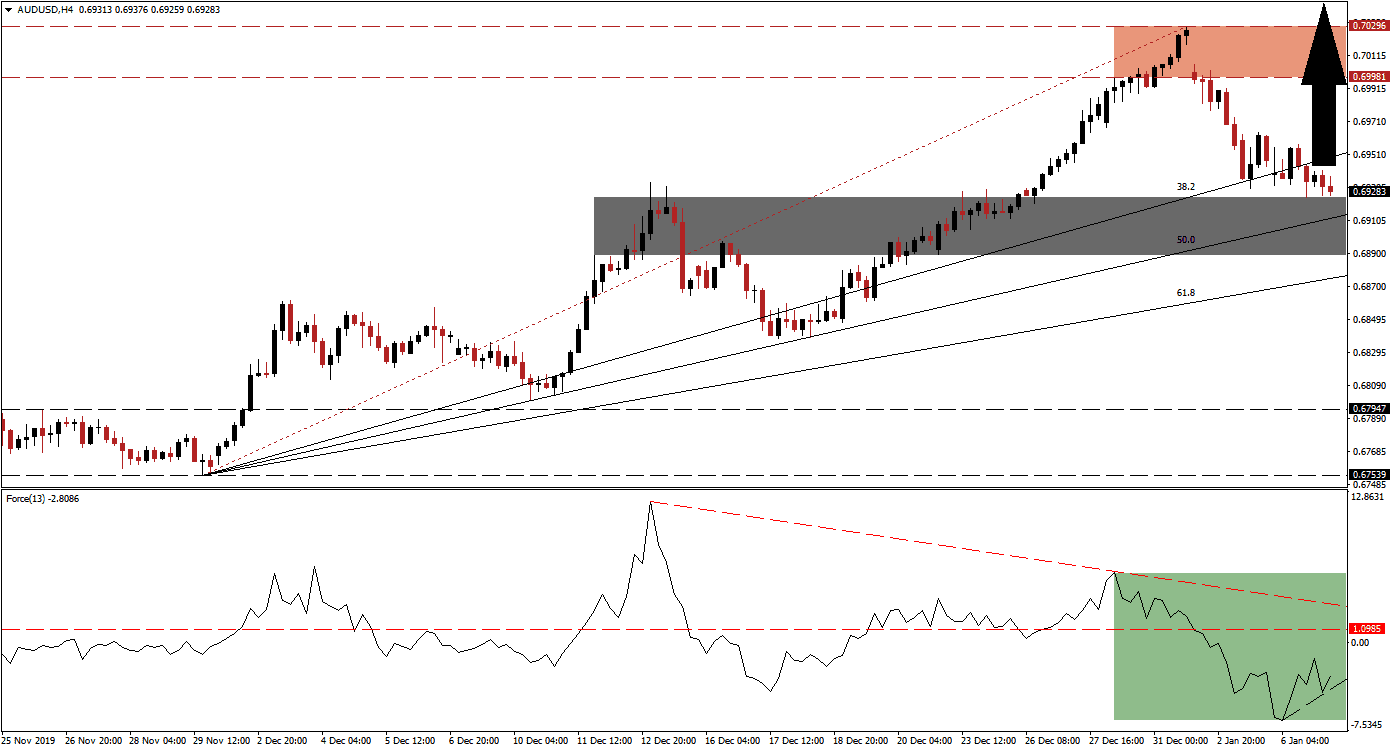

Traders chose to brush aside tension in the Middle East quickly as the US military is sending the Bataan Amphibious Readiness Group to the Persian Gulf. This three-ship group includes 2,200 Marines and one helicopter unit, following the deployment of 3,500 troops from the Army’s 82nd Airborne Division to Kuwait. Markets started to recover from their initial reaction to the US killing of key Iranian General Soleimani. The AUD/USD is losing bearish momentum as it is descending into its short-term support zone, which is enforced by its ascending 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, started to recover from a fresh low as this currency pair converted its 38.2 Fibonacci Retracement Fan Resistance Level into support. A positive divergence materialized in its early phase, suggesting the current downtrend is vulnerable to a reversal. The Force Index remains below its horizontal resistance level in negative territory, as marked by the green rectangle. A gradual increase is anticipated to take this technical indicator above the 0 center-line and through its descending resistance level. It will place bulls in charge and initiate a reversal in the AUD/USD.

This currency pair started its corrective phase with a price gap to the downside. This occurred inside of its resistance zone located between 0.69981 and 0.70296, as marked by the red rectangle. Before the sell-off, the AUD/USD embarked on a strong advance, and a short-term counter-trend move was necessary. The 50.0 Fibonacci Retracement Fan Support Level has reversed two previous corrections, which is favored to be repeated a third time. With the fundamental outlook supporting the bullish technical scenario, the long-term uptrend is expected to remain intact.

A short-covering rally may emerge after price action moves into its enforced support zone located between 0.68888 and 0.69249, as marked by the grey rectangle. This is expected to take the AUD/USD back above its 38.2 Fibonacci Retracement Fan Resistance Level, clearing the path into its resistance zone. Economic data out of the US on Friday showed the manufacturing recession has accelerated in December, and if today’s data shows a deterioration in sub-components of service sector data, this currency pair may attempt a breakout. The next resistance zone awaits this currency pair between 0.71085 and 0.71363. You can learn more about a breakout here.

AUD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.69250

Take Profit @ 0.71250

Stop Loss @ 0.68600

Upside Potential: 200 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 3.08

In the event of a breakdown in the Force Index below its ascending support level, invalidating the positive divergence, a breakdown in the AUD/USD is likely. The uptrend will remain intact unless this currency pair moves below its 61.8 Fibonacci Retracement Fan Support Level. Due to the dominant bullish outlook, any sell-off is anticipated to remain confined to its long-term support zone located between 0.67539 and 0.67947.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.68350

Take Profit @ 0.67550

Stop Loss @ 0.68750

Downside Potential: 80 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.00