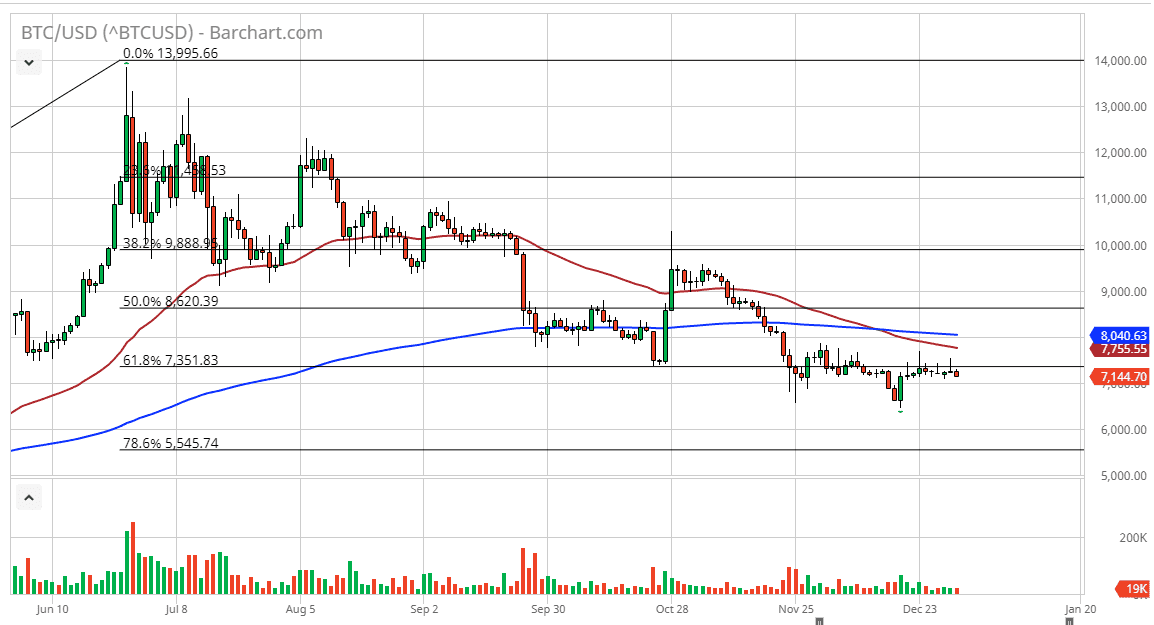

Bitcoin markets drifted a bit lower during the New Year’s Eve trading session, as we continue to juggle just below the $7250 level. The 50 day EMA is above and sloping lower, as it has recently broken down below the 200 day EMA. At this point in time I think that Bitcoin is ready to reach towards the lows again, and perhaps even the $6000 level after that. Rallies at this point continue to offer selling opportunities and given enough time we will probably try to fulfill my target of $4800 as it is based upon the measurement of the descending triangle that we broke out of just above the $10,000 level.

In fact, we had recently tried to break back above the $10,000 level based upon the Chinese suggesting that they were “researching block chain”, and unfortunately people thought that was a signal to start buying Bitcoin. At this point, market participants came back into the Bitcoin market on that Monday, and then broke it down. Most of the money that you have seen during that spike come into the market was retail money, and therefore industry insiders pummeled and sold into that rush.

Since then, we have not only rolled over, but we have seen the so-called “death cross”, when the 50 day EMA breaks down below the 200 day EMA, a longer-term negative signal. Ultimately, it looks like we are continuing the downside and therefore I think a lot of people are willing to come in and punish Bitcoin if it does try to rally. In fact, it’s not until we break above the 200 day EMA that I would even remotely consider buying this market, and even then, I would have to reevaluate the entire situation. I think it is a situation that Bitcoin simply isn’t being adopted, and therefore it makes sense that we continue to go lower. The halving coming in May is in theory a bullish sign but at this point it doesn’t seem like anybody cares, which in and of itself is an extraordinarily negative sign as well. This is a market that should continue to go lower, but we will get the occasional bit of optimism that comes into the marketplace but look at that as an opportunity to punish this market yet again. Quite frankly, there is nothing on this chart that looks remotely positive.