With the coronavirus causing more deaths, and disruptions to the supply chain, the global economy is expected to feel a considerable impact. China is the epicenter of the flu-like virus, and travel restrictions have been put in place. With the economy already strained, recession fears are on the rise. Australia reports a slump in its export price index for the fourth quarter, while New Zealand saw imports decrease sharply, resulting in a monthly budget surplus. This failed to lift its currency, as the AUD/NZD pushed above its support zone on the back of a momentum increase.

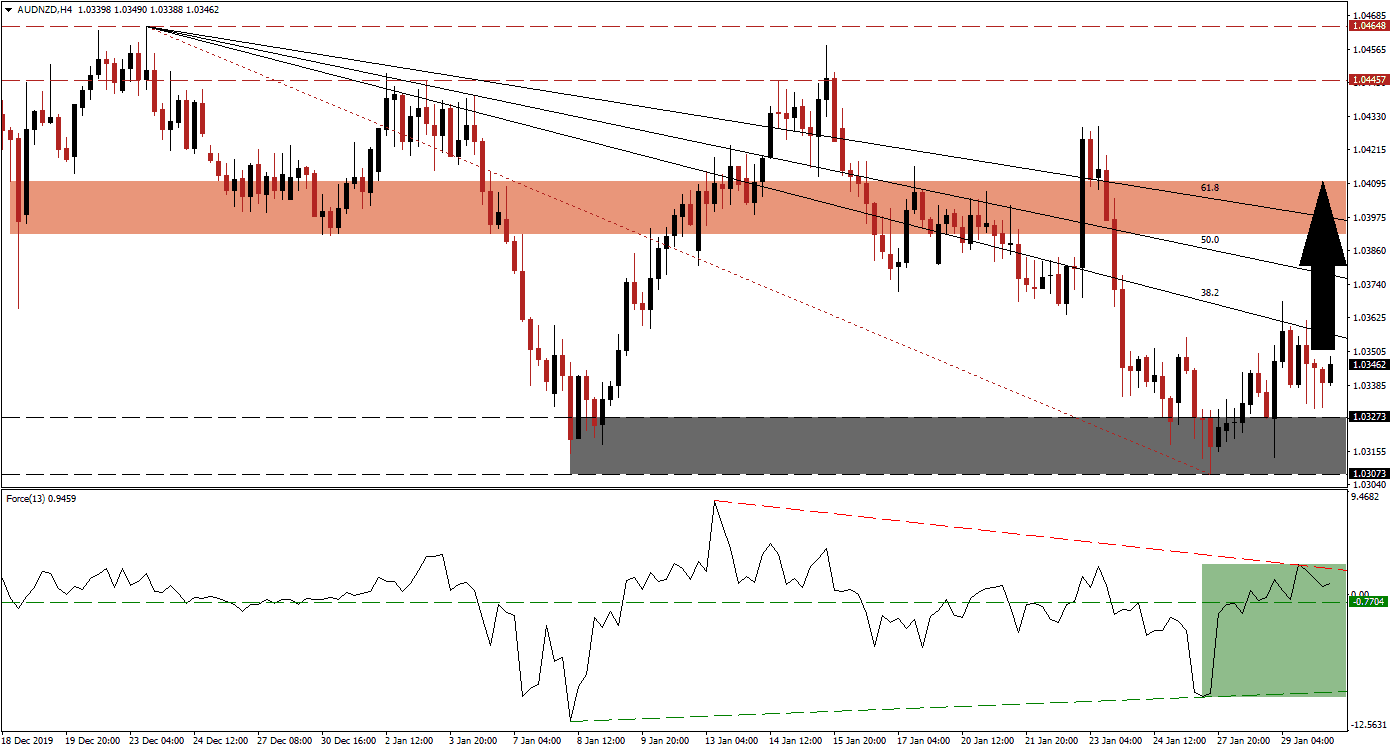

The Force Index, a next-generation technical indicator, points towards a build-up in bullish pressures after accelerating to the upside from a higher low. After converting its horizontal resistance level into support, as marked by the green rectangle, it failed to extend its advance. A descending resistance level emerged, but the Force Index remains in positive territory with bulls in charge of the AUD/NZD. This technical indicator is expected to move farther to the upside, leading price action into a breakout sequence. You can learn more about the Force Index here.

After the breakout in this currency pair above its support zone located between 1.03073 and 1.03273, as marked by the grey rectangle, the AUD/NZD is now faced with its descending 38.2 Fibonacci Retracement Fan Resistance Level. The size and diversity of the Australian economy, already battered by bush fires, in comparison to the New Zealand economy, is anticipated to provide a solid fundamental catalyst for price action to push through its entire Fibonacci Retracement Fan sequence.

Forex traders are advised to monitor the intra-day high of 1.03683, the peak of a failed breakout. A move above this level is likely to invite more net buy positions and elevate the AUD/NZD into its short-term resistance zone. Price action will face this zone between 1.03918 and 1.04103, as marked by the red rectangle. An extension of the pending breakout sequence into its long-term resistance zone between 1.04457 and 1.04648 cannot be ruled out. You can learn more about a breakout here.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.03450

- Take Profit @ 1.04100

- Stop Loss @ 1.03250

- Upside Potential: 65 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 3.25

In the event of a breakdown in the Force Index below its ascending support level, the AUD/NZD could be pressured below its support zone. Any breakdown attempt in this currency pair is favored to be temporary, and Forex traders should take advantage of a breakdown with new long positions. The next support zone is located between 1.02369 and 1.02636.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 1.02900

- Take Profit @ 1.02400

- Stop Loss @ 1.03100

- Downside Potential: 50 pips

- Upside Risk: 20 pips

- Risk/Reward Ratio: 2.50