Gold markets initially gapped higher to kick off the trading session on Tuesday, but then broke down to get close to filling the gap from the Monday session before rallying yet again. By the way it has rallied, this looks very much like a market that is ready to continue going higher, and then perhaps try to break to the top of the shooting star from the Monday session. Ultimately, the market has shown the $1600 level to be crucial, and a major barrier for the buyers to break through. We may have gotten there a little too quickly, so more of a grind it makes quite a bit of sense.

Gold breaking above the $1600 level could open up the door to much higher pricing, perhaps reaching towards the $1800 level. At this point, I believe that pullbacks continue to offer buying opportunities, reaching down to the $1550 level, perhaps even the $1500 level. Looking at this overextended market, there will be a lot of people who look at this as a market that they want to be involved with, so on pullbacks people will be looking at the market as a buying opportunity.

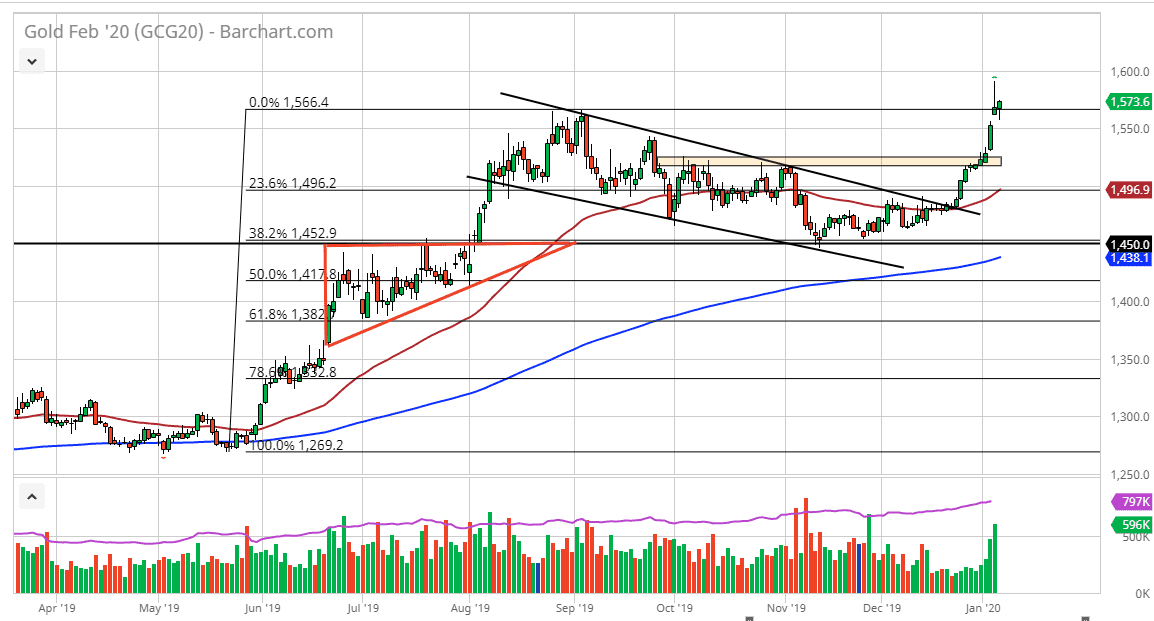

The 50 day EMA is currently at the $1500 level, which of course is a large, round, psychologically significant figure. The 50 day EMA is curving higher and it shows that obviously there is a lot of momentum to the upside, and now the 200 day EMA is starting to come close to the $1450 level, where we have bounced from. That level was also the 38.2% Fibonacci retracement level and when you bounce from there it’s typically a sign that there is a lot of momentum to the upside in a trend. This means that you should continue to go much higher and let’s face it here, there are plenty of reasons out there to keep this market going higher, not the least of which would be the US/Iran situation, and of course the US/China situation. At this point, there is also concerned about the global slowdown, and if that continues to be an issue as well, that continues to be another situation that could cause issues. Ultimately, pullbacks are going to be necessary and those should be looked at as a welcome for those who are bullish. I have no interest in shorting gold, it is far too strong at this point in time and therefore I’m looking for buying opportunities.