Preliminary PMI data for January out of Australia showed an acceleration of recessionary data, with the services sector leading. This is a worrisome development if it expands to other economies. The Australian economy has been struggling with bush fires across large swaths of its territory, and today’s data shows a reflection of the ongoing economic damages. After the release of PMI data, the GBP/AUD was able to extend its advance with a solid push above its short-term support zone.

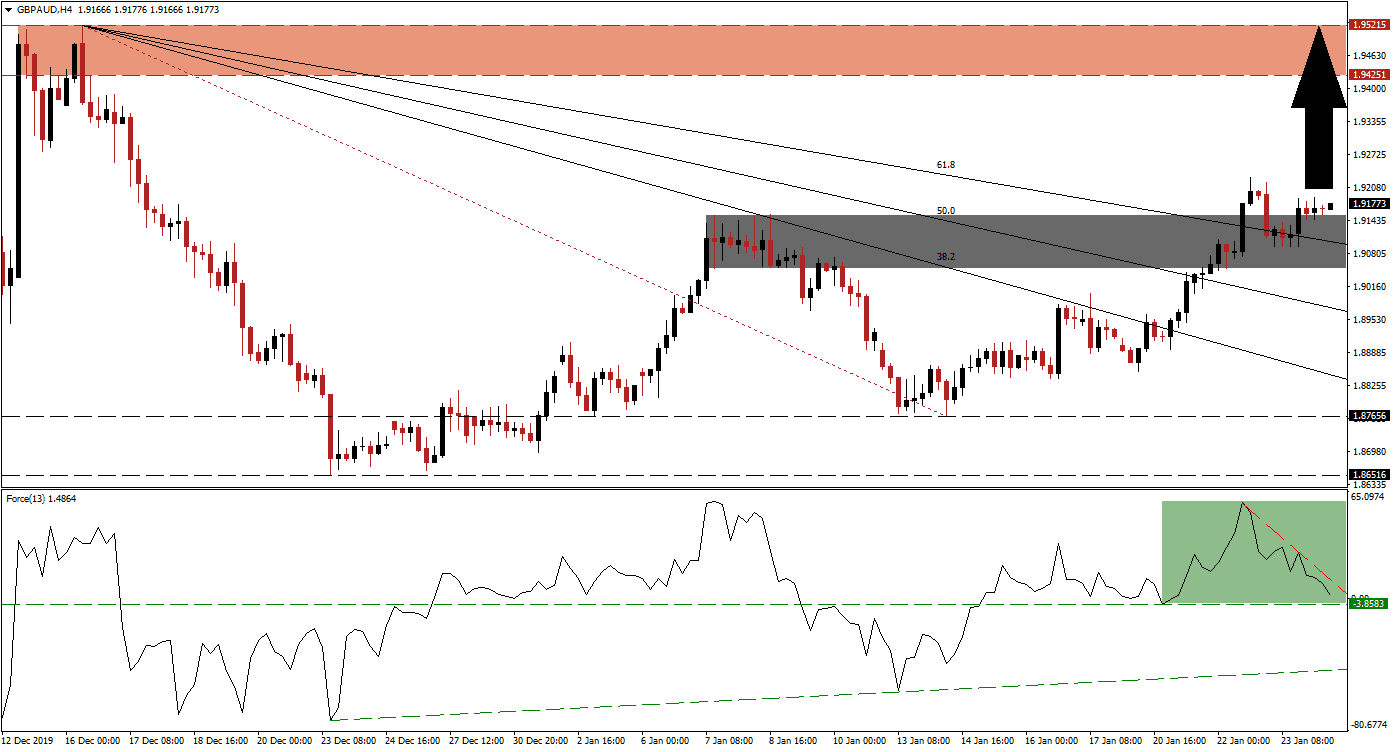

The Force Index, a next-generation technical indicator, spiked with the first breakout in this currency pair above its short-term support zone. It has since retreated from its peak, but remains above its horizontal support level, as marked by the green rectangle. A descending resistance level formed, adding to downside pressures, while bulls are in control of the GBP/AUD. This technical indicator maintains its positions above the 0 center-line from where a renewed advance is expected. You can learn more about the Force Index here.

Following the conversion of the short-term resistance zone into support, the path to the upside is clear. The converted support zone is located between 1.90510 and 1.91558, as marked by the grey rectangle. This currency pair bounced off of the descending 61.8 Fibonacci Retracement Fan Support Level, which is crossing through the support zone. While the GBP/AUD may retrace into its Fibonacci Retracement Fan sequence once again, amid a rise in volatility, price action is anticipated to accelerate to the upside.

Fundamental developments favor more upside in the GBP/AUD. The UK economy printed its best labor report in 2019 for the three months ending in November, the latest available report. This is defying fears of a slowdown due to Brexit and keeps inflationary pressures elevated, driven by wage inflation. Price action is likely to ascend into its next resistance zone located between 1.94251 and 1.95215, as marked by the red rectangle. A breakout above this zone is possible, but a fresh catalyst will need to emerge. You can learn more about a breakout here.

GBP/AUD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.91750

- Take Profit @ 1.95200

- Stop Loss @ 1.90750

- Upside Potential: 345 pips

- Downside Risk: 100 pips

- Risk/Reward Ratio: 3.45

A reversal in the Force Index below its horizontal support level is likely to result in a contraction into its ascending support level. The GBP/AUD is likely to be pressured into a breakdown, allowing the 38.2 Fibonacci Retracement Fan Support Level to guide price action into its long-term support zone. This zone is located between 1.86516 and 1.87656, with the top range anticipated to end any corrective phase. Forex traders should view this as an excellent buying opportunity.

GBP/AUD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.90000

- Take Profit @ 1.87650

- Stop Loss @ 1.90900

- Downside Potential: 235 pips

- Upside Risk: 90 pips

- Risk/Reward Ratio: 2.61