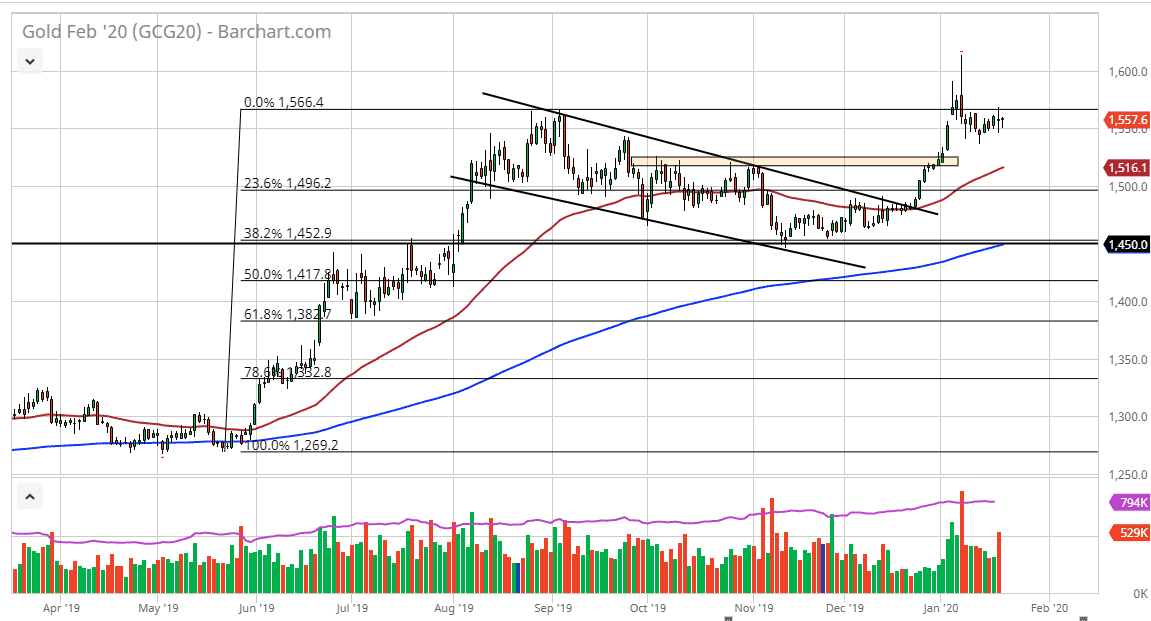

The gold markets initially pulled back during the trading session on Wednesday but continue to find buyers at the $1550 level. By turning around the way we have, we have formed a hammer and it looks as if the gold market is ready to go much higher. Ultimately, the market I think then goes looking towards the $1600 level, as the level was a massive resistance barrier, which now is a target.

Looking at this chart, it’s obvious that there are plenty of buyers not only at the $1550 level, but I also believe that the $1525 level and the 50 day EMA. The 50 day EMA is sloping at a nice angle, and it should continue to suggest that the market is going to continue to go higher. The hammer candlestick of course is bullish, and the fact that we have formed a couple of them recently tells me that there truly are buyers underneath.

Pay attention to the US dollar, because if it falls in strength it’s possible that the gold market could rally based upon that. Furthermore, if the market sees some type of major “risk off” situation, then gold will obviously be bought up as a bit of a safety trade. Either way, this is a market that looks as if it is ready to go higher and with a little bit of artistic license you can form a bullish flag. That bullish flag suggesting that we go to the $1650 level. Either way, I don’t have any interest in shorting gold because it is far too strong at this point in time.

In fact, it’s not until we break down below the $1500 level that I would consider shorting this market. Even then I would have to think about it quite a bit. Gold looks fundamentally strong, as well as structurally strong so there’s no reason to try to fight against what has been the case for several weeks. If we can finally break above the $1600 level, this market will probably go looking towards the $1800 level given enough time. That being said, this is a market that is of course very noisy most of the time, so this move won’t be any different than any other. Expect choppiness and pullbacks, but that should offer plenty of value that you can take advantage of, perhaps building a larger core position slowly as we can continue to the upside.