The EUR/USD price did not enjoy its recent gains, which reached the 1.1240 resistance, the highest level in nearly five months, before falling back to the 1.1125 level during the last Friday session. What supported the return of the gains of the US dollar is a return to it as a safe haven by investors, due to renewed tensions between the United States and Iran, which will dominate the currency market this week as well.

Some technical analysts say the pair's downside performance is limited, and that new gains are likely to last for a long time. We believe that the gains of the Euro will remain under the pressure of the continued slowdown of the Eurozone economy, and the effectiveness of ECB foggy plans under the new leadership.

The European single currency has retreated from the first moment of the New Year's trading after strong gains earlier in the week, although the bearish correction was the largest on Friday due to investors risk evasion amid escalating tensions between the United States and Iran, that favored the dollar and the yen In the Forex world as safe havens.

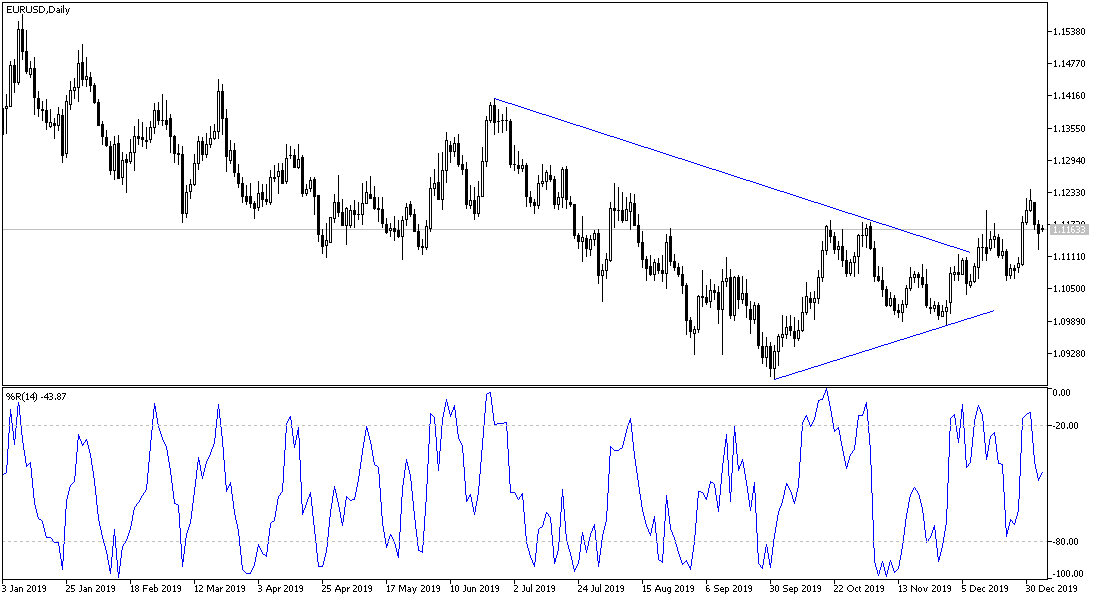

Prior to that, risk currencies made strong gains in the New Year, as investors welcomed President Donald Trump's announcement that a "first-stage deal" with China would be signed on January 15. It is expected that the Euro will try to spend the next three weeks maintaining a move above the 1.1221 resistance, which coincides with the upper boarder of the downtrend channel that dominated trading during most of last year. Once stabilized above this level, the 200-week moving average at 1.1360 will be achievable.

The minutes of the Fed's December meeting showed that US Federal Reserve officials preferred to keep interest rates in a low range of 1.5% to 1.75% so that the US economy can cope with the slowdown in global economic growth and the trade wars led by the Trump administration. Officials were also concerned that inflation had not yet reached the Fed's 2% target level, and many of the bank's policymakers expressed in the December 10-11 meeting that the risks of the trade war between the United States and China have diminished, along with the prospect of Brexit. The meeting took place two days before the Trump administration and Beijing reached an initial trade agreement.

According to the technical analysis of the pair: As we mentioned before, we now confirm that the opportunity for a bullish correction for the EUR/USD will remain as long as it is stable above the 1.1200 psychological resistance. If the last resistance at 1.1240 is exceeded, the pair may obtain investor confidence again to move towards higher targets. The exacerbation of tensions in the Gulf region will not be in the interest of the pair’s bounce. On the downside, a return to the 1.1000 support is a strong threat for the bullish correction, and thus a return to the downward path that dominates the pair in the long run.

With regard to the economic calendar data: German retail sales will be announced, and the Eurozone services PMI will be announced. There are no significant US economic releases today.