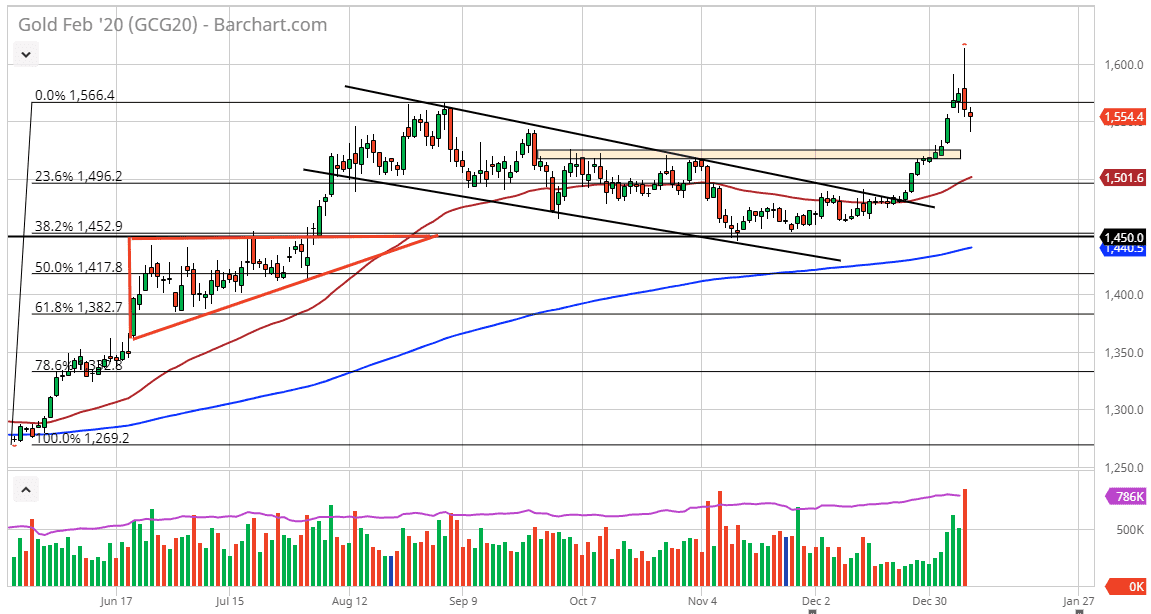

Gold markets initially fell during the trading session on Thursday, breaking below the $1550 level before turning around to rally. We ended up forming a bit of a hammer, which was preceded by a shooting star. The market had recently rallied towards the $1600 level on fears of the US and Iran going to war, but as tensions calmed down, gold sold off. We have been bullish to begin with and it makes sense that we would get a bit of a continuation. That being said, the jobs number coming out on Friday will have a massive implication as to where we go next.

We did fill the gap, and that of course is something that’s important but with the jobs number it’s a little bit difficult to understand what we will do in the short term. I do recognize that any significant pullback adhere should be thought of as a buying opportunity because quite frankly although it will be very noisy on Friday, the reality is that when jobs report won’t change the trajectory of gold going forward. It might cause a certain amount of volatility during the day, but longer-term it’s obvious that we are very bullish. The 50 day EMA is starting to turn to the upside, but we have quite some distance between here and there. The market will look at the $1550 level as support, just as it will look at the $1525 level and the $1500 level.

To the upside, I believe that the $1600 level will continue to be resistance but it’s probably only a matter of time before we break out above it. At this point, look at any pullback as an opportunity to pick up gold “on the cheap”, because we have seen a drive higher before the situation with the Iranians, perhaps based upon the idea that several central banks around the world will continue to be very loose with monetary policy. Furthermore, people are starting to murmur about the Federal Reserve cutting rates later this year. We are a bit far from that, but it certainly looks as if a lot of the numbers out there are starting to show signs of a bit of slowing down in the US, and that of course will continue to drive the gold markets higher based upon expectations. Nonetheless, the most important thing here is that we are in an uptrend and it should be bought.