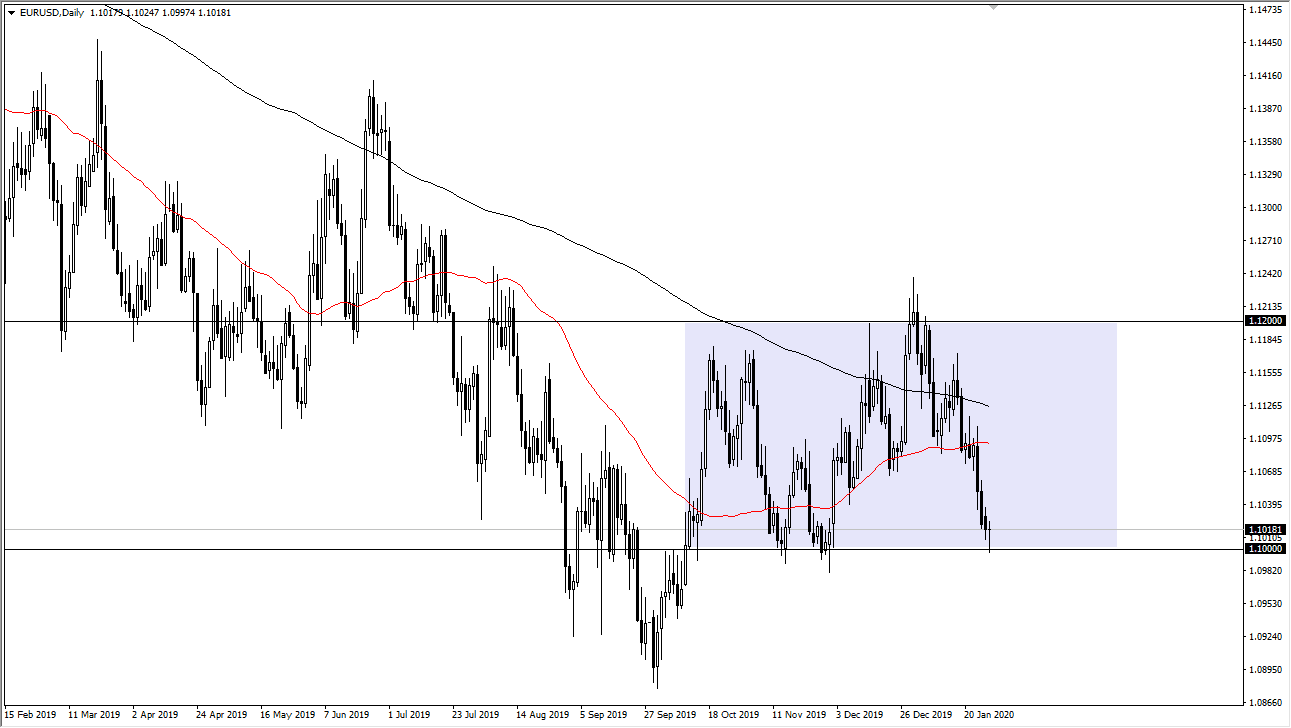

The Euro has initially fallen during the trading session on Tuesday, crashing into the 1.10 level yet again which has been reliable support for some time. Beyond that, the market had fallen apart quite drastically over the last couple of weeks so it’s not a huge surprise that we have not been able to break down. At this point, I would anticipate a bit of a bounce and I believe that the FOMC statement will come out later in the day and push this market in one direction or the other. If we break above the top of the hammer, then I believe that the market goes looking towards the 1.11 handle, which is near the 50 day EMA. Furthermore, the 1.11 level is essentially “fair value” in this market as it is right in the middle of the rectangle that the market has been bouncing around. The 1.12 level above is the resistance, while of course the 1.10 level is support. In other words, the middle of that area is where the market continues to find itself going back towards.

The question now isn’t so much as to whether or not we can bounce, but whether or not we can break above the 1.11 handle. If we do break above, there it’s likely that the market will find the 1.12 level to be very difficult. Alternately, if the market was to break down below the 1.0980 level, then this market probably falls apart. That would be more than likely due to the Federal Reserve saying something hawkish that shocks the market. Quite frankly, the ECB has recently suggested that there is going to be more asset purchases going forward, so the one question that I have for the Federal Reserve is whether or not they are going to try to counteract that. Furthermore, there is a huge issue out there with the US dollar being far too strong. Because of this, it’s very likely that the Federal Reserve will probably do something to try to boost the markets, and by extension drive down the value of the greenback. Perhaps it will be more asset purchases, or possibly even more straightforward quantitative easing. That being said though, it’s difficult to imagine that they will use that phrase, because they have been very cautious about doing so. Either way, they look very likely to be cautious when it comes to upsetting the market these days.