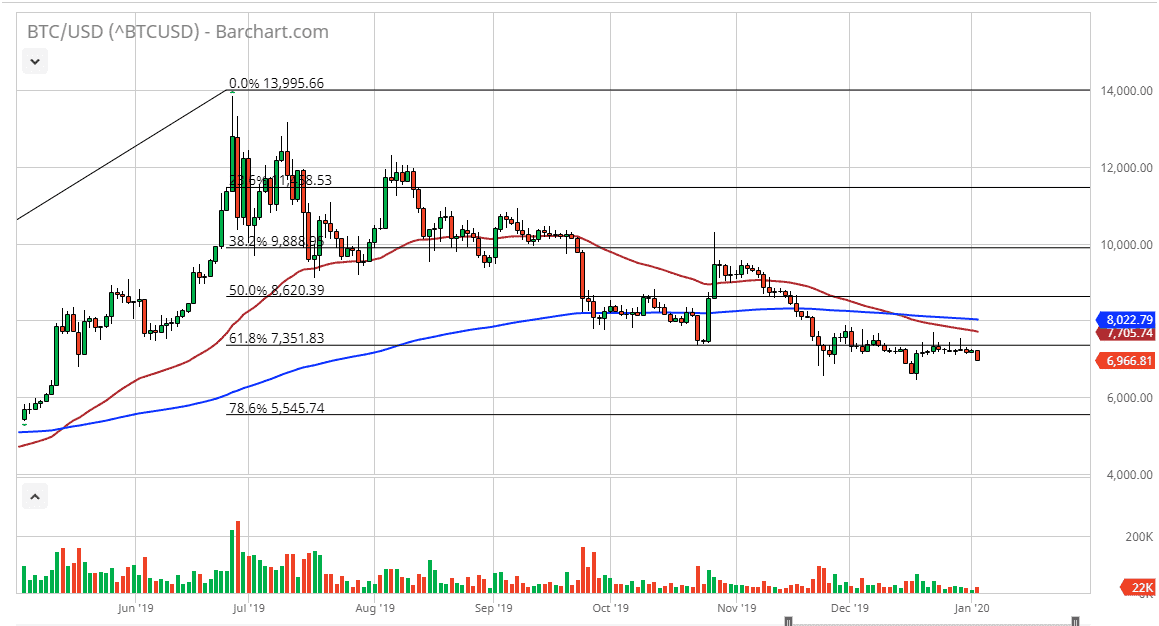

Bitcoin has broken down a bit during the trading session on Thursday as traders came back to work, continuing the overall negativity that we have seen for quite some time. Recently, I have been warning that we are going to go lower, and it seems as if Thursday is showing signs of that happening. Ultimately, the market is simply continuing the overall downtrend, as the 50 day EMA is starting to race towards the downside again. Based upon previous technical analysis, I still maintain a longer-term target of $4800.

The candlestick on Thursday with the first one that had any type of movement to it, lease for the last couple of weeks. At this point, market participants will probably go looking towards the lows near $6500, perhaps down to the six dollars level but I do anticipate that the $6500 level will cause a little bit of a reaction simply due to the fact that it was the most recent low. Beyond that though, the longer-term move is based upon the down trending slope of the moving averages, and of course the fact that the market is finally moving after the holiday. It is telling that the first move was to the downside and not the out, so this should be more continuation.

If we do rally from here, I anticipate that the 50 day EMA is going to cause a certain amount of resistance, so any rally to that area should be an opportunity to go short again. Ultimately, the $6000 level underneath will cause a bit of a bump on the way down to the lower levels, so I look at this is an opportunity to sell rally from there as well. The question now is whether or not we can break down below the $4800 level and I would anticipate that there would be a lot of interest at the $5000 level as well, so I think it’s probably going to be more or less a short-term spike below to turn around and focused more on the $5000 handle eventually. All things being equal, this is a market that should continue to be lucrative for those looking to short sell. If we did turn around a break above the 200 day EMA, which is currently at the $8000 level, then I would have to rethink the outlook for the market, but right now it looks pretty dire.