Gold markets fell a bit during the trading session on Monday, as traders came back to work from not only the weekend, but in some cases the holidays. This is a market that has seen a lot of erratic behavior as of late, and as tensions between the Americans and the Iranians ease, that should help keep the gold markets a bit soft. Furthermore, the Americans and the Chinese are getting ready to sign a “Phase 1 deal” this week, and that helps gold pull back a bit as well.

However, to suggest that the gold markets are suddenly going to rollover for significant pullback might be a bit premature. After all, when it comes to the situation between the Americans and the Chinese, this “Phase 1 deal” is the easy part. Most of this looks as if it’s going to involve agricultural purchases, which quite frankly China had to do sooner or later anyway. The decimated pork production in the mainland and of course the massive number of soybeans needed to feed the population was always going to work in the United States favor however, the next phase is going to involve things like intellectual property, which is a much bigger issue. Because of this, it would probably not take too much to get the markets spooked again when it comes to this issue.

As far as the Americans and the Iranians are concerned, the Iranians certainly are distracted by their own homegrown problems, namely the local population protesting the downing of the Ukrainian airliner, but one would have to think it’s only a matter of time before that situation players up again. Clearly, these two countries are getting along anytime soon. Because of this, militias that are backed by the Iranians continue to do missile attacks and the like against US forces, and if that’s going to continue to be the case one would think that it’s only a matter of time before the US strikes back. In other words, that situation has cooled off, but not resolved itself.

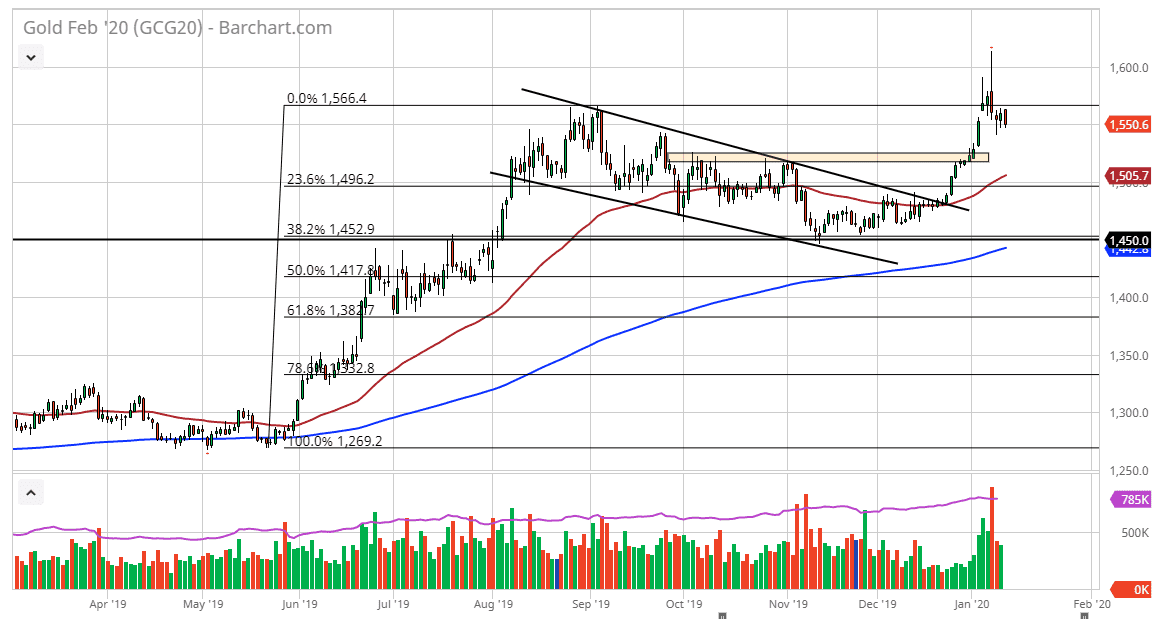

Furthermore, there are some major global growth concerns out there as well, so that could drive money into gold also. That being said, from a technical analysis standpoint it would make sense for a pullback towards the 1525 level, perhaps even the $1500 level. We have the 50 day EMA offering support in that general vicinity as well, so that’s what I’m hoping to see, a gentle pullback to that area and then a continuation of the big move higher.