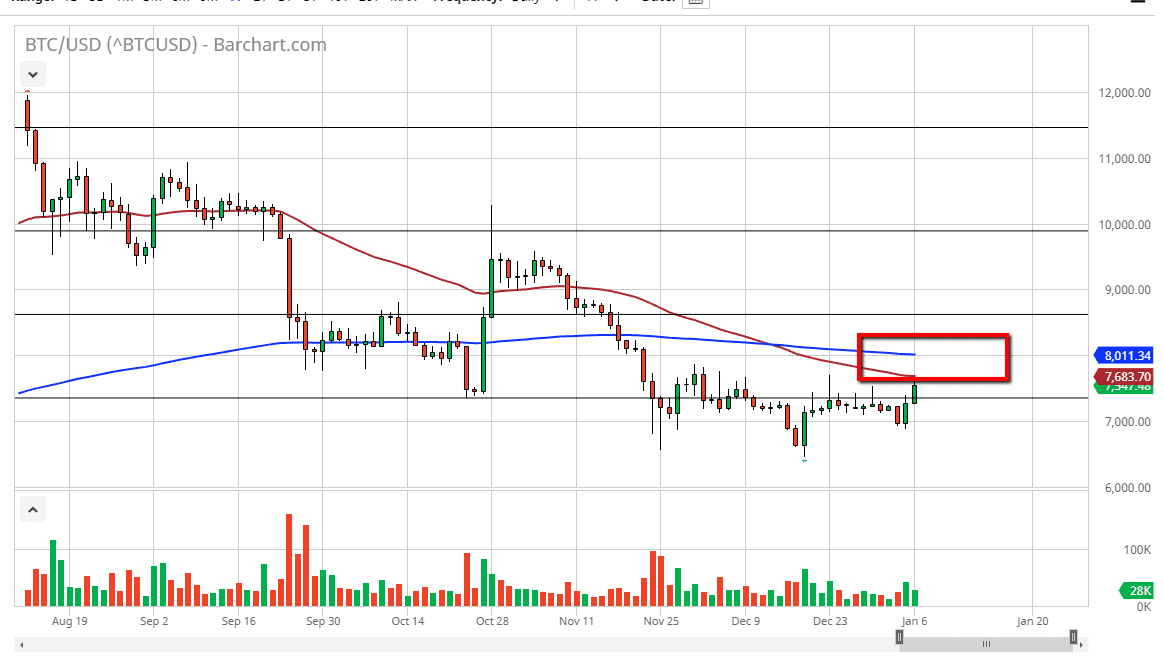

Bitcoin markets rallied a bit during the trading session on Monday as people came back to work, breaking above the 7500 level. That’s an extraordinarily good sign for the short term, but the 50 day EMA is just above and we of course have the 200 day EMA reaching towards the $8000 level. There is a complete “zone of resistance” between those two moving averages that I think will keep this market somewhat soft. Beyond that, you can also make an argument that the market has pulled back just a bit towards the end of the day, and therefore I think we will continue the overall downtrend.

The 200 day EMA is a major barrier to overcome for the buyers, so if we did get a daily close above there, I would have to take a look at the potential of a move to the upside. However, I suspect that any signs of exhaustion between here and there will be thought of as an opportunity to carry out the longer-term downtrend. The market does look as if it is trying to find some type of base here, but the longer-term technical analysis still suggests that we are going to go lower from here.

The Bitcoin market has gotten bashed quite significantly over the last several months, and at this point we should continue to see a lot of exhaustion. The descending triangle that eventually started this downtrend measured for a move towards the $4800 level. That’s an area that I think we will get to eventually, but the question now is whether or not we bounced significantly between now and then or if we just rolled right back over. What I do find interesting is that even with a major event like the assassination of an Iranian general didn’t have more of an effect on money flowing into crypto to protect itself. If Bitcoin can’t get a boost from something like that, it’s hard to tell what will turn things around. I understand that there is a halving in May 2020 as far as the hash rate is concerned, but quite frankly Bitcoin isn’t being adopted in a manner that makes much difference. It simply will become more difficult to mine the coin, but in the end if it’s not catching on, it just makes something that isn’t going to be worth this much take even more work. That being said, I have yet to see a reaction to that scenario.