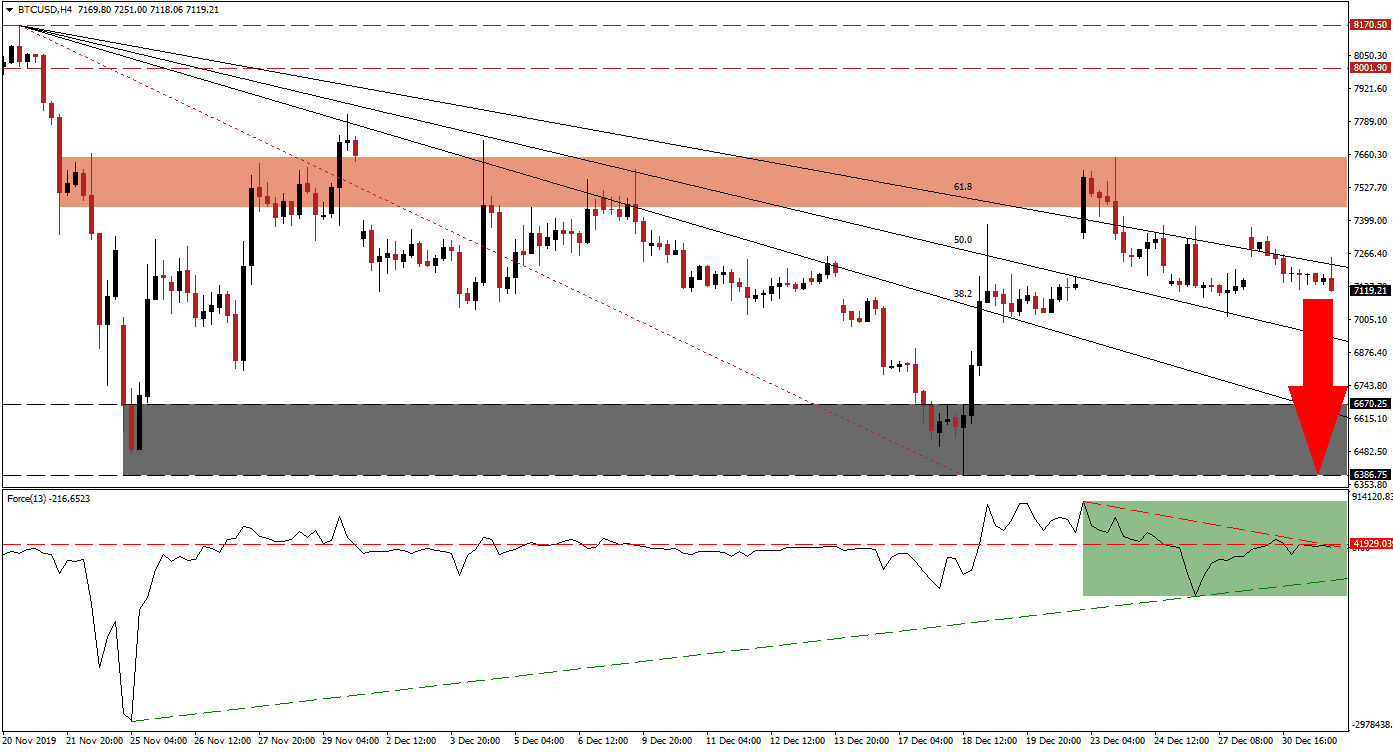

Bitcoin is positioned to extend its bearish chart pattern after price action was rejected by its short-term resistance zone. The BTC/USD attempted to invalidate the downtrend and briefly eclipsed its descending 61.8 Fibonacci Retracement Fan Resistance Level with a price gap to the upside. This was quickly reversed, and this cryptocurrency pair completed a double breakdown, which took it back inside the Fibonacci Retracement Fan sequence. Price action is now favored to revisit its next long-term support zone. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, indicated the rise in bearish momentum after this cryptocurrency pair reached its short-term resistance zone. It converted its horizontal support level back into resistance but was able to form a higher low. An ascending support level materialized, and the Force Index advanced. This technical indicator is now pressured by its descending resistance, as marked by the green rectangle. It additionally remains in negative territory, and bears are in control of the BTC/USD.

Price action has been rejected by its sort-term resistance zone on eight occasions and requires a significant fundamental catalyst to sustain a breakout attempt. This zone is located between 7,448.00 and 7,647.25, as marked by the red rectangle. The start of 2020 may usher in a fresh wave of sell orders, especially by professional traders conducting portfolio adjustments. Many retail traders are looking forward to Bitcoin’s halving event this year, based on the hope it will accelerate the BTC/USD higher, as it has done the previous two times. It may have the opposite impact in 2020, and result in a massive sell-off coupled with the exodus of miners.

Following the breakdown which took price action below its 61.8 Fibonacci Retracement Fan Resistance Level, more downside is anticipated. The BTC/USD is cleared to descend into its support zone located between 6386.75 and 6,670.25, as marked by the grey rectangle. This zone will play a critical role in price action for 2020, as it is expected to embrace the cost of production for Bitcoin. The costs are gradually increasing, but have provided a sound support level. A breakdown will force miners to leave the network, leading to a drop in the hashrate. The price usually follows the hashrate, but there is plenty of debate regarding this topic. You can read more about a breakdown here.

BTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 7,120.00

Take Profit @ 6,400.00

Stop Loss @ 7,350.00

Downside Potential: 72,000 pips

Upside Risk: 23,000 pips

Risk/Reward Ratio: 3.13

In case of a breakout in the Force Index above its descending resistance level and push above the 0 center-line, the BTC/USD is likely to attempt a ninth breakout above its short-term resistance zone. Given the current bearish technical scenario, the upside potential may be limited to its next long-term resistance zone between 8,001.90 and 8,170.50.

BTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 7,750.00

Take Profit @ 8,150.00

Stop Loss @ 7,550.00

Upside Potential: 40,000 pips

Downside Risk: 20,000 pips

Risk/Reward Ratio: 2.00