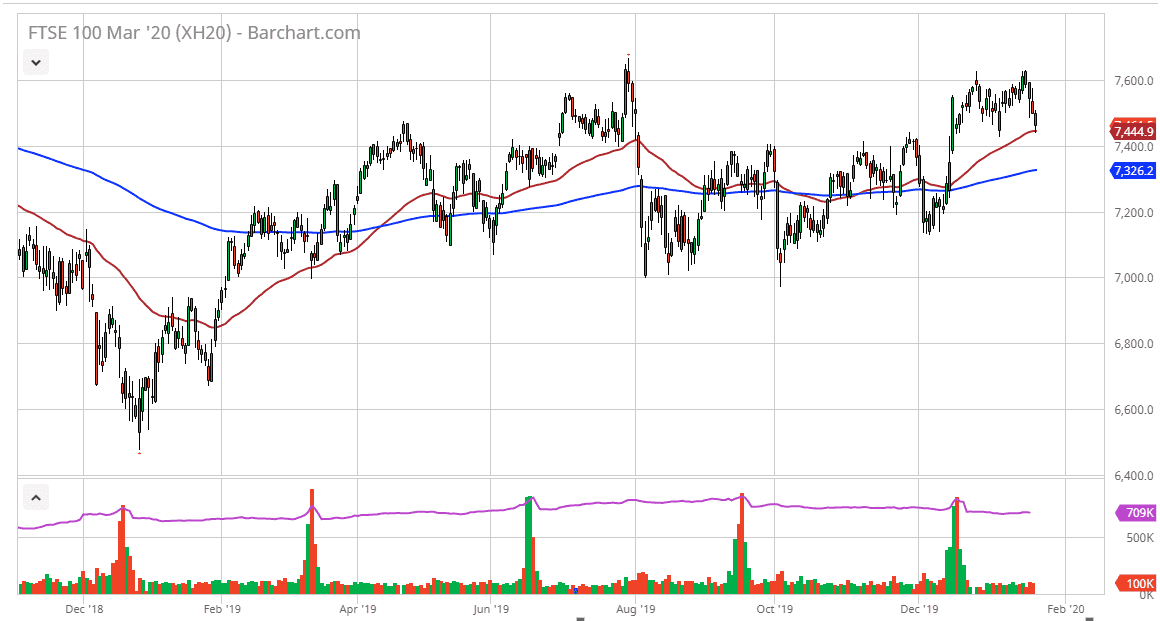

The FTSE 100 futures market initially pulled back a bit during the trading session on Thursday, reaching down towards the 50 day EMA and finding support. By turning things back around, the market looks as if it is ready to continue the overall consolidation and choppiness that we have seen over the last couple of months. If you think about it, it makes quite a bit of sense that this would be the case as Brexit is causing quite a bit of uncertainty. At this point, the market is likely to use the 50 day EMA is an area that could attract a lot of attention.

That being said, the market were to break down below the 50 day EMA, then the FTSE 100 should go down to the 7400 level. Furthermore, if we break down below there, it’s likely that the 200 day EMA would come into play which is currently at the 7326 handle. The candlestick for the trading session on Thursday does look a bit like a hammer, so that means that we could reach towards the highs again near the 7600 level above. This could be more consolidation going forward as the market tries to get a bit of a push with inertia to the upside. If we can break above the 7600 level, and more importantly a fresh, new high, then the FTSE 100 should continue to go much higher.

Once we break above the highs, the market is likely to go looking towards the 8000 handle. This will probably be coinciding with the Brexit moving forward, as the British continue to see more strength going forward as the European Union separates from it. Furthermore, the market has also recently seen much better employment in the United Kingdom and that shows that although we have a lot of uncertainty in the UK, the reality is they are doing much better than anticipated, and therefore think it will reflect itself in the stock markets as well. All things being equal, the market has pulled back and offers value at this point. However, you will have to be cautious about jumping “all in” because of the inherent volatility in this scenario. At this point, I don’t have any interest in shorting this market, but having said that I think it’s only a matter of time before we continue to extend based upon the rectangle that we have been trading in, we should have a move as high as 8200 longer term.