The FTSE 100 futures market was relatively negative during the trading session on Thursday, after the Bank of England released a mixed message by holding rates steady. While they didn’t feel the need to cut interest rates, this of course works against equities as stock traders have been fed a steady diet of low interest rates four years. However, they also suggested that down the road they could very well struggle to produce inflation, at least through the end of 2021. In other words, they have left the door for interest-rate cuts open down the road, but this isn’t necessarily something that they have set in stone.

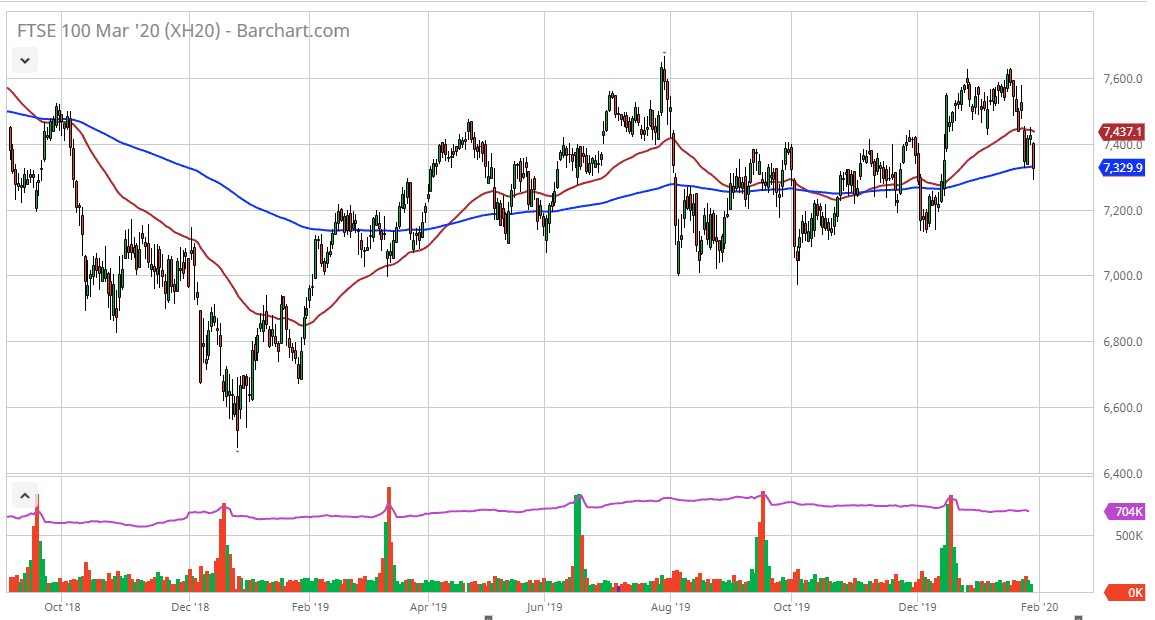

Adding all of that to the situation with Brexit, which is still a bit murky, it’s not a hard stretch of the imagination to see why the FTSE may have fallen during the trading session. That being said, the FTSE 100 futures contract is trading right at the 200 day EMA, an area that seems to be producing a bit of support at this point, so a bounce isn’t out of the question right now. If the market can take the 7400 level back, it’s very likely that it will go back towards the highs at 7600 over the next several weeks. That being said, it doesn’t mean that it will be easy. Furthermore, you should look at this market as one that has been rising gradually as it has been more of a choppy grind to the upside over the last several months. While the trend is higher, it’s only slightly higher so it’s difficult to get overly bullish in the short term.

Simultaneously, the British pound has been rallying a bit so that works against the value of stocks sometimes as well, as it can make your exports pricier for other countries around the world to buy. At this point, one has to look at pullbacks as value, but you need to be very cautious about your position size simply because the FTSE 100 is a market that has been so noisy as of late. All things being equal though, if we do break down below the bottom of the trading range for the Thursday session, the next major support level will be found down at the 7200 level which has seen buyers and sellers recently, and more than once. I remain positive, so I’m not interested in shorting.