While the Eurozone is anticipated to face similar issues in 2020 as it has over the past decade, the Euro may find itself being pushed to the upside. The primary driver of this advance will be US Dollar weakness, and asset rotation out of the world’s number one reserve currency. The Euro established itself as a sound second choice. Bullish momentum is recovering after the EUR/USD reached its short-term support zone. Economic data out of the Eurozone featured a mix of upside and downside surprises, Germany may continue to provide bearish catalysts.

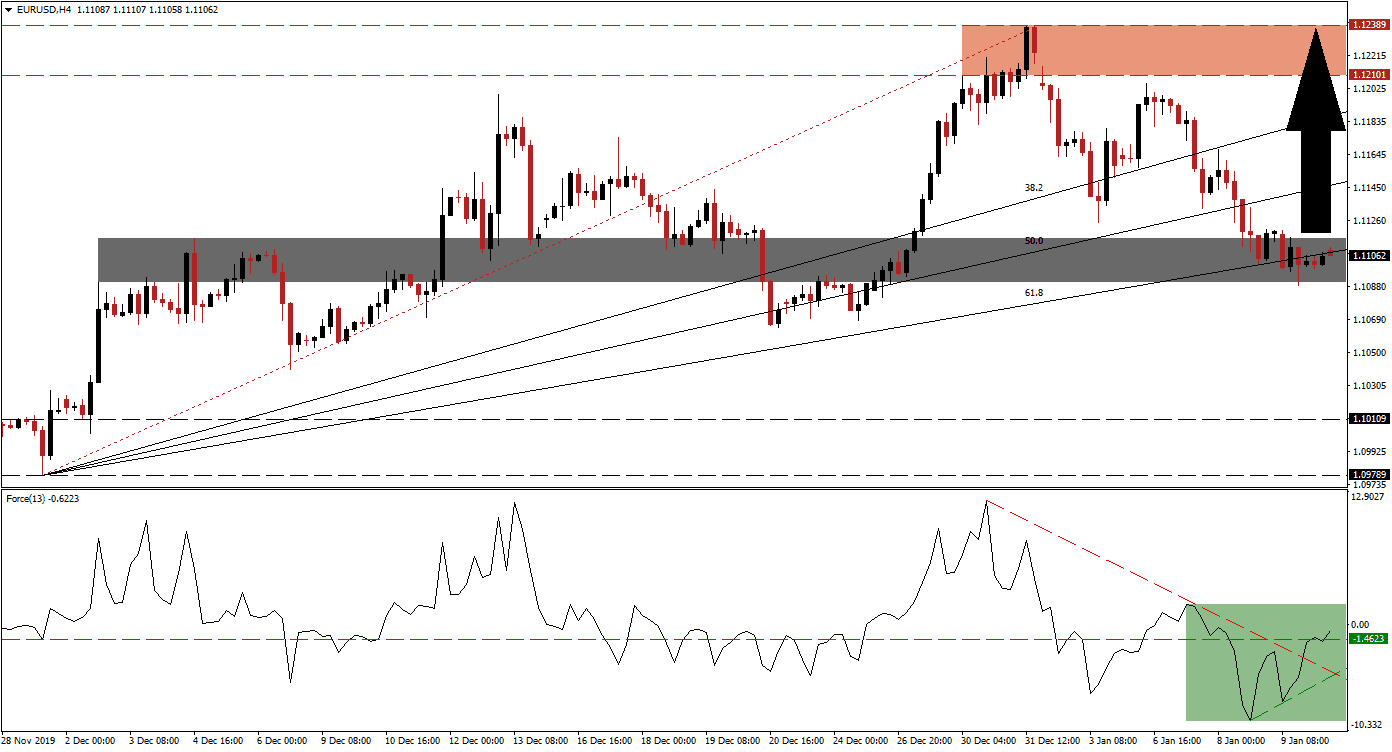

The Force Index, a next-generation technical indicator, recorded a new low as a result of the corrective phase. Bullish momentum reversed direction quickly, and an ascending support level emerged. It allowed the Force Index to convert its horizontal resistance level into support, as marked by the green rectangle. The advance also pushed this technical indicator above its descending resistance level. A breakout above the 0 center-line is favored to place bulls in charge of the EUR/USD, leading to a fresh breakout sequence.

A short-covering rally is expected to follow the anticipated breakout in this currency pair above its short-term support zone, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. This zone is located between 1.10848 and 1.11158, as marked by the grey rectangle. The Fibonacci Retracement Fan sequence is likely to guide the EUR/USD to the upside until it can challenge its resistance zone. Volatility may spike temporarily after today’s US NFP release. You can learn more about the Fibonacci Retracement Fan here.

Signs that the manufacturing recession is spilling over into the significantly more massive services sector started to flare up, a development that deserves attention. Net capital outflows out of the US Dollar, on the back of economic underperformance, are likely to accelerate as the year progresses. The EUR/USD is expected to recover into its resistance zone located between 1.12101 and 1.12389, as marked by the red rectangle. More upside is favored, but a new catalyst needs to materialize for a breakout to be possible.

EUR/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.11000

Take Profit @ 1.12350

Stop Loss @ 1.10600

Upside Potential: 135 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.38

In the event of a breakdown in the Force Index below its ascending support level, the EUR/USD may attempt to extend its corrective phase. Due to the long-term bullish fundamental outlook for this currency pair, the downside potential remains limited to its support zone located between 1.09789 and 1.10109. Forex traders should consider this a solid buying opportunity.

EUR/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.10300

Take Profit @ 1.09800

Stop Loss @ 1.10550

Downside Potential: 50 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.00