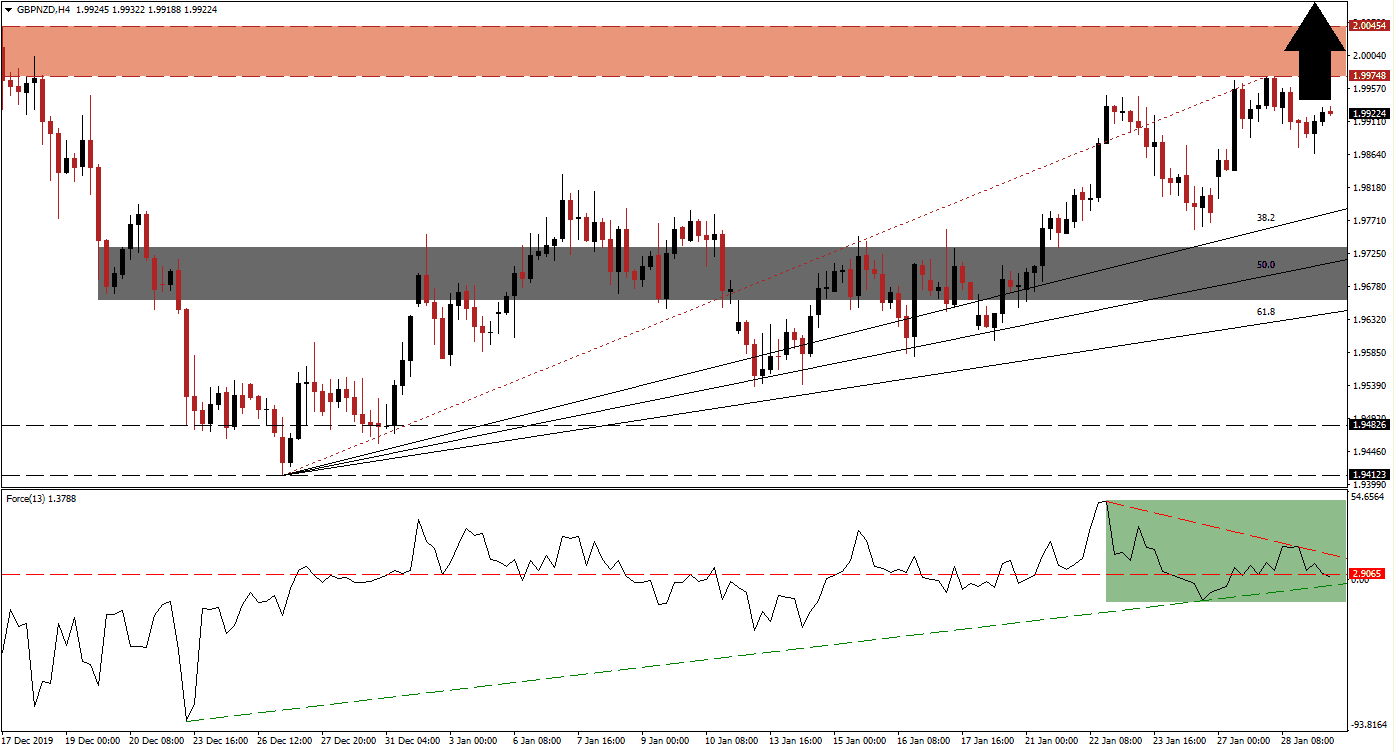

Brexit is less than 72 hours away, and while opinions on the long-term impact differ, the British Pound is advancing. Following the initial shock that Prime Minister Boris Johnson, after a landslide electoral victory last month, amended a bill to make an extension of the transition period illegal, the uptrend in the currency resumed. A bullish chart formation emerged in the GBP/NZD through a series of higher highs with higher lows, and price action is now faced with its next resistance zone.

The Force Index, a next-generation technical indicator, confirms the general increase in bullish momentum, anticipated to support more upside in this currency pair. After retreating from a higher high into a higher low, the Force Index rebounded to a lower high, and a descending resistance level emerged. This technical indicator is now approaching its ascending support level, as marked by the green rectangle, after converting its horizontal support level into resistance. Bulls remain in charge of the GBP/NZD, while a renewed advance is favored.

As a result of the advance in this currency pair, the support zone continues to be elevated, as the Fibonacci Retracement Fan is redrawn. The current support zone is located between 1.96589 and 1.97329, as marked by the grey rectangle. It is enforced by the ascending 50.0 Fibonacci Retracement Fan Support Level, pending another upgrade as the GBP/NZD is attempting to retake the critical psychological 2.00000 resistance level. Economic data out of the UK showed signs of improvement, especially in the labor market, adding to bullish fundamental developments.

While a temporary drop by this currency pair into its 38.2 Fibonacci Retracement Fan Support Level cannot be ruled out, the technical scenario favors a push into its resistance zone located between 1.99748 and 2.00454, as marked by the red rectangle. Bullish momentum is expected to force a breakout, extending the rally into its next resistance zone that awaits the GBP/NZD between 2.03444 and 2.04115, the peak of the post-election spike. You can learn more about a breakout here.

GBP/NZD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.99250

- Take Profit @ 2.04000

- Stop Loss @ 1.98250

- Upside Potential: 425 pips

- Downside Risk: 100 pips

- Risk/Reward Ratio: 4.25

A breakdown in the Force Index below its ascending support level is likely to result in a reversal in the GBP/NZD. The downside potential remains limited to its short-term support zone, with the 61.8 Fibonacci Retracement Fan Support Level closing in on the bottom range of it. Forex traders are advised to consider any temporary contraction in this currency pair as a solid buying opportunity.

GBP/NZD Technical Trading Set-Up - Limited Reversal Scenario

- Short Entry @ 1.97500

- Take Profit @ 1.96600

- Stop Loss @ 1.97900

- Downside Potential: 90 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 2.25