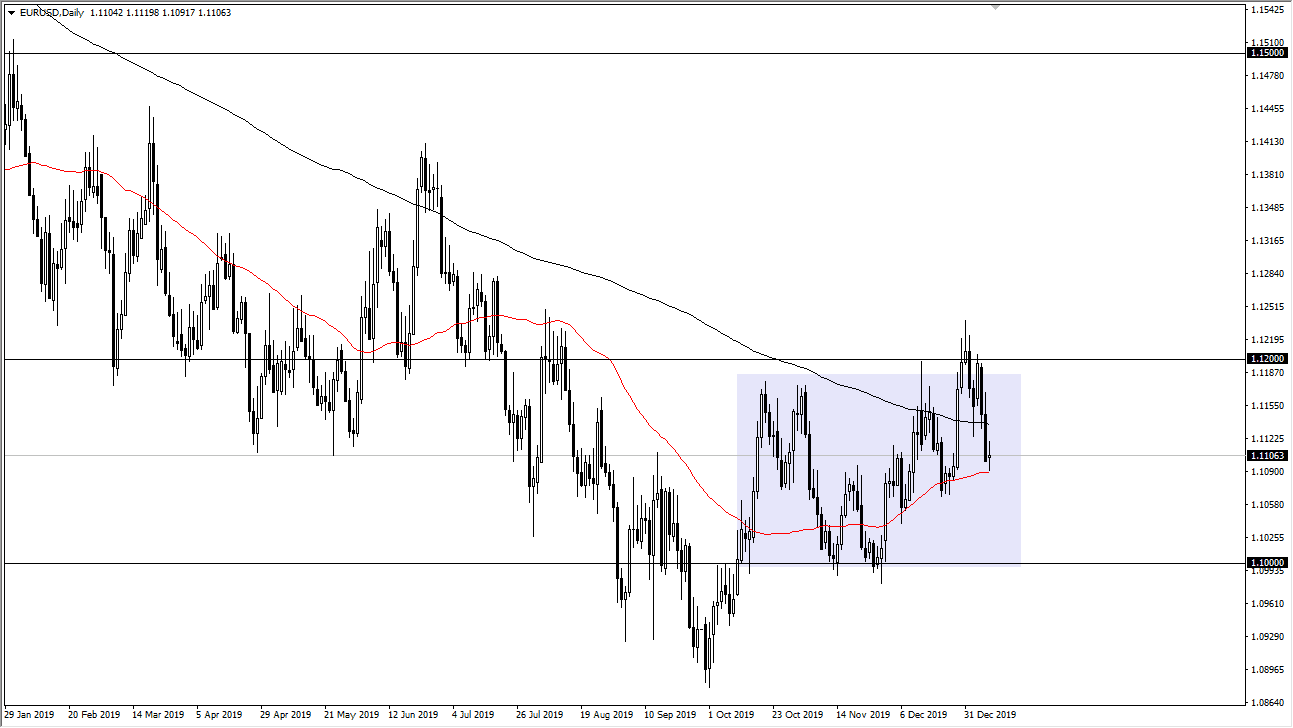

The EUR/USD has gone back and forth during the trading session on Thursday, as we are sitting just above the 50 day EMA. The 50 day EMA of course offers a lot of support typically, and more importantly we are in the middle of the 200 point range that we have been stuck in. The 1.11 level is right in the middle between the 1.10 level on the bottom and the 1.12 level on the top. With that, the Euro will cause a certain amount of volatility during the trading session as the market is going to get the US employment figures. That typically throws a lot of choppy noise in this market, and it would not be very surprising to see that this market is unchanged by the time the day is said and done. However, if we get a daily close above the top of the candlestick for Thursday, then it’s likely that we will go looking towards 1.12 handle above.

Ultimately, if we were to break down below the bottom of the candlestick and the 50 day EMA, then it’s likely that the market will drop down towards the 1.10 level underneath. All things being equal, this is a market that is going to be very difficult to hang onto for any significant amount of movement, but at this point we can still see “higher lows” as it looks like we are trying to turn around and change the overall trend. That is normally very messy to say the least, and this has been no different. The market will continue to look at this overall area as a bit of back-and-forth trading, and quite frankly this is a very difficult market to hang onto for any length of time. You have to have long-term conviction, but ultimately this is a short-term trading type of situation. Looking at the chart, if we can break above the 1.12 level on a daily close is likely that we will then go looking towards 1.14 handle. Otherwise, if we were to break down below the 1.10 level, it’s likely that we could then go down to the 1.09 handle, perhaps even down to the 1.08 handle after that. There is even a gap down at the 1.0750 level that has yet to be filled so that’s also a possibility. However, we have a lot of decisions to make between now and anything like that.