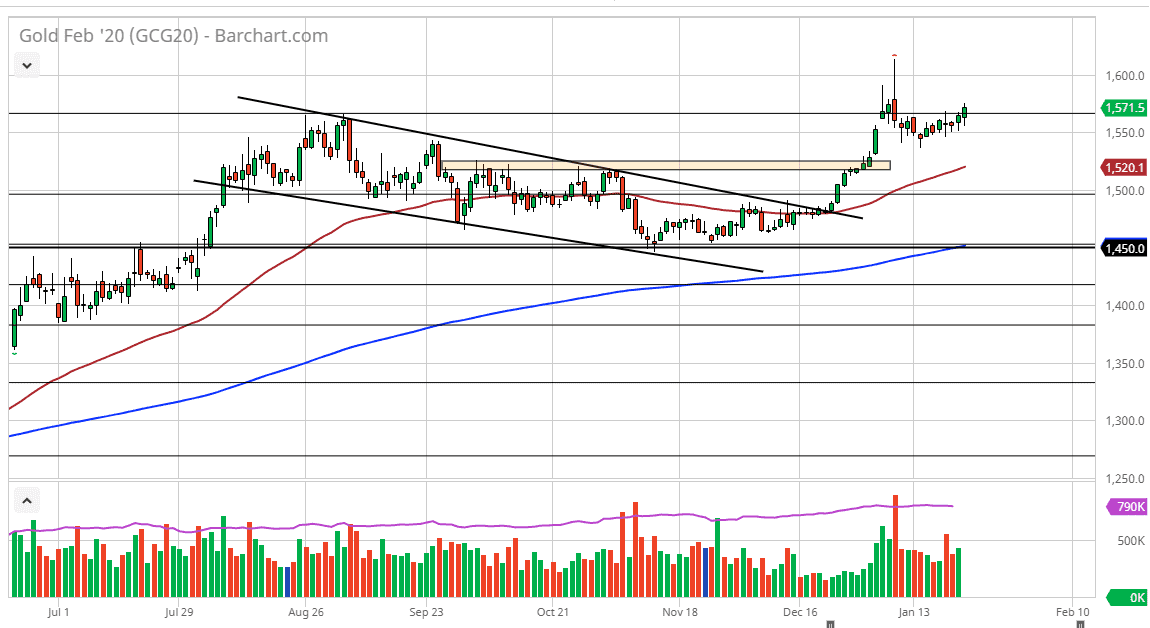

The gold markets pulled back just a bit during the trading session on Friday, but then shot higher as we continue to see a lot of bullish pressure in general. We are broken above the $1565 level, and therefore could go reaching towards the $1600 level. The market pulling back from time to time should be a nice buying opportunity, and I believe that the $1550 level underneath is massive support. There had been a hammer there eight sessions ago, and it shows just how resilient this market has been. Looking at this market it looks as if it is starting to curl higher, and it will go looking towards the highs again.

Underneath, the $1525 level is supported and the 50 day EMA is starting to reach towards that direction. In this attitude, it’s likely that we could find some type of interest in the market underneath. I believe that after Christine Largarde gave her press conference for the ECB this week, it shows just how loose monetary policy is going to be for not only that central bank, but a majority of them. With that in mind, I like the idea of buying gold for a longer-term move, as it should eventually break out and go looking towards the $1650 level, which is the measured move from the pseudo-bullish flag that we are breaking out of. Furthermore, I believe that due to the longer-term analysis, we are probably going to go looking towards the $1800 level.

Looking at this chart, I don’t see any argument for selling, at least not until we break down below the $1500 level. If the $1500 level gets sliced through, that could change quite a bit, but we are almost $75 away from that level. At this point, it looks very likely that value hunters will continue to jump into this market and accelerate it to the upside. On a side note, several of the currency pair is that I pay attention to are forming more of a “risk off” attitude, which of course will help gold markets to go higher. Overall, markets continue to grind back and forth and go much higher. The 50 day EMA is starting to tilt higher, showing signs of strength. Ultimately, the resistance seen at the $1600 level will be very difficult to overcome, but I do think that we do eventually.