GBP/USD: Strongly Bearish

Yesterday’s signals produced a very profitable short trade from the bearish inside candlestick breakdown from the resistance level identified at 1.3100.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Short Trade Idea

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3022 or 1.3037.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

- Long entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2870.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that although the price had come down, and was rejecting the lower resistance level at 1.3080, it did not look likely to fall much further. Therefore, I wanted to avoid trading this pair yesterday and wait until risk sentiment improves when it should become a good buy.

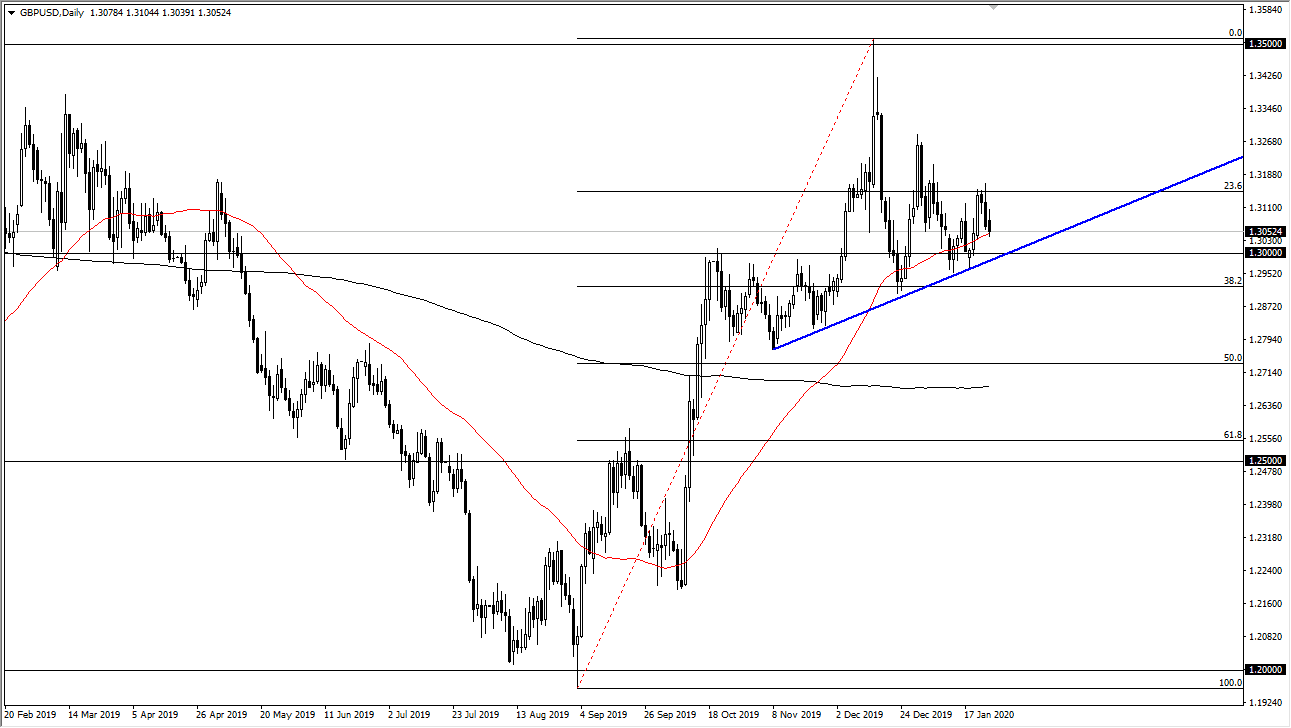

This was a bad call – I was completely wrong. The price is falling strongly and this morning the British Pound, along with the Australian Dollar, was behaving very weakly. This weakness has been confirmed technically b y the fact that the price has already broken strongly below two former support levels just above the big round number at 1.3000. The price looks set now to fall further and test the supportive ascending trend line shown in the price chart below which currently sits at about 1.2975.

I would take a bearish bias today if we get a retracement to either of the new resistance levels nearby and a bearish price action reversal there.

Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time. There is nothing of high importance due today regarding the GBP.