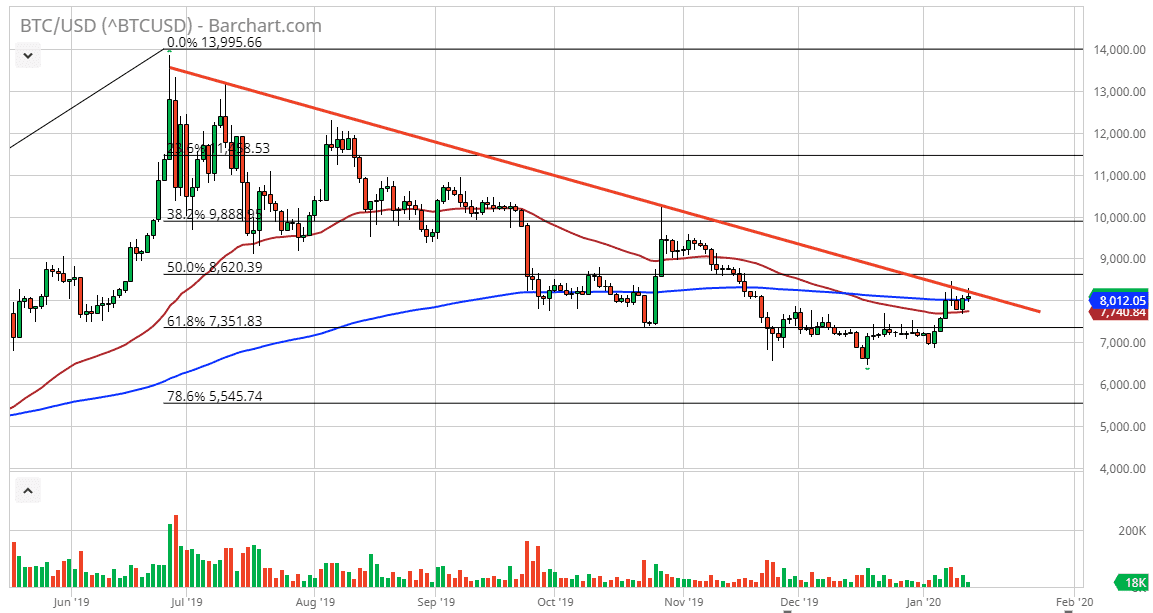

Bitcoin has rallied slightly during the trading session on Monday to kick off the week, as we continue to bounce around the 200 day EMA. However, the market has given back quite a bit of the gains for the day, and therefore we ended up showing signs of exhaustion. The shooting star shaped candlestick of course is a negative sign, but the fact that it formed right at a downtrend line suggests that we do have quite a bit of selling just above.

This is starting to become a repeating story, as the Bitcoin markets rally, sellers come in to take advantage of that move as soon as there is exhaustion. That being said, the 200 day EMA is going to attract a lot of attention, but there is also support underneath at the 50 day EMA. I think at this point the market is going to be squeezed into a position, so the next impulsive move will probably dictate where we go for the next several weeks. That being said, we are at a perfect place for selling to occur, so it is possible that we get a breakdown. If we were to break down below the 50 day EMA I believe at that point the market will clearly go looking towards the $7000 level, perhaps even the $6500 level after that. Furthermore, the descending triangle that kicked off this big move lower measured for a move down to the $4800 level, something that we have not seen that yet, and I still believe longer-term that could very well be the target.

With that being said, I believe that the market will continue to be looking for sellers every time it rallies, because that’s been the pattern with Bitcoin for quite some time. Those who hold a lot of these coins are willing to dump them off every time the public steps in to try to take advantage of a rally. It is not a very liquid market, at least not like the Forex markets, so it’s very easy for a huge player to come in and crush a rally. Furthermore, Bitcoin simply is not been adopted. That of course is a major problem as it is still trying to figure out exactly what it is going to be going forward. It’s been “digital gold”, “new money”, an alternative to fiat currency, a way to play block chain, and a whole host of other things that have not panned out.