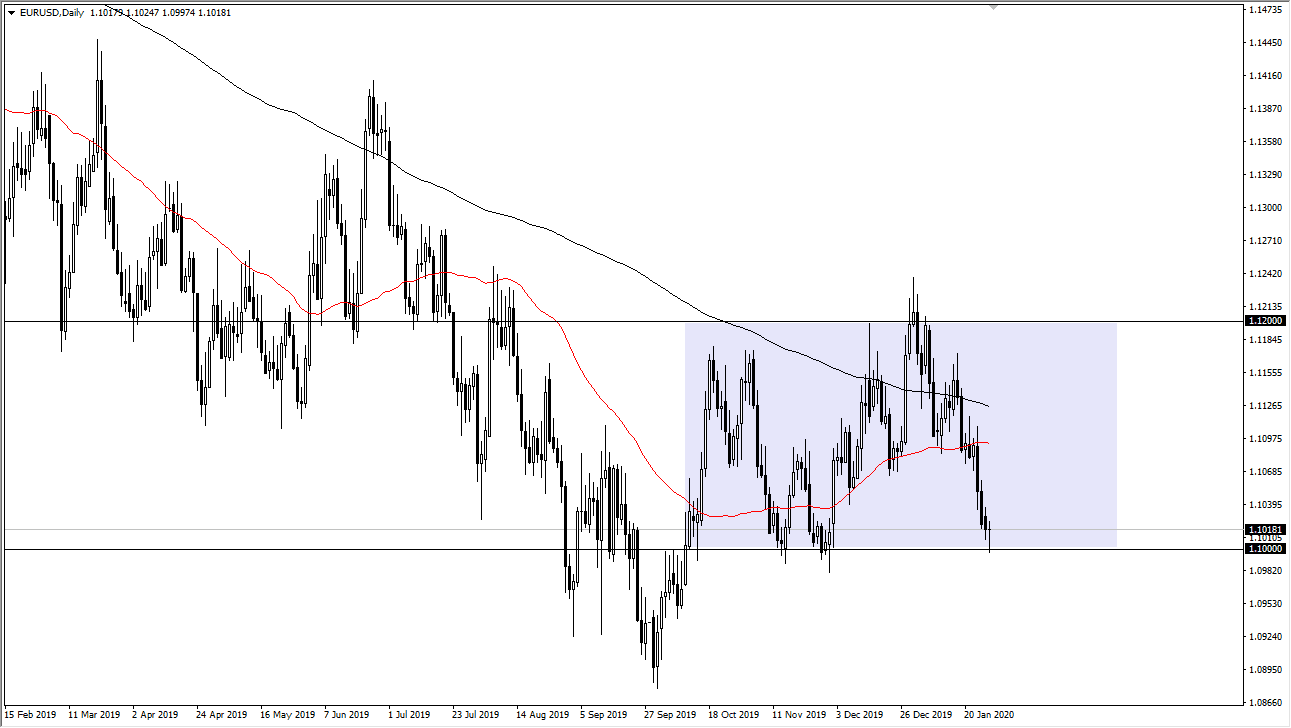

The Euro has broken down below the 1.10 level during trading on Wednesday, which of course has been a major support level over the last several months. We have seen the market bounce from here a couple of times, so at this point one would have to assume that there is a certain amount of buying pressure just waiting to happen. If that’s going to be the case then the Euro could continue to go higher, perhaps even reaching towards 1.10 level above. That is essentially “fair value” in the range as we have been bouncing between 1.10 on the bottom and the 1.12 level on the top.

All things being equal, we continue to go to that area, because it should be noted that we have recently made a “higher high” and now are making a low that matches with the previous one. This type of volatility suggests that there is a lot of confusion in the market, which isn’t a huge surprise considering that the Federal Reserve came out and gave a somewhat downbeat assessment of the economy during the press conference on Wednesday, although the monetary policy hasn’t changed. Shortly before that, the European Central Bank promised to be loose with its monetary policy for the foreseeable future, so quite frankly we have a couple of central banks here that don’t really have anything to do but be as accommodative as possible.

If we were to break down below the 1.0980 level, then it’s very likely that the Euro would fall rather hard, down to the 1.09 handle. On the other hand, if we can break above the 50 day EMA which is closer to the 1.11 level, then we may make a play for the 1.12 level given enough time. As things stand right now, the markets are simply sitting on the sidelines in trying to figure out which direction to go. Eventually things will become a bit more obvious, but right now it’s clear that confusion is the one thing that you can pay attention to. Furthermore, there is the possibility that the United States and the Europeans are going to start bickering as far as tariffs are concerned as well. This would obviously be negative for the Euro, as the trade policy between the United States and Europe has been relatively benign over the last couple of years. However, now that the US/China trade situation is on the back burner, Europe may find itself in the crosshairs.