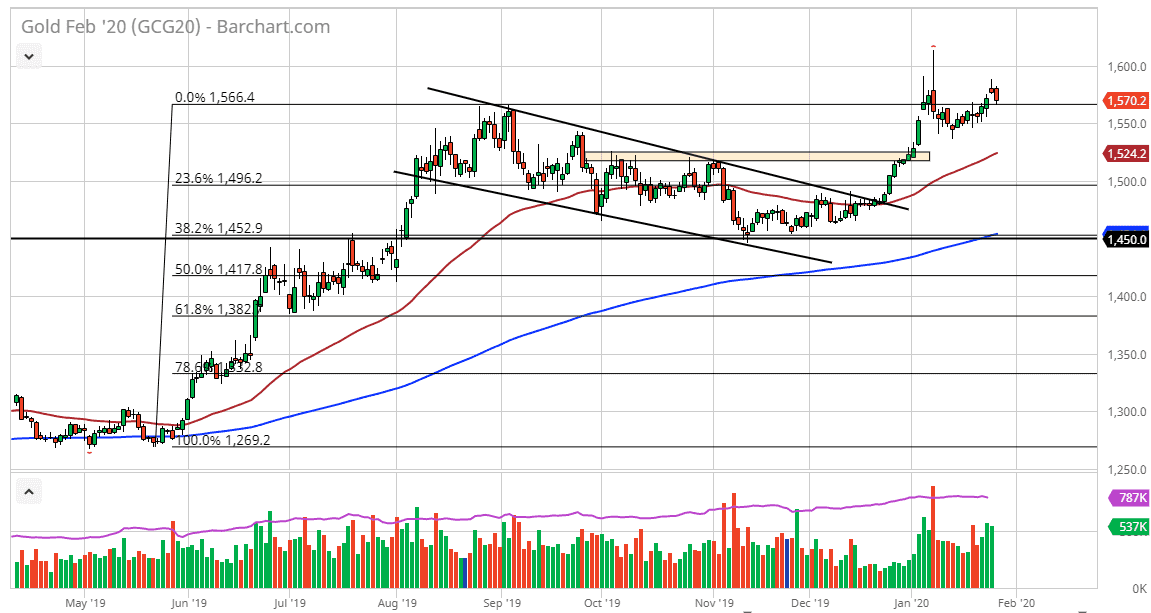

Gold markets have pulled back a bit during the trading session on Tuesday, reaching down towards the $1568 level. That being said, the market looks very likely to reach down even lower, but with the Federal Reserve having a monetary policy statement during the trading session on Wednesday, gold will be very sensitive to whatever happens with the US dollar. At this point, it’s very likely that we will probably have somewhat of a quiet day heading into the meeting. Ultimately, the market looks very likely to continue going higher, but the question now is how far back do we need to drop to find buyers again? Ultimately, I do believe that the overall attitude of this market continues to be bullish, as the market is likely to see value hunters on dips.

The 50 day EMA is closer to the $1525 level and sloping higher. The $1550 level is an area that has a lot of support built in due to the fact that it is a large figure, but it is also where we have bounced from previously. At this point, the market is likely to continue to go looking towards the $1600 level over the longer term, which has been significant resistance. If we can break above there, then the market is very likely to continue to go towards the $1650 level.

Furthermore, the $1500 level should be supportive as well, so keep in mind that if we were to fall down towards that area, it’s very likely that there should be plenty of support. All things being equal, there is a lot of buying opportunities eventually, but quite frankly I think it will be a huge surprise if we get all the way down to the $1500 level. The candlestick for the trading session on Tuesday of course is very bearish, but I think at this point it is simple profit-taking ahead of the FOMC Statement more than anything else. With that being the case, the likelihood of someone wanting to hang on to gold into that very risky asset is minor if it’s a large position. At this point, gold still looks healthy but unless the Federal Reserve decides to suddenly get hawkish, I do believe that eventually gold will rally based upon very loose monetary policy. If the Federal Reserve starts to talk about loosening monetary policy, then gold will of course take off to the upside.