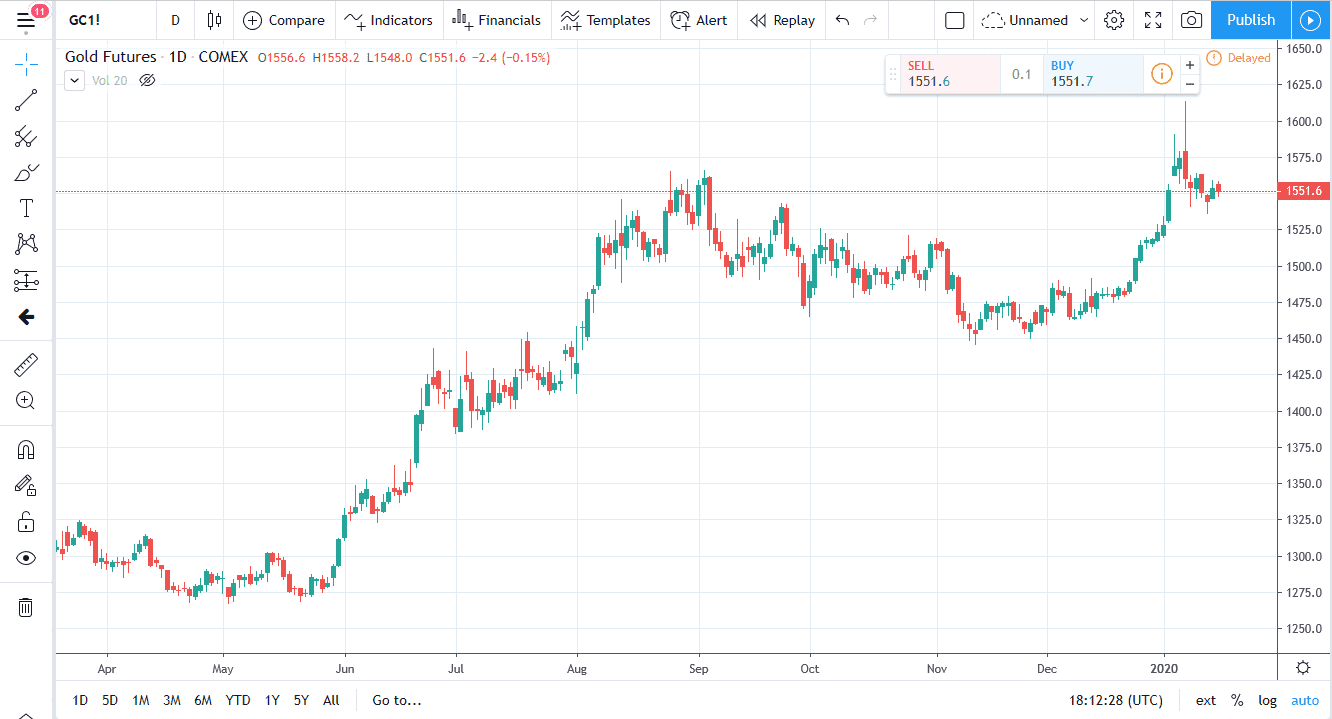

Gold markets pulled back a bit during the trading session on Thursday, as US economic figures came out much stronger than anticipated. After all, retail sales increased for the third straight month of December, while the number of Americans filing for unemployment benefits continues to drop for the fifth week in a row. Ultimately, this brought a lot of strength into the US dollar, which works against the value of gold. However, it should be noted that the technical set up for gold is still very strong, and therefore I have no interest in shorting this market.

In fact, you can make an argument for a bullish flag if you just ignore them massive spike that happened a while back when markets tried to break over the $1600 level. If you look at volume profile, it is a very thin area, so it really wasn’t as if many people were trading up there. It is because of this that I am perfectly comfortable wiping out that wick on the candlestick and making this a bullish flag. The bullish flag measures for a potential move of about $100, meaning that the market would probably go looking to an area close to the $1650 level.

That being said, I’m also interested in the fact that Tuesday did up forming a nice-looking hammer just below the $1550 level, which in and of itself is a relatively psychologically important figure. Beyond that, there is also a gap in that area that should attract a lot of attention and furthermore we have even more support down at the $1525 level as seen by both buying and selling in that area.

I think at this point the market is trying to build up enough stabilization to turn around and rally yet again. Granted, we have recently had easing of tensions between the United States and Iran, as well as the Americans and the Chinese signing a trade agreement, or at least a partial trade agreement, and that has got people a bit more relaxed. Nonetheless, it’s not as if gold sold off drastically after those events. This tells me there are still plenty of people out there willing to buy it. With that in mind I believe that if you can build up a position slowly, you should do quite well. In other words, I like the idea of building a core position slowly and taking the market higher.