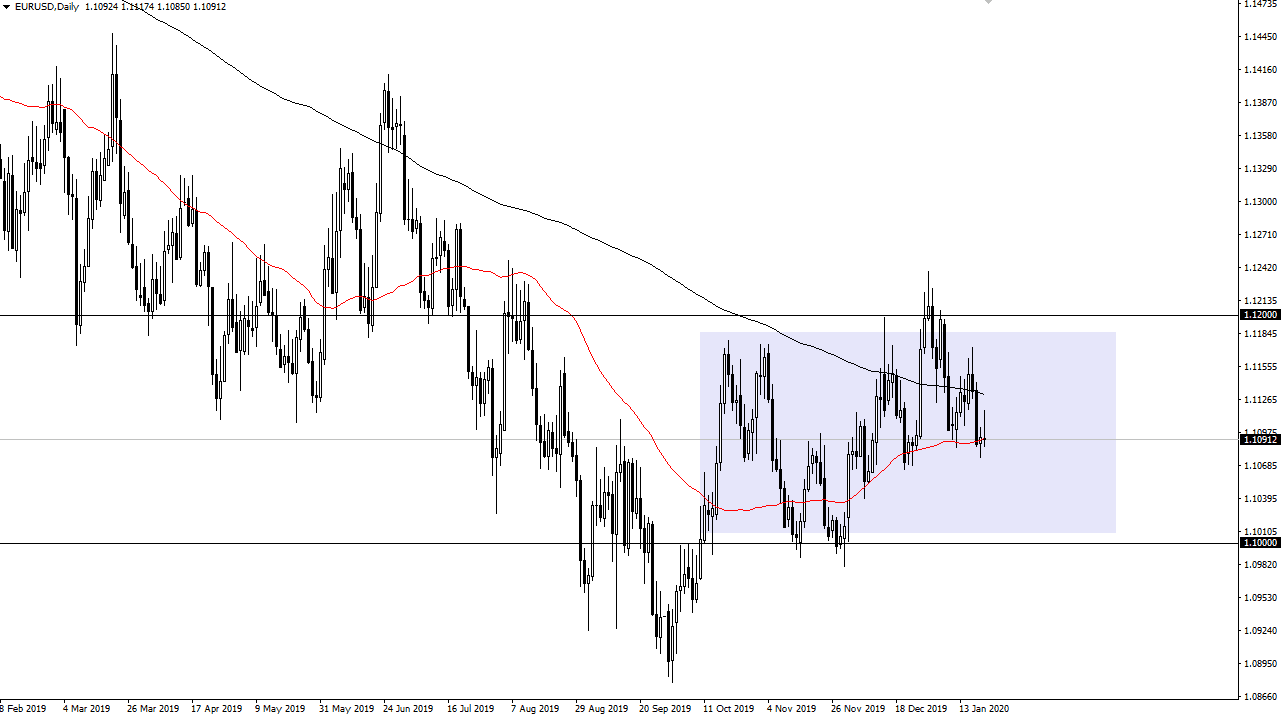

The Euro initially tried to rally during the trading session on Tuesday but gave back all of the gains to turn around a break below the 1.11 handle again. Ultimately, this is a market that is trading between the 50 day EMA and the 200 day EMA, and around the 1.11 handle. That’s an area that is essentially “fair value”, as it is the middle of the range that we have been trading in lately. The 1.12 level on the top is resistance, and the 1.10 level underneath is support. This is a market that goes back and forth in that area for the time being, but what’s interesting is that the Euro could not hold gains after the explosive and extraordinarily positive German ZEW Economic Sentiment indicator came out much higher than anticipated. Quite frankly, Germany having good news is that enough to lift the Euro, then it shows just how little direction this market has.

The EUR/USD pair is a great proxy for what I see in the Forex markets right now, and that’s a serious lack of direction in most markets. I’m not a big fan of trading this currency pair, because quite frankly it doesn’t move very much. That being said, when it does move it tends to chop back and forth in order to struggle finding any type of bigger move. However, someday we will break out of this 200 point range and when we do it will be a cue to hang onto a longer-term position. Until then, this is a short-term back-and-forth scalping type of situation and for my money the easiest trade is to fade a move towards the outer area of the 200 point range, expecting a return to the 1.11 level as it is a bit of a magnet for price. That’s a simple “reversion to the mean” type of trade setting up and it’s likely that the markets will probably continue to look at that as the way going forward. Until something changes from a drastic point of view, this is probably a market that has nowhere to be anytime soon. With that, day traders may like this market, but I don’t like putting too much faith into a move for any real length of time as that has failed to work out for quite some time now. The 50 day EMA and the 200 day EMA both offer enough interest by longer-term traders to have this market stay very choppy.