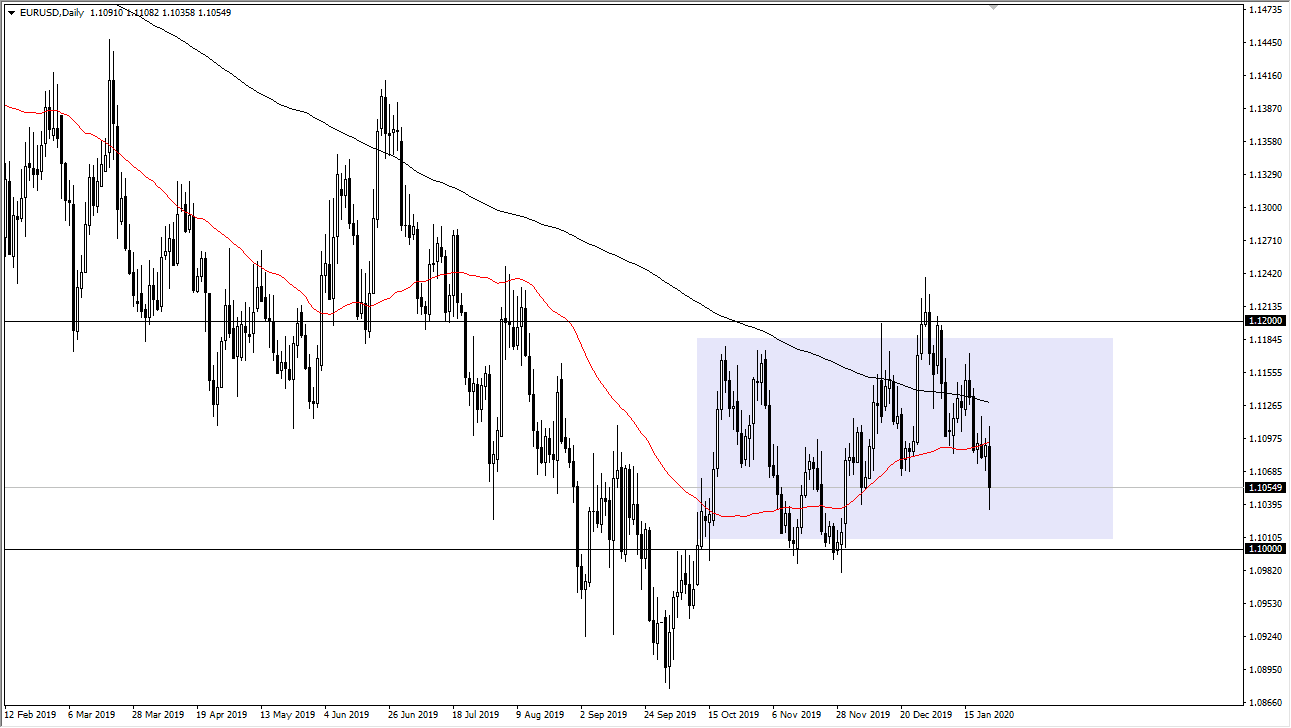

The Euro initially tried to rally during the trading session on Thursday but found the area above the 50 day EMA as a little bit too expensive to continue going higher. Because of this, we turned around to break down and then of course the very dovish statement coming out of the ECB later in the day did not help the case for the Euro going higher either. That being said, we are still very much in a major consolidation area, so it’s difficult to imagine a scenario where we are simply going to slice through the bottom and continue going lower for a significant amount of time, at least not without some type of external force.

Looking at the candlestick, you can see that we did break down below the 1.1050 level but gave back some of the dollar gains towards the end of the session. I believe that the 1.10 level underneath is massive support, and therefore if we were to break down below there it would be a very negative sign, but ultimately it would take a significant amount of momentum to break things down, perhaps sending the market down to the 1.09 level, and then eventually the 1.08 level. To the upside, the ceiling in the overall consolidation is at the 1.12 handle, just as “fair value” is closer to the 1.11 level.

When you look at the longer-term chart, we are most decidedly in a downtrend, and the actions over the last week or so have driven that home. However, it’s not until we break down below the 1.10 level that the downtrend will continue in earnest though, and at this point it looks like the market will continue to see a lot of volatility. At this point though, after the ECB press conference it’s obvious that the Europeans are still very loose with monetary policy and probably will continue to be for the foreseeable future. The 1.12 level above is massive resistance, so if we were to break above that level it would be an extraordinarily bullish sign. It certainly doesn’t look as if it’s going to happen though, so I wouldn’t worry too much about it but if it did, that would show a huge shift in sentiment when it comes to this pair. I think that the Federal Reserve would have to do something to spook the market away from the greenback in order to see that happen.