Ethereum has advanced in unison with the return of bullish sentiment across the cryptocurrency sector. The rally is now threatened by a profit-taking sell-off, as the exhausted upside is confirmed by a loss in momentum. Ethereum in circulation has reached a two-year low as this cryptocurrency pair advanced to multi-week highs. Failure to extend the current advance in the ETH/USD will result in a lower high, keeping the long-term bearish trend intact. You can learn more about a profit-taking sell-off here.

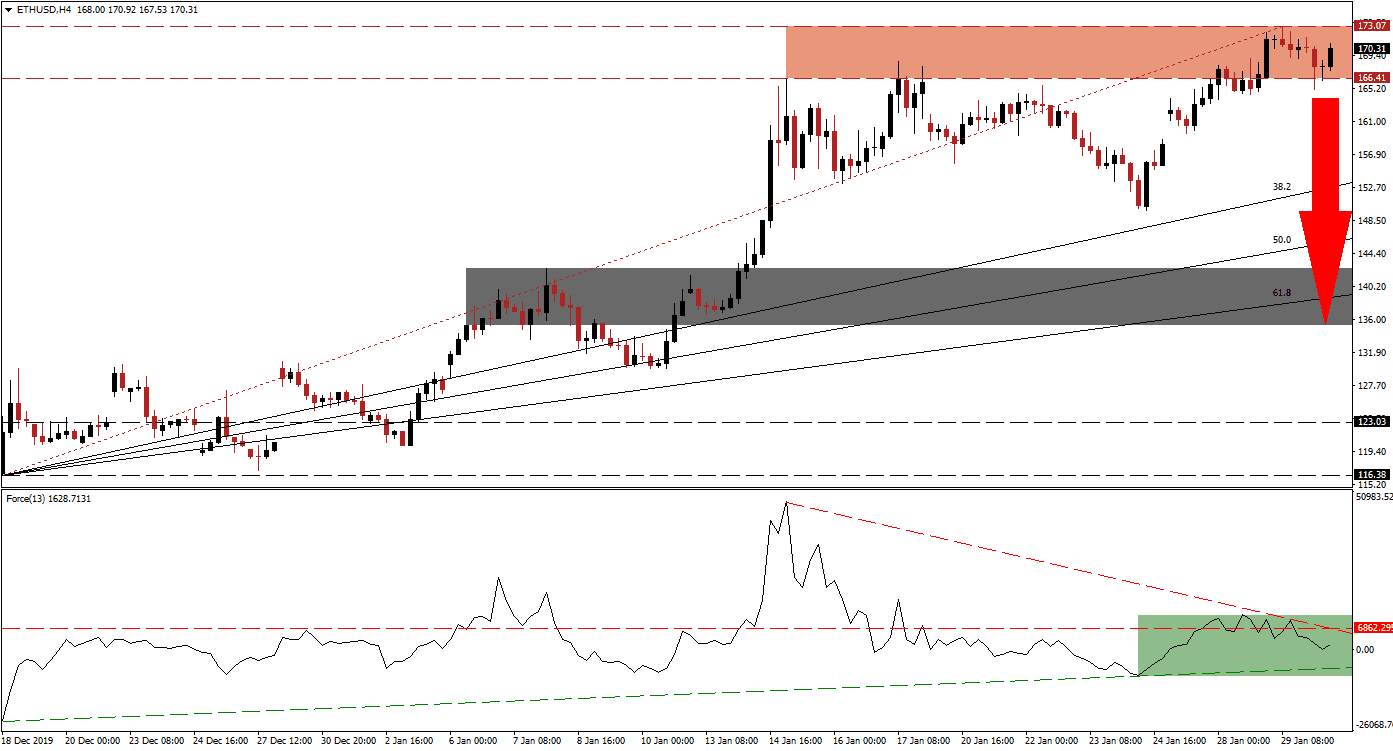

The Force Index, a next-generation technical indicator, provided the first warning that the advance in this cryptocurrency pair is approaching its end. A negative divergence formed as price action pushed higher while the Force Index moved to the downside. After the horizontal support level was turned into resistance, the contraction was halted by its ascending support level, as marked by the green rectangle. Bullish momentum failed to expand, and this technical indicator formed a lower high, allowing its descending resistance level to initiate another reversal. A breakdown below the 0 center-line is anticipated, placing bears in control of the ETH/USD.

Adding to bearish developments is the move by the ETH/USD below its Fibonacci Retracement Fan trendline. This occurred inside of the resistance zone located between 166.41 and 173.07, as marked by the red rectangle. From a fundamental perspective, the growing amount of Ethereum locked away in decentralized financial applications, currently estimated at 3% of total supply, adds to long-term concerns. Social media euphoria over a parabolic rally serves as further evidence that a breakdown is pending.

A profit-taking sell-off should close the gap between this cryptocurrency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level. One key level to monitor is the intra-day low of 159.50, the low of a previous pause in the rally. A breakdown below this level will close a price gap to the upside, expected to result in the addition of fresh net sell orders in the ETH/USD. Price action may then continue its corrective phase into its short-term support zone located between 135.30 and 142.54, as marked by the grey rectangle, from where more downside is possible. You can learn more about a support zone here.

ETH/USD Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 170.00

- Take Profit @ 135.50

- Stop Loss @ 177.50

- Downside Potential: 3,450 pips

- Upside Risk: 750 pips

- Risk/Reward Ratio: 4.60

Should the Force Index reverse above its descending resistance level, the ETH/USD is likely to attempt a breakout. The upside potential remains limited to its next resistance zone located between 189.89 and 192.91, which will represent an excellent short selling opportunity for traders. Fundamental concerns that fueled the previous contraction remain in place, with a long-term bearish chart formation dominant.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 181.00

- Take Profit @ 191.00

- Stop Loss @ 177.50

- Upside Potential: 1,000 pips

- Downside Risk: 350 pips

- Risk/Reward Ratio: 2.86