The DAX has tried to pull back just a bit during the trading session on Wednesday, as we may have gotten a bit of a stretch. At this point though, it’s obvious that the market is trying to form some type of up trending channel, so ultimately this is a market that should eventually find buyers. Ultimately, this is a market that should remain somewhat bullish, as the European Central Bank should continue to be very loose with monetary policy. That has people looking to buy “blue-chip stocks”, which generally means the DAX 30.

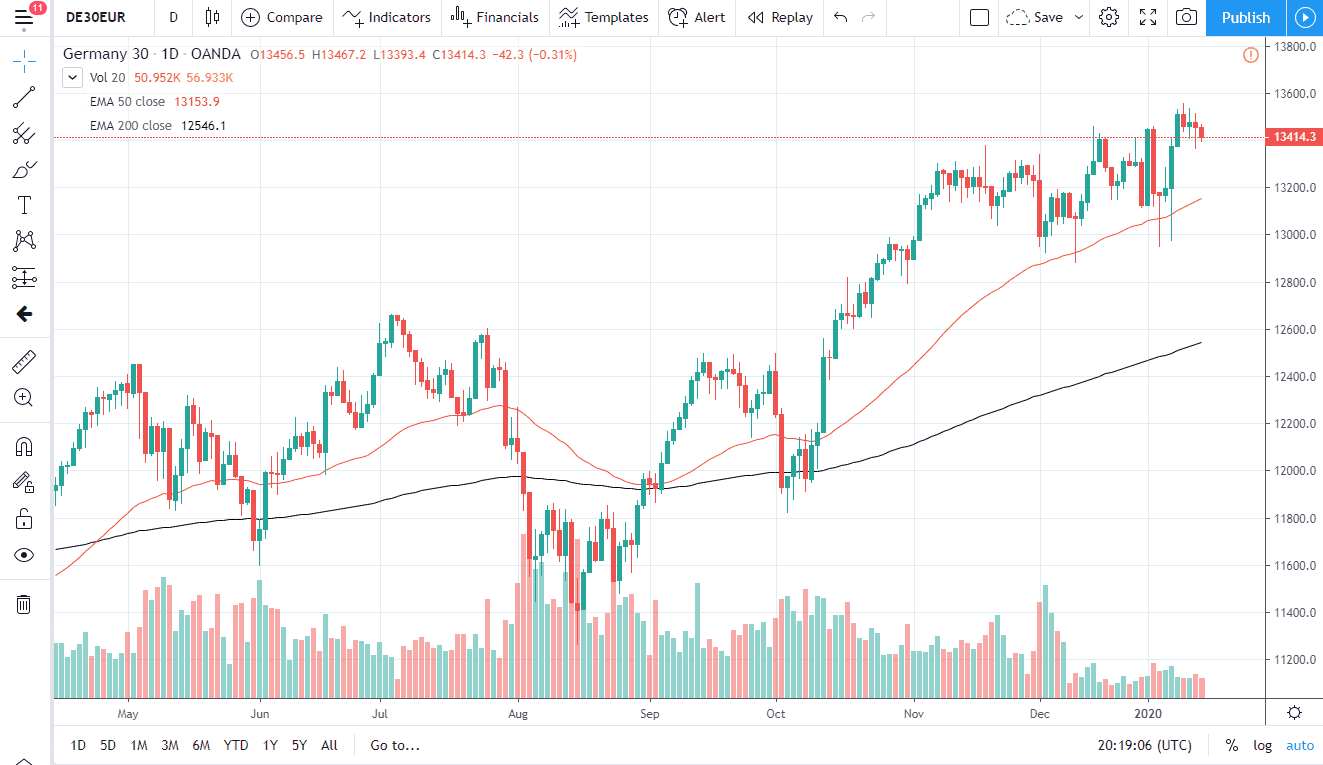

As the market has pulled back from the top of the channel, one would have to assume that the market will find buyers at the lower level of the same channel. Ultimately, I believe that the 50 day EMA, pictured in red on the chart, should continue to offer dynamic support, somewhere around the 13,200 level. At this point, the market should continue to show quite a bit of resiliency, so even though I expect to see a pullback as being very likely, I believe that if you are patient enough you should be able to pick up the DAX at areas that should represent value.

As long as the Euro stays relatively cheap, that should also help the DAX 30 which is full of exporting German companies. That being the case, the market is likely to continue enjoying currency help, as the EUR/USD is trading underneath the $1.12 level, making German products extraordinarily affordable for the rest of the world. Beyond that, the market has been very stable, and it should be looked upon as an opportunity to trade a nice ascending channel that has been reliable so far. In fact, I’m not overly concerned about any pullback until it gets below the 13,000 level. As long as it can stay above there, I believe that it’s only a matter of time before the buyers get involved and take advantage of cheaper pricing. To the upside, the market was to break out above the 13,600 level before pulling back, then it shows that there is a leg higher getting ready to happen. That would be an extraordinarily bullish sign, so having said that I believe you would have to jump in above that level, but I prefer buying the pullback as it is much more sustainable by the bullish traders out there to lift this market.