Bitcoin has rallied significantly during the trading session on Friday after the Americans killed an Iranian general, sparking a major “risk off” type of rally. Interpersonal the world, people will use Bitcoin in order to get out of local currencies and preserve wealth. I suspect this is basically what happened as we did get a little bit of a volume spike, but it is worth pointing out that we are right at the previous resistance and stop dead in our tracks there. It is because of this in a few other assets that I’ve been following, then I believe the major “risk off move” is probably somewhat limited.

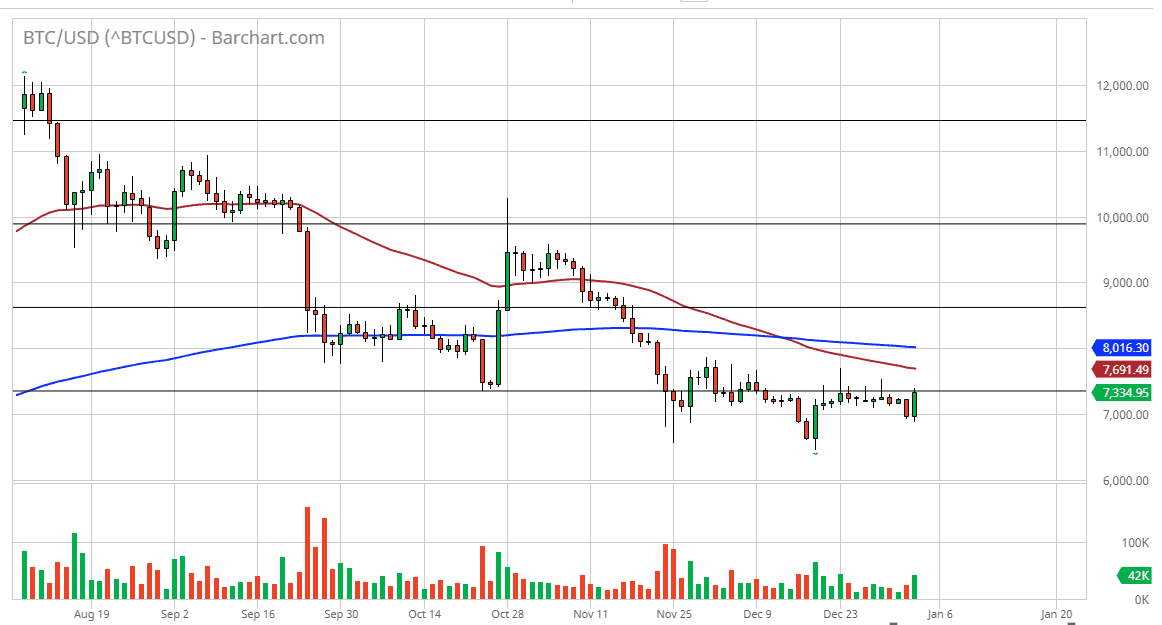

With that in mind I believe that the 50 day EMA above will continue to be significant resistance, which is currently at the $7690 region. Signs of exhaustion in that area should be taken advantage of, as the market will continue to go back and forth and try to determine the next move. The blue 200 day EMA just above the $8000 level will also be extraordinarily resistive as well, so the first signs of weakness after a rally, I would be short of this market yet again. Remember, the longer-term trend is most decidedly negative, and that is not changing anytime soon.

The candlestick that formed for the trading session on Friday is of course very bullish, but it has not broken the resistance. As we go into the weekend, volume will be thin but that will probably lead to a fake out more than anything else. Most of this is going to be based upon how the Iranians react, which of course they haven’t yet. The fact that the Americans would take out a top general suggests that Donald Trump isn’t messing about. The question now is whether or not the Iranians will back off.

If they did something drastic over the weekend it’s likely that the Bitcoin markets will react in a very positive manner. However, if they do not and things seem to de-escalate a bit, then Bitcoin will probably fall. The question now is going to come down to whether or not the Iranians believe that the Americans will escalate even further or not. If they do, it’s very likely they will find a way to back down from this. If for some reason they don’t, they will probably press the issue, causing all kinds of chaos and therefore bullish pressure for Bitcoin.