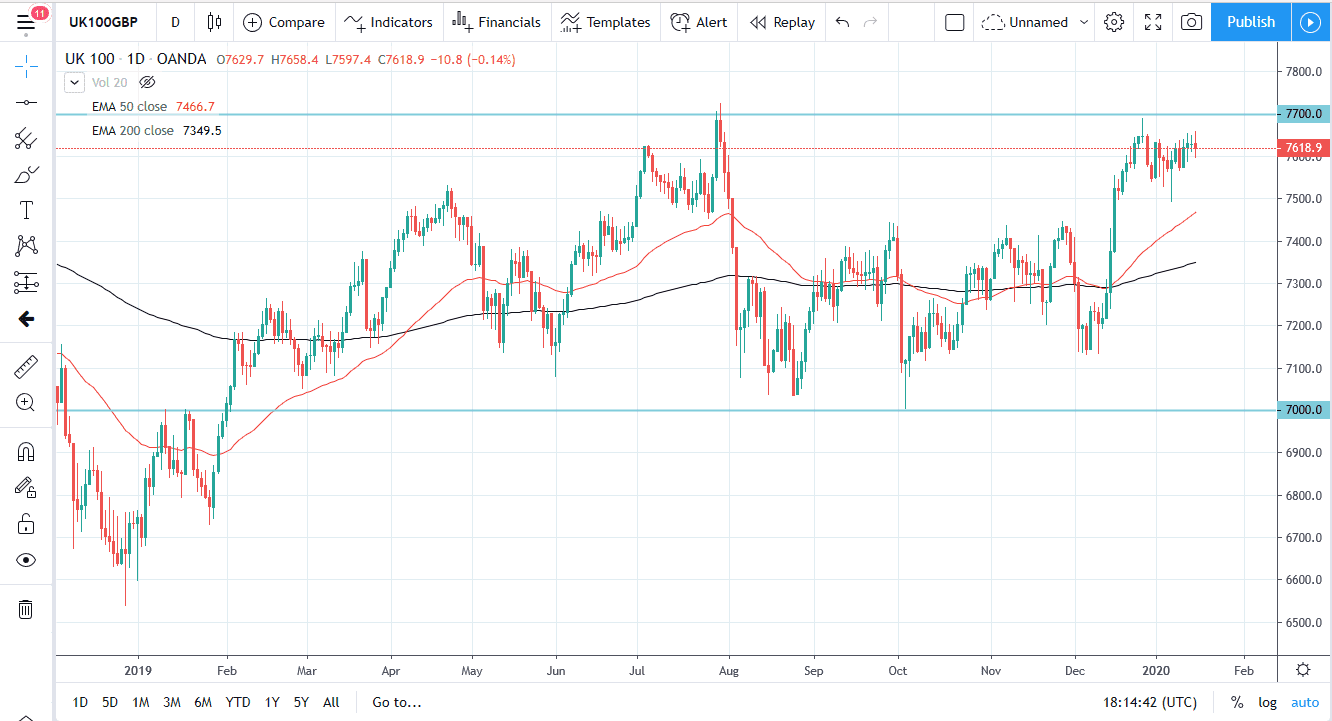

The FTSE 100 has been chopping sideways more than anything else over the last week or two. However, when you step back and look at the “big picture”, you see that we are at the top of the range that the index has been in for quite some time. This range extends from the 7000 level underneath, while the 7700 level has offered a stable resistance level.

If you take a look at the recent action, going back the last month or so, you can make an argument for some type of bullish flag. That being said, the 7700 level will continue to cause a lot of issues, and it doesn’t look as if the market is quite ready to take off currently. However, there was a nice hammer that formed right off of the 7500 level last week, and that suggests that there are buyers underneath willing to take advantage of the FTSE 100 when it pulls back. The 50 day EMA is starting to reach towards the 7500 level as well, so that obviously could cause a certain amount of support as the 50 day EMA does tend to attract a lot of attention.

All things being equal though, I am a bit cautious about getting overly bullish until we can close above the 7700 level on the daily chart. If we do, that should, at least in theory, drive this pair towards the 8400 level. Obviously, there are a lot of issues when it comes to trading anything involving Great Britain, as we continue to work our way through the Brexit situation. However, it does look as if we are getting a bit of a “relief rally” in the sense that reports of the United Kingdom falling off of the face of the earth may have been just a bit premature.

What people want to see is stability before they invest. As the United Kingdom has gotten through the elections, it now looks as if they are going to truly leave the European Union, and at this point it also looks as if the United Kingdom may be able to benefit from a free-trade agreement with the United States, or at least something close to it. This and it’s very likely that they will get something done with the European Union now, so therefore traders are starting to look at a lot of UK assets as being mispriced.