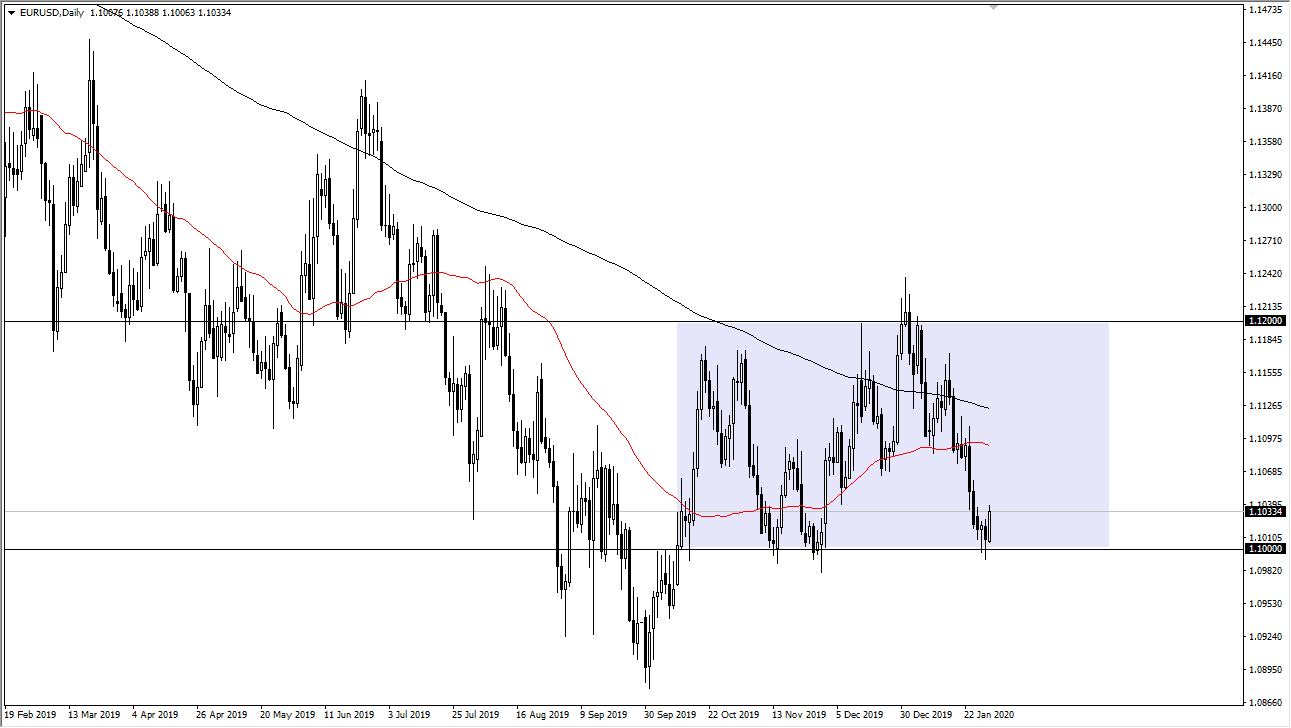

The Euro has had a strong session on Friday, as we continue to see the 1.10 level underneath offer plenty of support. That is an area that has been important more than once, and therefore it’s not a huge surprise to see that it has in fact attracted buyers. Furthermore, we have formed a couple of hammers during the couple of previous sessions, which shows just how supportive this area probably is. This also shows that if we were to break down below the 1.0980 level, it would be a significant break down to send this market much lower. The market probably then goes down to the 1.08 level, and then eventually the 1.0750 level after that.

Because we have sold off so drastically and so violently over the last couple of weeks, I suspect that the path of least resistance is probably to the upside. The 50 day EMA is currently sitting at roughly 1.11, an area that could be thought of as “fair value” as it is the middle of the overall consolidation area that we have been in. This is because the 1.10 level is the bottom of the rectangle that extends all the way to the 1.12 handle.

All things being equal, you should keep in mind that although the European Central Bank has shown itself to be very dovish and likely to continue being so, the reality is that the Federal Reserve has since stated that they are going to be very dovish as well. In other words, the massive selloff of the Euro may have been a bit overdone, and although I do expect a bounce in this area, I’m not necessarily expecting a major trend change, at least not in the short term.

Looking at the chart, we are a bit overdone and have raced directly to a major support level, so this recovery should not be a huge surprise. This is especially true after Jerome Powell’s comments. Furthermore, markets don’t go in one direction forever, so the idea that this market was simply going to continue falling apart was probably a real stretch of the imagination. I like the Euro, but only for the short term as I suspect we are simply going to be going back and forth, as although both central banks have spoken, essentially nothing has changed as we are in a relatively neutral stance, there are geopolitical and global concerns that probably favors the US dollar slightly.