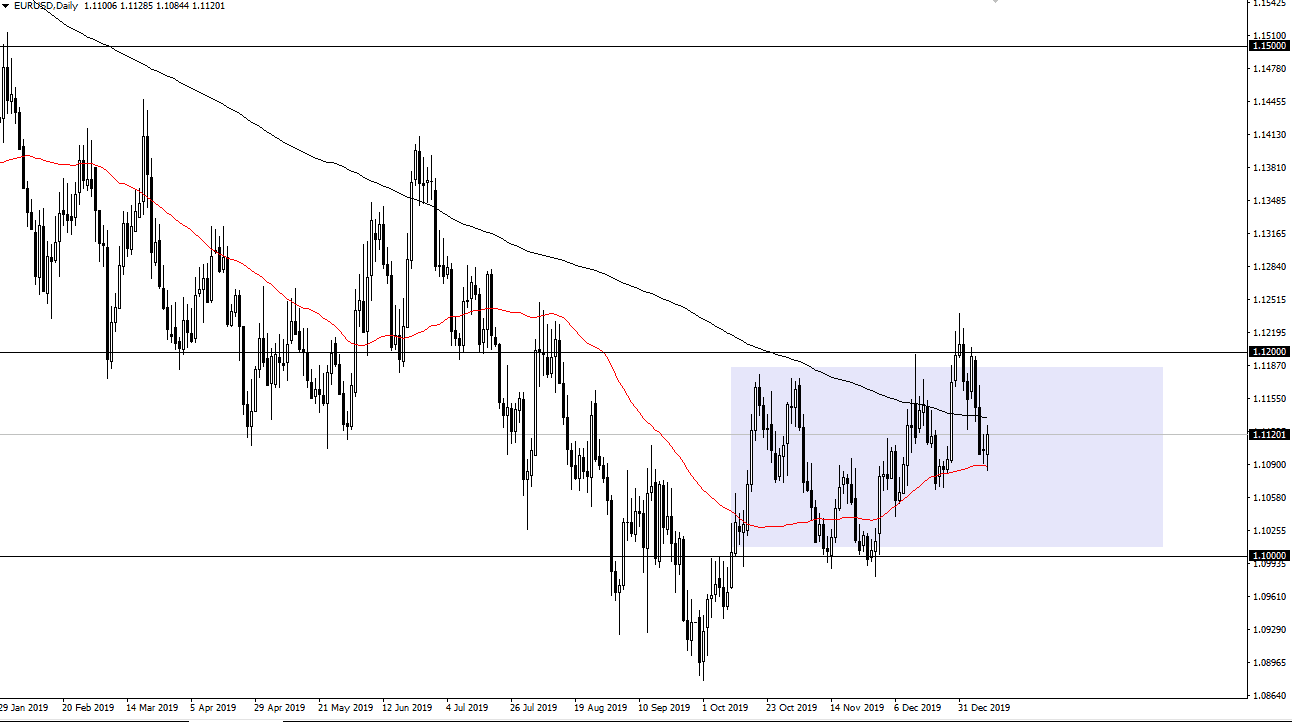

The Euro has rallied slightly during the trading session on Friday as you would expect, considering that the US jobs number missed the expected announcement, showing the US dollar as being vulnerable during the trading session. We have bounced from the 50 day EMA and perhaps even more importantly have bounced from the 1.11 handle. This is a “higher low” yet again, so it is possible that we will see the markets go looking towards the 1.12 level again. That being said, there is a significant amount of resistance between the 1.12 handle and the 1.1250 level, so don’t expect the EUR/USD market to suddenly shoot straight up in the air. If we do clear the 1.1250 level though, then you would have to make an argument for the Euro to continue going higher.

To the downside, if we were to break down below the lows from the trading session on Friday, then it opens up the door to the 1.1075 handle, followed by the 1.10 level underneath. Overall, this is a market that should continue to be very noisy, as the pair is typically choppy anyway. I do believe that we are in the midst of trying to do a bit of a trend change, but all things being equal there are still a lot of questions out there that will continue to push this market back and forth. As things stand right now, even though we are making a “higher low”, we still have to respect the fact that we are in the middle of the consolidation area that is roughly 200 points.

The Euro has been beaten down rather significantly for several years, and we are starting to get to the point where one has to question how much longer the trend goes. After all, the European numbers, although not very strong, are starting to stabilize which is the beginning of things turning around. While the European Union isn’t necessarily a bullish place to invest right now, it’s “less bad”, and that something that should be paid attention to. In other words, it’s not necessarily that the Euro should be strong, but perhaps it is undervalued at this point. Regardless, pay attention to the levels mentioned in this article and you will have a bit of a roadmap as to where we are going next. It does look like higher in the short term is probably what we see, but I’m not expecting anything massive.