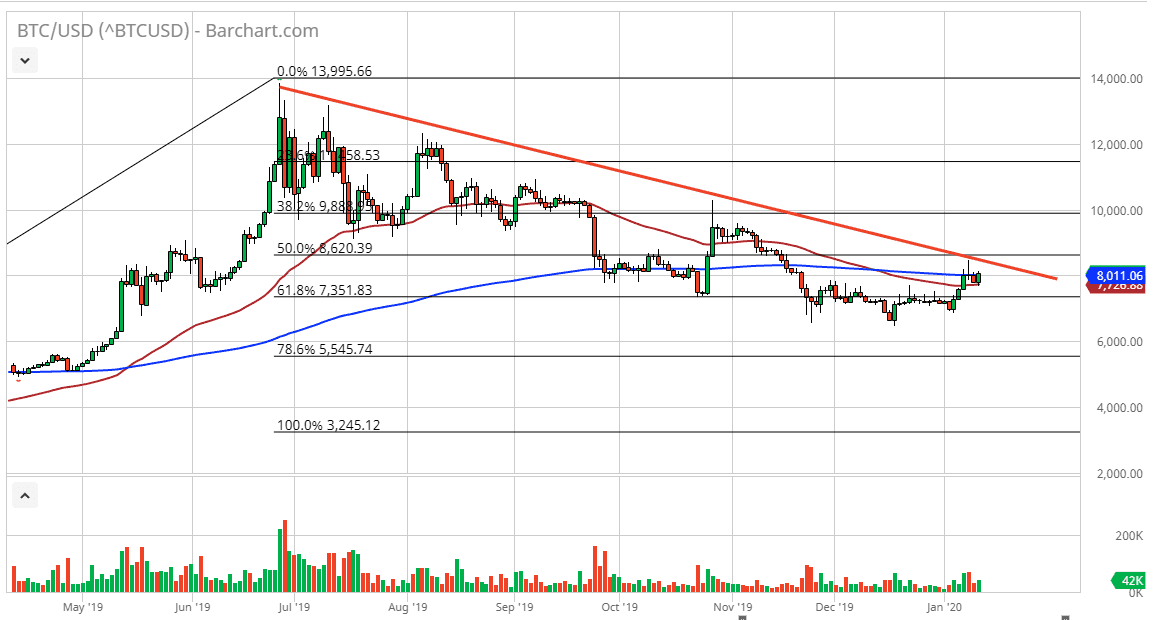

Bitcoin markets rallied a bit during the trading session on Friday, reaching towards the highs of the Thursday session. We are currently testing the shooting star from the Wednesday session that was so negative, and perhaps even more importantly, the 200 day EMA. Bitcoin has been in a downtrend for quite some time so it would make quite a bit of sense to see a continuation of that negativity. Furthermore, if we break down below the 50 day EMA it will more than likely go down towards the lows again.

Breaking above the top of the shooting star from the Wednesday session would be a very bullish sign, as it would not only clear short-term resistance based upon that trading session, but it would also slice above the downtrend line that is so highly visible in this market. That being said, I think that the Bitcoin market is going to struggle to break out above there. The market is likely to go much higher, perhaps reaching towards the $10,000 level if we do get that breakout, but the way that Bitcoin has been acting recently it would not surprise me at all to see it fail at that trendline again.

If we break down below the $6500 level, the market will then break down rather significantly. The $4800 level is still my longer-term target based upon the descending triangle at the top of the range of trading over the last year, and therefore I am still bearish. That doesn’t necessarily mean that we have to go there, just that technical analysis favors that move. It also doesn’t necessarily mean that we can get there easily, so I do anticipate that it’s going to take a certain amount of wherewithal to hang on to the trade to the downside. There will be the occasional bump and rally, but those are to be sold as we continue to see quite a bit of negativity. That being said, if you can scale into a position you should do quite well. That has certainly been the case for the last several months and there’s nothing on this chart that tells me things are any different. Overall, we look like we are ready to make some type of significant decision, but trends are there for a reason, and the trend is most certainly suggest that we are going to go lower in the price of Bitcoin.