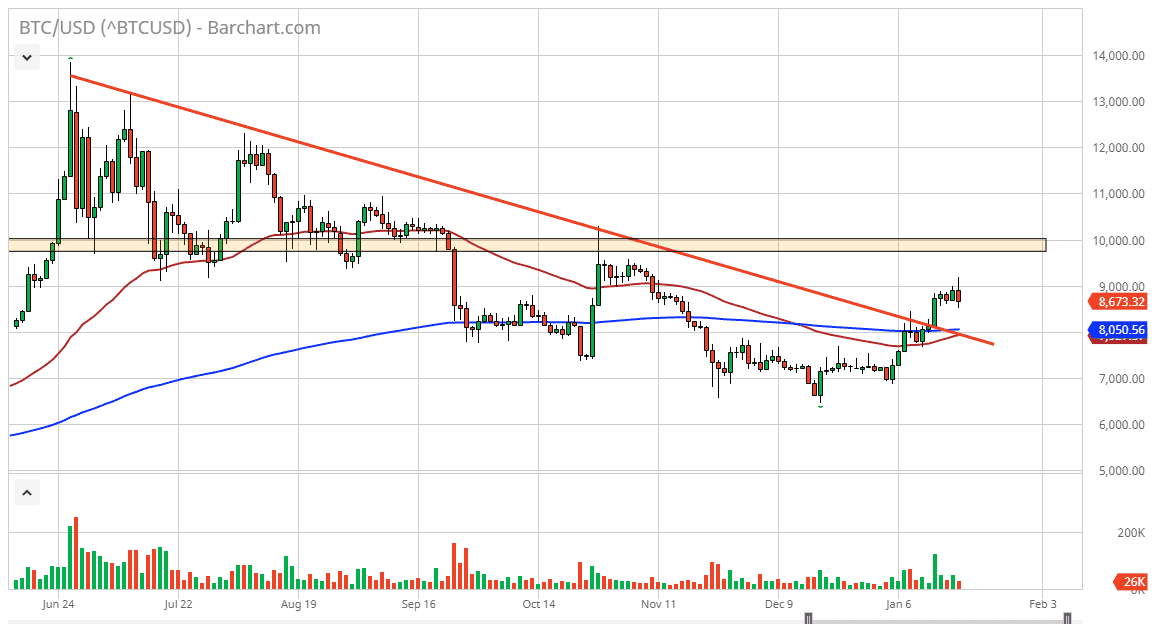

Bitcoin has initially rallied during the trading session on Monday, breaking above the $9000 level but has turned right back around to form a bit of a shooting star. The question now is moving what happens from a longer-term standpoint? Bitcoin has clearly broken a major downtrend line, but on that breakout, I figured that somewhere between that trend line and the $10,000 level, Bitcoin would run into serious trouble. $9000 extends all the way to the $10,000 level above that offers resistance.

The question isn’t so much as to whether or not we can pull back, but the question is whether or not we break back down. The 50 day EMA is starting to approach the 200 day EMA near the $8000 level, which also matches up quite nicely with the previous downtrend line. In the short term, I fully anticipate the Bitcoin will probably go back to that area to look for signs of support. That is of course an area where we could have a lot of questions answered, but ultimately, I think that this is a market that will make a longer-term decision in that vicinity.

There are talks about the halving in May driving price higher, but overall it may not be the explosive reason for price going higher as it has been in the past. The market has a long history of rallying and then being sold into as just 1000 wallets contain over 40% of all Bitcoin in the world. In other words, the “whales” quite often got in early and then dump Bitcoin into the marketplace every time it spikes. It’s exactly what you would do, so that makes quite a bit of sense that is what they are doing. Nonetheless, this is a market that continues to make “lower highs”, regardless of the point of wise doing so. If we were to turn around and break above the top of the candlestick for the trading session on Monday, that would obviously be very bullish and could send the market towards the crucial $10,000 level. If that market level gets broken, then we could really start to see an uptrend start to form, one that probably would last quite a while. At this point though, we still haven’t quite broken through a lot of resistance although the trendline was a good start. I anticipate that we pull back about $700, and then start to answer more important questions from a longer-term standpoint.