Gold markets have gone back and forth during the trading session on Tuesday as traders have come back to work. That being said, we have seen a lot of volatility on Thursday as traders started to put positions on after the Martin Luther King Jr. holiday. Now that we have seen a full day of volume in the market, it suggests that we are going to continue to trade in a range bound pattern, with the $1550 being roughly the magnet for price.

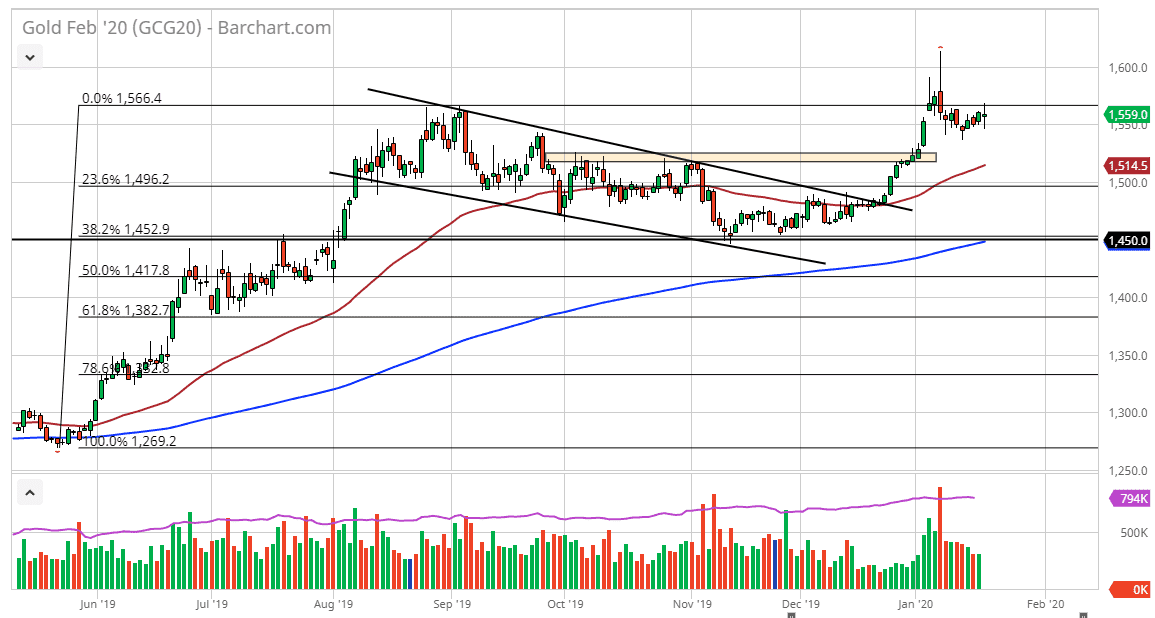

It doesn’t take too much in the way of artistic license to suggest there is a bullish flag on this chart. That bullish flag suggests that we are going to go towards the $1650 level, possibly even the $1700 level. Looking at this chart, I also recognize that the hammer from last week suggests quite a bit of support, and at this point it’s likely that it will continue to hold the market afloat. Underneath there, the $1525 level is supportive, just as the large, round, psychologically significant figure of $1500 of course should come into play as well.

To the upside, the market will more than likely struggle with the $1600 level, but we have already pierced that level so it would not be a huge surprise to see this market break above there rather rapidly in some type of anti-US dollar move, or perhaps some type of geopolitical shock. Central banks around the world continue to loosen monetary policy anyway, so it does make quite a bit of sense that we would see the market find a reason sooner rather than later to go higher. Nonetheless, this is a market that is in an uptrend so therefore we can’t fight that uptrend. It’s not until we close below $1500 on a weekly chart that I would be willing to short this market, because that would be a change in the overall attitude of the market. Between now and then, this is a market that you need to look it dips as a potential buying opportunity. This doesn’t mean that we take off to the upside right away, but you can approach at this in one of two ways: you can either build up a larger core position in the form of little bits and pieces on dips, or perhaps short-term trading positions, buying on the dips and taking profits after a few dollars.