors and markets, a very high impact. This because investors search for new signals to any changes in the Federal Reserve's assessment of the labor market, as well as local and global economic performances, because the bank will take all these key factors into its future interest rate decisions. The latest economic data results will support positions in favor of keeping the interest rate unchanged and guidelines for greater reliance on data by Chairman Jerome Powell and the Federal Open Market Committee.

Markets are betting that the Fed will offer at least one additional rate cut in 2020, although the bank itself has said it will require a “fundamental change” in its GDP forecasts of about 2% in 2020, with near-target inflation and full employment, in order to claim any other policy actions. So far, the country's economic performance appears to be in favor of the bank's policy.

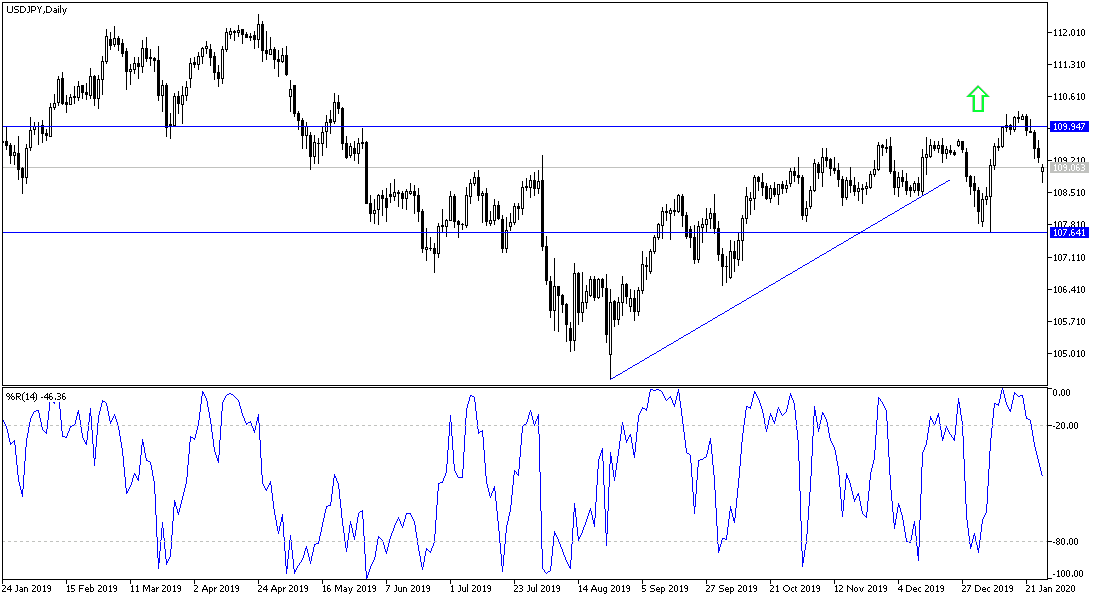

According to the technical analysis of the pair: It appears that the price of USD/JPY is trading under severe downward pressure in the short term. This follows a major reversal last week, which ended all gains early this year. The pair has now retreated by more than 40% as shown using Fibonacci retracements. Therefore, bears will target short-term profits at around 109.075 or less at 108.803, at 50% and 61.80% Fib levels, respectively. On the other hand, bulls are targeting rebound gains around the 23.40% Fib level at 109.688 or higher at 110.00.

In the long term, according to the performance on the daily chart, the pair is still moving inside a bullish channel, and this comes after reaching the bottom at the 104.446 support in August of last year. Thus, bears will target long-term profits at the 108.373 support or less at 107.121. On the other hand, bulls will be looking to maintain momentum by targeting profits at 110.238 or higher at 111.665.

There are no economic releases from Japan today. From the U.S, New home sales data will be announced. Taking into consideration the extent of the risk appetite in the market.