This currency pair is exposed to central banks on a mission to devalue their respective currencies. Switzerland and the European Union are export bellwethers, where a weaker domestic currency makes their goods more affordable. The Swiss National Bank is well-known for its direct market interventions, but the safe-haven status of the Swiss Franc is countering attempts by the SNB. A less direct approach is taken by the European Central Bank, via its quantitative easing program. More downside is favored in the EUR/CHF as a result of existing fundamental conditions, resulting in a breakdown from current levels.

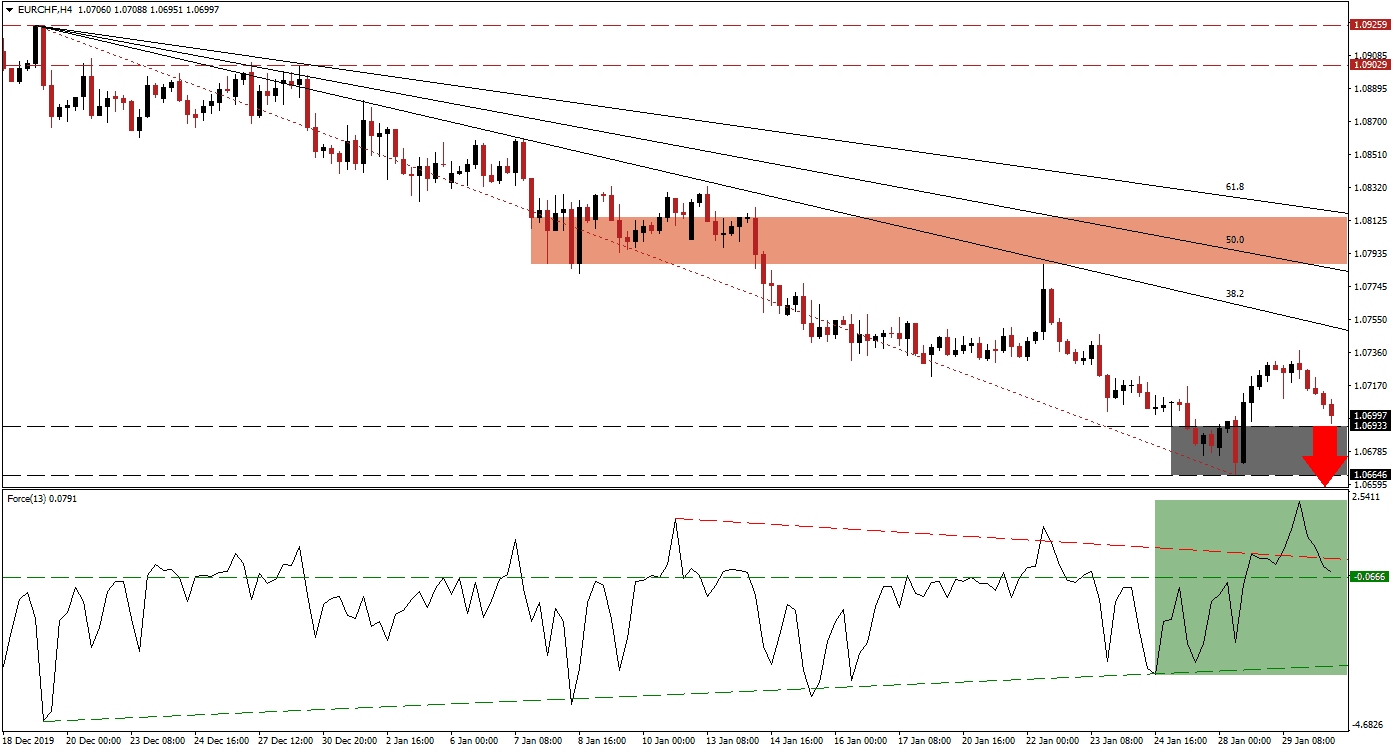

The Force Index, a next-generation technical indicator, spiked to a fresh high as this currency pair pushed out of its support zone. It led to a temporary breakout above its descending resistance level but was quickly reversed as bullish momentum is fading. The Force Index is now on the verge of converting its horizontal support level into resistance with a breakdown, as marked by the green rectangle. It will additionally place this technical indicator into negative conditions, allowing bears to take control of the EUR/CHF. You can learn more about the Force Index here.

As a result of the ongoing sell-off in this currency pair, the short-term resistance zone is being lowered, limiting the upside potential for necessary counter-trend rallies. This zone is currently located between 1.07870 and 1.08144, as marked by the red rectangle. The descending 50.0 Fibonacci Retracement Fan Resistance Level has already crossed below it, maintaining downside pressure on the EUR/CHF, while the 61.8 Fibonacci Retracement Fan Resistance Level is pressuring the top range of it. Today’s economic data out of the Eurozone may provide the next short-term catalyst for price action.

With global growth concerns dominant, a breakdown in the EUR/CHF below its support zone located between 1.06646 and 1.06933, as marked by the grey rectangle, is anticipated. The Eurozone is confronted with problems on multiple fronts, applying downside pressure on already depressed economic growth. Price action is positioned to extend its series of lower highs and lower lows, which should take this currency pair into its support zone between 1.04933 and 1.05295. You can learn more about a support zone here.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.07000

- Take Profit @ 1.05000

- Stop Loss @ 1.07450

- Downside Potential: 200 pips

- Upside Risk: 45 pips

- Risk/Reward Ratio: 4.44

In case of a breakout in the Force Index above its descending resistance level, the EUR/CHF may delay its breakdown. A temporary advance into its 50.0 Fibonacci Retracement Fan Resistance Level remains an option, allowing Forex traders an opportunity to enter new short positions. The long-term outlook is bearish, as ECB Euro devaluation is expected to trump SNB Swiss Franc manipulation.

EUR/CHF Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 1.07600

- Take Profit @ 1.08100

- Stop Loss @ 1.07250

- Upside Potential: 50 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.50