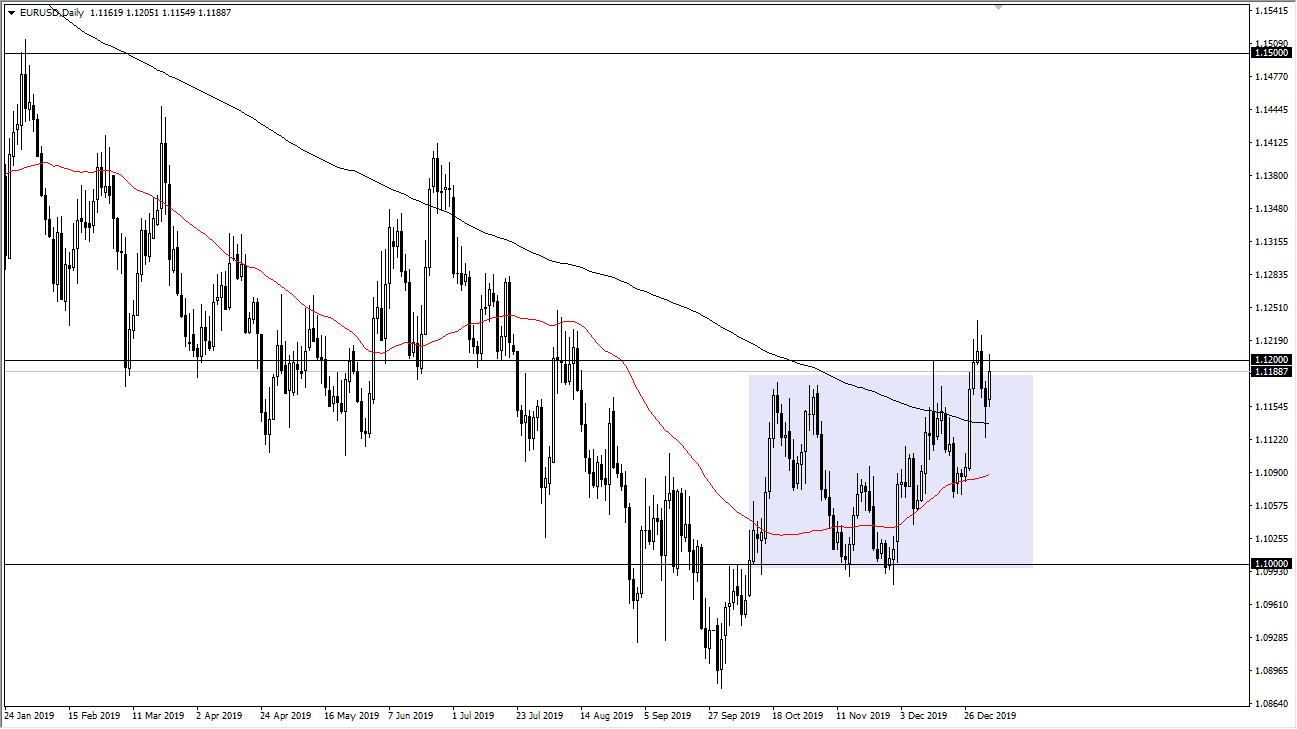

The Euro has tried to rally a bit during the trading session on Monday, reaching towards the 1.12 handle. Ultimately, the market has shown the 1.12 level to be very resistive, as we have formed a shooting star in that general vicinity a few sessions ago, and now we are pulling back from that level as well. Ultimately, the currency markets continue to look at the 1.12 level as a major stronghold for the sellers, so if we were to break above the shooting star, clearing the 1.1250 level, then the market would be free to break out. If that happens, then the Euro will go looking towards 1.14 level above which is a scene of resistance. However, as you can see over the last couple of attempts it has been very difficult.

To the downside, if we were to break down below the hammer from the Friday session, the market could go looking towards the 1.11 level, followed by the 1.10 level. All things being equal, this is a market that is still technically within a range, but you should be looking at the fact that we have had “higher highs and higher lows” as of late. The US dollar has been showing signs of weakness against several G 10 currencies, not just the Euro. So, the question now is whether or not the market is going to continue to work against the US dollar, or if people will run back towards it. I have noticed the AUD/USD, EUR/USD, and GBP USD pair is all looking very similar.

Looking at this chart, I think that we will probably see a lot of choppiness, and quite frankly it’s going to be difficult to trade this market until we break either the shooting star mentioned previously or the hammer below. Until then, we are basically looking at a scenario where markets will chop back and forth, showing signs of difficult trading, and therefore being patient and waiting for a signal that is clear will probably be the best way going forward to deal with the Euro. All things being equal, I like the idea of going long if we get a breakout, simply because there’s less noise. However, you can only trade what happens, know what you wish to see. To the downside, a move to the 1.10 level could happen but it’s going to see a lot of choppiness on the way down there.