The DAX futures continue to look very positive as we had initially pulled back during the trading session on Tuesday, only to find buyers again as the German ZEW Economic Sentiment announcement came out almost double what it was expected to. By doing so, it shows that business leaders in Germany are starting to see signs of optimism, and therefore it’s likely that they will invest in their companies going forward. As it goes, it’s a forward looking indicator as people will not be looking to spend money on a company that isn’t going to be making money.

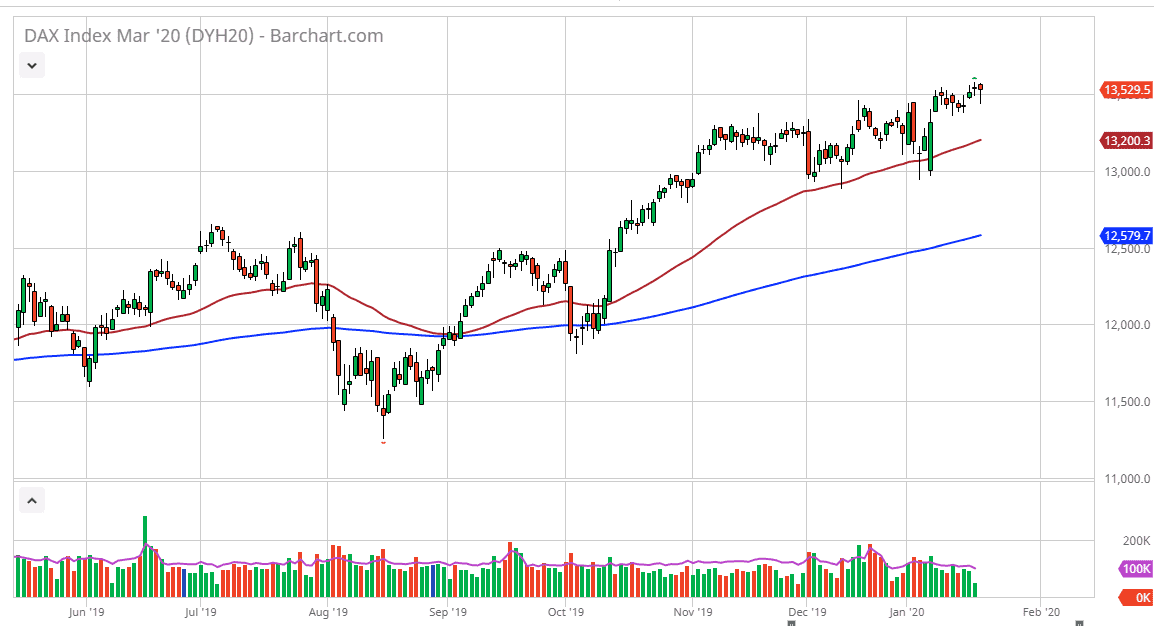

Remember, Germany is highly sensitive to the export market, as Germany is one of the world’s great exporters. With the cheap Euro, this has made German products cheaper, and therefore it makes quite a bit of sense that they could be picking up a bit of momentum. Looking at the shape of the candlestick, it looks very bullish as we have turned around to form a bit of a hammer. The hammer sits at the €13,500 level, which is previous resistance, and therefore it’s likely that it should be somewhat supportive. This is especially true considering that we’ve seen church a burst higher from the €13,000 level recently.

The 50 day EMA is currently at the €13,200 level and rising at a roughly 40° angle. That of course is bullish because it is not overdone, but more or less a steady march higher. As exactly what you want to see as far as longevity of a trend is concerned, and therefore this is an encouraging sign. In fact, I believe that the “floor” in the overall uptrend is either going to be the 50 day EMA or perhaps the €13,000 level. If we were to break down below there then obviously things would change but right now it looks as if the market is trying to make a statement and go looking towards the €14,000 level which is the next large, round, psychologically significant figure. At this point, it’s very likely that pullbacks will continue to be buying opportunities, and short-term traders will look at those moves as an opportunity to take advantage of value. Value of course is something that we should strive for going forward, as the market is obviously one that bullish, and steady which of course is a combination I like. As long as the Euro doesn’t depreciate rapidly, the DAX should continue to find buyers.