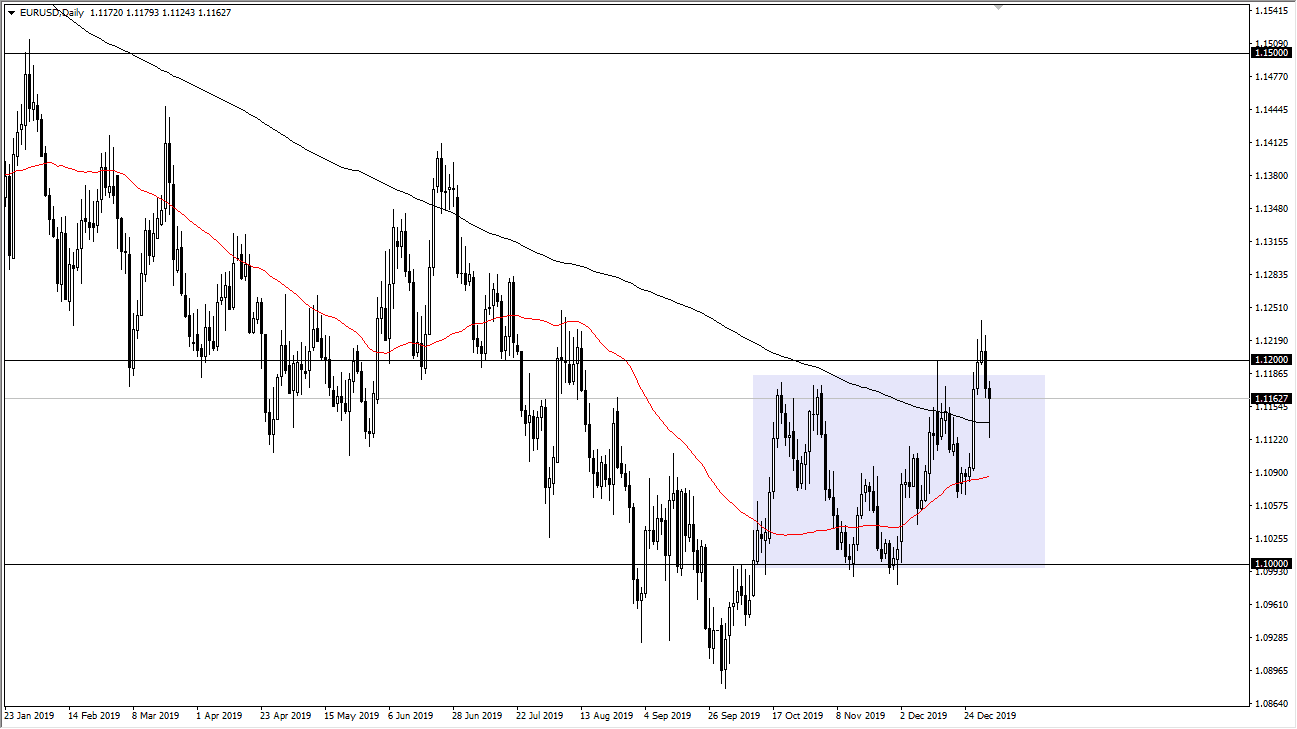

The Euro broke down rather significantly during the trading session on Friday, slicing through the 200 day EMA in a bit of a “risk off” type of scenario, as the markets continue to try to figure out what to do about the US/Iran situation. The Euro found enough support to turn around and form a bullish looking candlestick though, so that of course is a good sign. If we can break above the top of the candlestick, it’s likely that the market could go towards the 1.12 handle, and perhaps breaking above the 1.1250 level after that. If we do, then the market is likely to go looking towards the 1.14 handle to the upside.

To the downside, if the market breaks down below the hammer candlestick for the trading session of Friday, the market will then break down towards the 50 day EMA which is closer to the 1.1090 handle. A breakdown below their opens up the door to the 1.10 level, then it’s very likely that the market will continue to go looking towards the upside. That being said, the market has made a long series a “higher highs, and higher lows.” That being said, the 200 day EMA is starting to curl to the upside so we could see a significant amount of trend change here coming just waiting to happen.

A hammer is of course a very bullish sign, so at this point it’s likely that the buyers are looking at this with great interest. Ultimately, I do believe that the market is going to try to send the Euro higher, and it almost looks as if we are ready for some type of trend change. Maybe this is due to the fact that the US numbers have softened a bit and people are starting to think that perhaps the Federal Reserve will have to soften its monetary policy stance. That being said, that should also come into play as well. At this point, a trend change could be happening but it’s obviously a market that has a lot of noise to chew through if that does in fact end up being the case going forward. Ultimately, the one thing I think you can probably count on is going to be a significant amount of choppy and noisy behavior. That being said, if the market were to do some type of trend change, it could be several attempts in the process of doing so.