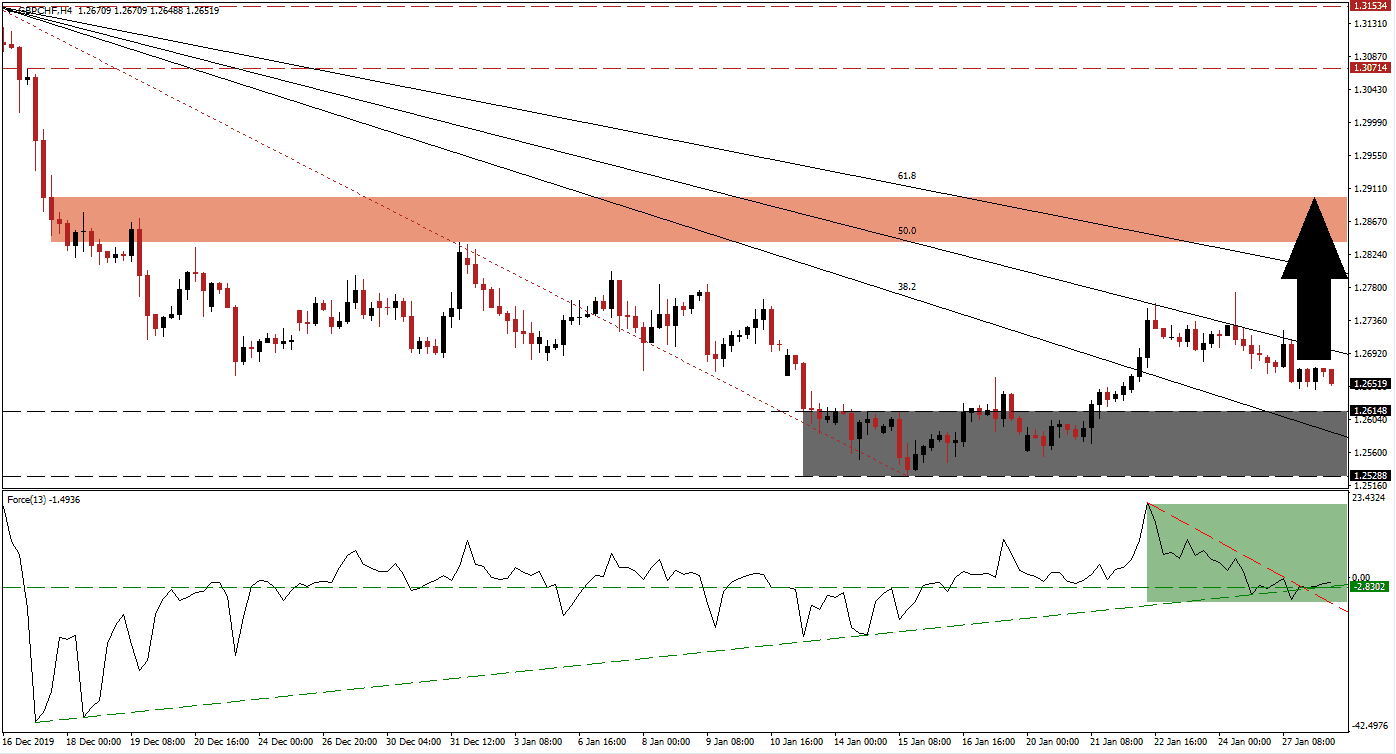

After this currency pair recorded a higher high and pushed through its descending 50.0 Fibonacci Retracement Fan Resistance Level, a reversal emerged. This was solely due to safe-haven demand for the Swiss Franc as the deadly coronavirus is spreading. South Korea reported that the economic impact shifted from tourism to technology, increasing the rotation from risk-assets into safe-havens. The GBP/CHF maintained the breakout above its support zone, and a resumption of the uptrend is favored.

The Force Index, a next-generation technical indicator, reversed from a higher high as price action retreated. Despite the reversal, bullish momentum remains dominant as the ascending support level halted the contraction in the Force Index. It has led to a breakout above its descending resistance level, as marked by the green rectangle, and converted its horizontal resistance level into support. This technical indicator is now expected to push into positive conditions, allowing bulls to take control of the GBP/CHF. You can learn more about the Force Index here.

A bullish chart pattern formed after the GBP/CHF completed a breakout above its support zone located between 1.25288 and 1.26148, as marked by the grey rectangle. The series of higher highs and higher lows are anticipated to guide this currency pair farther to the upside. Brexit is officially set to conclude on January 31st 2020, but the UK will have to follow EU regulations until the end of the transition period ending December 31st 2020. Immense trade negotiations are set to start, with the EU noting they require more time, which may result in a volatile period for the British Pound.

Despite noise out of the EU, the long-term outlook for the GBP/CHF is increasingly bullish. While price action may challenge the top range of its support zone, a breakout sequence is favored to emerge. A push above its 50.0 Fibonacci Retracement Fan Resistance Level should accelerate this currency pair into its short-term resistance zone located between 1.28392 and 1.28998, as marked by the red rectangle. An extension of the breakout into its long-term resistance zone between 1.30714 and 1.31354 is possible, but a fresh catalyst will be necessary.

GBP/CHF Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.26500

- Take Profit @ 1.29000

- Stop Loss @ 1.25800

- Upside Potential: 250 pips

- Downside Risk: 70 pips

- Risk/Reward Ratio: 3.57

In case of a breakdown in the Force Index below its descending resistance level, which currently acts as support, the GBP/CHF is expected to face downside pressure. Given the improving fundamental outlook, enforced by the technical scenario, a breakdown is limited to its next support zone between 1.23301 and 1.24023. This will allow Forex traders to take advantage of a sound buying opportunity.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 1.24900

- Take Profit @ 1.24000

- Stop Loss @ 1.25300

- Downside Potential: 90 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 2.25