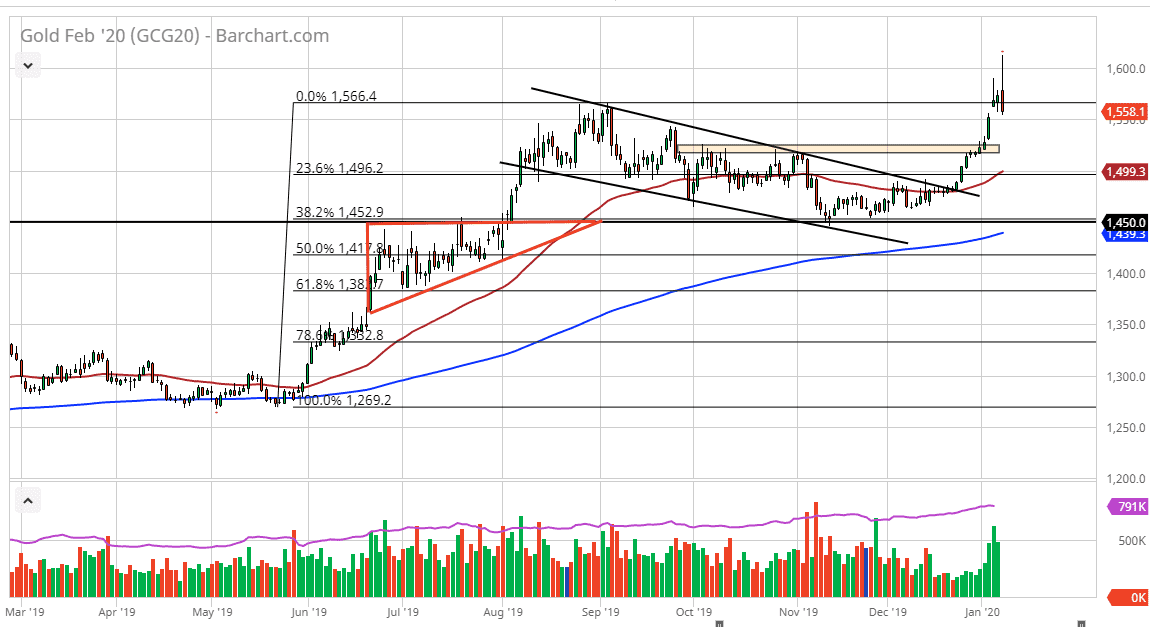

Gold markets initially shot straight through the roof based upon the Iranians sending a dozen or so missiles at US bases in Iraq, but after it was revealed that there was no damage time, and that it was obvious that the Iranians weren’t actually aiming for troops themselves, it eased tensions as Iran took credit for “slapping America across the face”, but not wanting to escalate the situation. Furthermore, the President of the United States suggested that he wasn’t wanting to escalate either but has placed further sanctions on the Iranians. That has the market calming down and the safety trade into gold has broken down rather significantly. At this point, it looks as if the market has filled the gap completely from the beginning of the week and has formed a horrific candlestick that suggests that we are going to continue to pull back.

This isn’t to say that I want to short gold, just that I think that there will be a buying opportunity at lower levels. Underneath, I believe that the $1500 level will be massively supportive, because not only is it a large, round, psychologically significant figure, but it also features the 50 day EMA. At this point, I believe that there would be sufficient “value” in the market for buyers a step back in. I also recognize that the $1525 level might be supportive as well, so don’t be surprised at all to see buyers in that vicinity also. I’m looking to buy some type of bounce or support of candle after a pullback, in order to take advantage of value to go long yet again in a market that has been a bit overextended.

Now that the market has seen quite a bit of selling pressure and a significant break down from the crucial $1600 level, it’s likely that the market will probably go down to the $1525 level. With that being the case, the market has formed a very negative candlestick so at this point on simply looking for a pullback to take advantage of. We also have the jobs never coming on a Friday and that will probably have an effect on the market as well. I expect Thursday to be very quiet, waiting for some type of reason to get involved. All things being equal, finding value is what the markets job will be from here, and therefore it’s very likely that being patient will offer value that you can take advantage of from what has been an obvious break out.