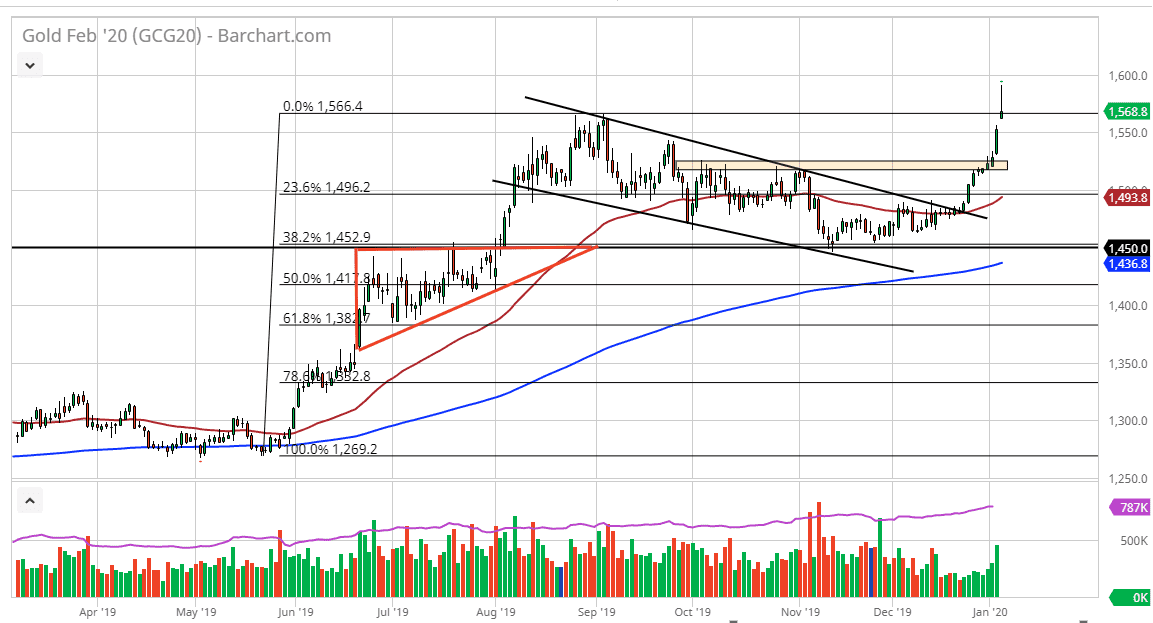

Gold markets initially gapped higher to kick off the trading session on Monday in reaction to the entire mass that is now the Middle East. The assassination of the Iranian general kick this thing off, and we even reached as high as $1590 before pulling back to form a shooting star. The gap has yet to be filled, so having said that it’s likely that the market will try to do so. The $1550 level underneath is an area that is a large, round, psychologically significant figure, but it is also an area where we had previously seen resistance so it should not be support. Furthermore, the Itself should offer support. Nonetheless, we have gotten a bit overdone at this point so I anticipate that a pullback will not only be likely, but perhaps even necessary.

The $1525 level underneath should offer plenty of support as well, so even if we break down through this area it’s likely that we would find buyers based upon the fact that the market took off from that area. That means that there was a lot of interest in the market at that point, and we started buying quite drastically.

The alternate scenario is that if we can break above the shooting star from the trading session on Monday, that will put the $1600 level under threat, and a move above there will kick off the next leg much higher. At this point in time, simple momentum will probably come into play and bring this thing back to the realm of normalcy. That doesn’t mean that we can’t go higher, but I do think that we need to slow down and pick up a few more buyers, unless of course something drastic happens again.

In the short term, it looks as if the market is simply waiting to see what the Iranians will do next. As they have not done anything yet, the markets may have seen a bit of profit-taking as gold had gotten so extended to the upside. Looking at this chart, we have gone somewhat parabolic of the last couple of weeks that this pullback is necessary in order to continue the momentum to the upside. Even though I fully believe that this market is going to pull back, I have no interest in shorting this market, because quite frankly there are far too many reasons to think that there will be a safe haven demand out there.